18 min read

.png)

Key Takeaways

- Yes, you can get a HELOC without a traditional appraisal – Lenders use AVMs for qualified borrowers with excellent credit and substantial equity.

- Appraisal-free HELOCs save time and money – Access funds in 7-10 days while avoiding $350-$800 appraisal fees and lengthy approval processes.

- Digital and alternative lenders lead the way – Specialized lenders offer streamlined products for seniors, self-employed borrowers, and non-traditional income situations.

Your home equity represents more than just ownership – it's a financial resource you can tap into when opportunities or needs arise. A Home Equity Line of Credit (HELOC) transforms the equity you've built into accessible funds for debt consolidation, home improvements, medical expenses, or other significant financial goals. But can you get a HELOC without an appraisal? The answer is increasingly yes, and understanding your options can save you both time and money.

Unlike a traditional home equity loan that provides a lump sum upfront, a HELOC functions as a revolving line of credit. You're approved for a maximum credit limit based on your home's current market value, then you can draw funds as needed during the draw period (typically 10 years). You only pay interest on what you actually borrow, and as you pay down the balance, that credit becomes available again – similar to how a credit card works, but with considerably lower interest rates since your property serves as collateral.

Why appraisal-free options matter in 2026

Traditionally, getting approved for a HELOC meant scheduling an appraiser, preparing your home for inspection, and waiting weeks for the valuation report – all while paying fees that could reach $800 or more. But the lending landscape has evolved dramatically. In 2026, the question isn't whether you can get a no appraisal HELOC – it's whether you qualify for one.

Modern lenders like Truss Financial Group increasingly use technology-driven alternatives like automated valuation models (AVMs) to assess property value without the hassle of physical inspections. This shift has opened doors for homeowners who need quick access to equity, whether for urgent home repairs, medical bills, or seizing time-sensitive investment opportunities.

Do You Always Need an Appraisal for a HELOC?

The short answer: not anymore. While most traditional lenders still require some form of property valuation, the appraisal landscape has transformed significantly in recent years.

Traditional vs. alternative valuation models

Traditional banks and credit unions have historically insisted on full appraisals for HELOCs because they need to verify your home's current market value and available equity. This makes sense from a risk management perspective – your property serves as collateral for the line of credit, so lenders want to ensure they're not over-lending.

However, alternative valuation methods have proven remarkably accurate in many scenarios. Automated valuation models use sophisticated algorithms that analyze public records, recent sales data, property tax assessments, and comparable properties in your area to generate instant valuations.

Situations Where Appraisals May Not Be Required

When banks waive appraisal requirements

Lenders might skip traditional appraisal requirements under several conditions:

- Recent appraisal on file – If you completed a full appraisal within the last 60-180 days (for example, when refinancing or purchasing), your lender may accept that existing valuation.

- Excellent credit profile – Borrowers with FICO scores above 750-800 demonstrate strong financial stability, making lenders more comfortable with alternative valuation methods.

- Smaller loan amounts – HELOC requests under $100,000 often qualify for appraisal waivers because the reduced loan amount minimizes the lender's exposure.

- Substantial existing equity – If you've paid down 40% or more of your home's value and maintained consistent on-time mortgage payments, lenders view you as a safer bet.

- Low existing mortgage balance – If the existing mortgage balance is low compared to the home's value, lenders might be more willing to waive the appraisal requirement.

- Stable housing market – Properties in areas with abundant recent sales data and steady price appreciation are easier to value using automated tools.

Most clients avoid full appraisals entirely through the Digital HELOC program with specific lenders, which uses AVM-backed valuations and streamlined approval processes. This approach benefits borrowers in multiple ways: you save money on appraisal fees, eliminate the stress of preparing your home for inspection, and access funds in a fraction of the time traditional lenders require.

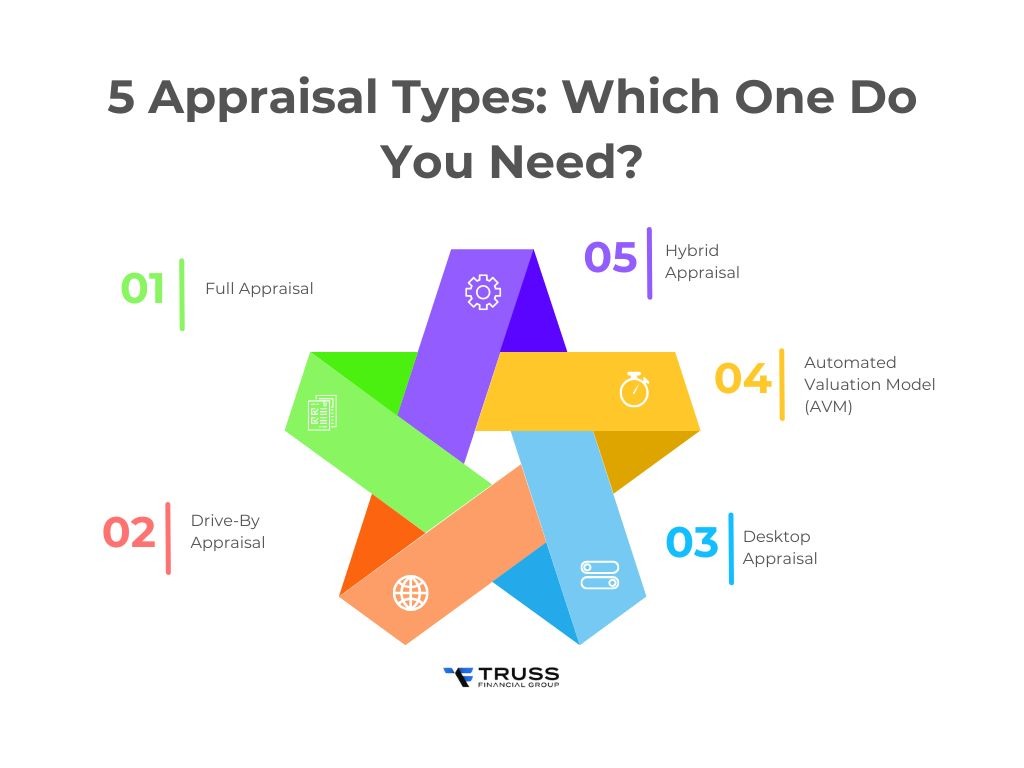

5 Appraisal Types: Which One Do You Need?

Not all appraisals are created equal. Understanding the five main types helps you anticipate what your lender might require and how it affects your timeline and costs.

1. Full Appraisal

A comprehensive physical assessment of your home's interior and exterior, providing the most detailed and accurate valuation available. A licensed appraiser visits your property, photographs each room, measures square footage, notes the condition of major systems, and researches recent sales of comparable properties.

Cost and timeline: $350-$800 | 1-3 weeks

Best for: Large loan amounts, properties with significant recent renovations, unique homes, or when maximum accuracy is essential.

2. Drive-By Appraisal

Drive-by appraisals are an exterior-only inspection that uses public records and comparable properties to estimate value. The appraiser examines only your property's exterior and neighborhood characteristics, then combines these observations with data from public records.

Cost and timeline: $100-$200 | 2-5 days

Best for: Properties in stable neighborhoods with abundant comparable sales; borrowers with smaller loan amounts.

3. Desktop Appraisal

Desktop appraisal is a remote appraisal that relies on electronic data without requiring a physical visit. The appraiser works entirely from their office, analyzing information from MLS databases, public records, tax assessments, and recent sales of similar properties.

Cost and timeline: $75-$200 | 1-3 days

Best for: Properties in data-rich markets; refinances where recent appraisals exist; borrowers seeking quick preliminary valuations.

4. Automated Valuation Model (AVM)

An algorithm-driven system that uses public records, tax assessments, and recent sales data to estimate home value without any human inspection. Computer algorithms analyze vast datasets and generate an instant valuation estimate.

Cost and timeline: $0-$200 | Same day (often instant)

Best for: Straightforward properties in neighborhoods with abundant recent sales; tech-savvy lenders offering Digital HELOC programs; borrowers prioritizing speed and cost savings.

Truss Financial Group often uses AVMs to qualify borrowers for their fast Digital HELOC, particularly when borrowers have excellent credit, substantial equity, and properties in stable markets.

5. Hybrid Appraisal

A middle-ground approach that combines elements of full and desktop appraisals. A local representative visits your home to take photos and measurements, then transmits this information to a licensed appraiser who completes the valuation remotely.

Cost and timeline: $150-$300 | 2-7 days

Best for: Properties in rural areas where licensed appraisers are scarce; moderate loan amounts.

No-Appraisal HELOC Options

Some lenders have developed specialized products for borrowers who don't fit traditional lending criteria. Rather than forcing everyone through the same process, they offer tailored solutions.

Digital HELOC: Fast-Track Funding Using AVM + eClosing

For borrowers who value speed above all else, a Digital HELOC leverages automated valuation models and electronic closing technology. Qualified borrowers can move from application to funding in as little as 7-10 days. The entire process happens online – application, document upload, electronic signature, and fund disbursement.

Senior HELOC: Tailored for 62+ Homeowners

Homeowners aged 62 and older often struggle with traditional HELOC applications. Many seniors live on fixed incomes that might not satisfy conventional debt-to-income requirements, even when they have substantial home equity. A Senior HELOC addresses these challenges with age-appropriate underwriting criteria that recognize retirement income streams – Social Security, pensions, investment distributions – as reliable sources.

First Position HELOC: Full Equity Access as Primary Lien

Instead of taking a second position behind your existing mortgage, a First Position HELOC replaces your current mortgage entirely and becomes the primary lien on your property. You gain access to your full equity potential without the constraints of a second lien while consolidating two potential payments into one credit line.

No Tax Return HELOC: Ideal for Self-Employed and High-DTI Borrowers

Self-employed borrowers, 1099 contractors, and business owners often face rejection from traditional lenders because they use legitimate tax deductions to minimize reported income. A No Tax Return HELOC uses alternative documentation methods – bank statements, asset verification, or stated income approaches – to qualify borrowers based on actual cash flow rather than tax-return income.

Comparison: No-Appraisal HELOC Products

|

Feature |

Digital HELOC |

Senior HELOC |

First Position HELOC |

No Tax Return HELOC |

|

Primary Benefit |

Speed & convenience |

Age-appropriate underwriting |

Maximum equity access |

Self-employed friendly |

|

Typical Timeline |

7-10 days |

10-14 days |

14-21 days |

10-14 days |

|

Appraisal Type |

AVM |

AVM or Desktop |

AVM or Hybrid |

AVM or Desktop |

|

Best For |

Tech-savvy borrowers needing quick funds |

Seniors on a fixed income |

Consolidating first & second liens |

1099 contractors, business owners |

|

Documentation |

Standard |

Income verification flexible |

Standard refinance docs |

Bank statements, asset verification |

|

Min. Credit Score |

680+ |

640+ |

700+ |

660+ |

|

Max LTV |

85% |

80% |

90% |

80% |

Are There Any HELOC Alternatives?

If a HELOC doesn't fit your needs, several alternatives exist for accessing funds.

- Home equity loans offer a lump sum based on the home's equity, with fixed interest rates and repayment terms. Unlike a HELOC's flexible draw period, you receive all the money up front and immediately begin making fixed monthly payments.

- Contractor financing provides direct financing options for home improvements that can bypass the home equity and appraisal process entirely. However, contractor financing often carries higher interest rates than home equity products.

- Personal loans are unsecured loans that do not require home equity as collateral but often come with higher interest rates than secured options. The application process is typically fast – often 24-48 hours from application to funding.

- Credit cards can be used for short-term financing needs, but are not ideal for large or long-term borrowing due to high interest rates (typically 18-29%). Many cards offer 0% introductory APR periods that can work for smaller projects.

What Are the Real Costs?

Understanding the complete cost picture helps you compare lenders effectively and avoid surprises.

- Appraisal fees vary significantly: traditional full appraisals cost $350-$800, drive-by appraisals run $100-$200, desktop appraisals range from $75-$200, and AVMs often cost nothing to the borrower.

- Closing costs can include title searches ($150-$400), recording fees ($50-$250), origination fees (0-3% of the credit line), and annual fees ($0-$100).

- Interest rates typically adjust with the prime rate, currently resulting in rates between 8-11% for most qualified borrowers. Monthly payments during the draw period usually cover interest only, but when you enter the repayment period, payments increase to cover both principal and interest.

Some lenders structure their products to minimize upfront expenses, featuring no upfront fees for qualified borrowers, AVM-based underwriting that eliminates or reduces appraisal costs, and soft-pull credit inquiries that don't impact your credit score.

This approach recognizes that many borrowers seek HELOCs specifically because they need to preserve cash flow. Requiring thousands in upfront fees defeats that purpose.

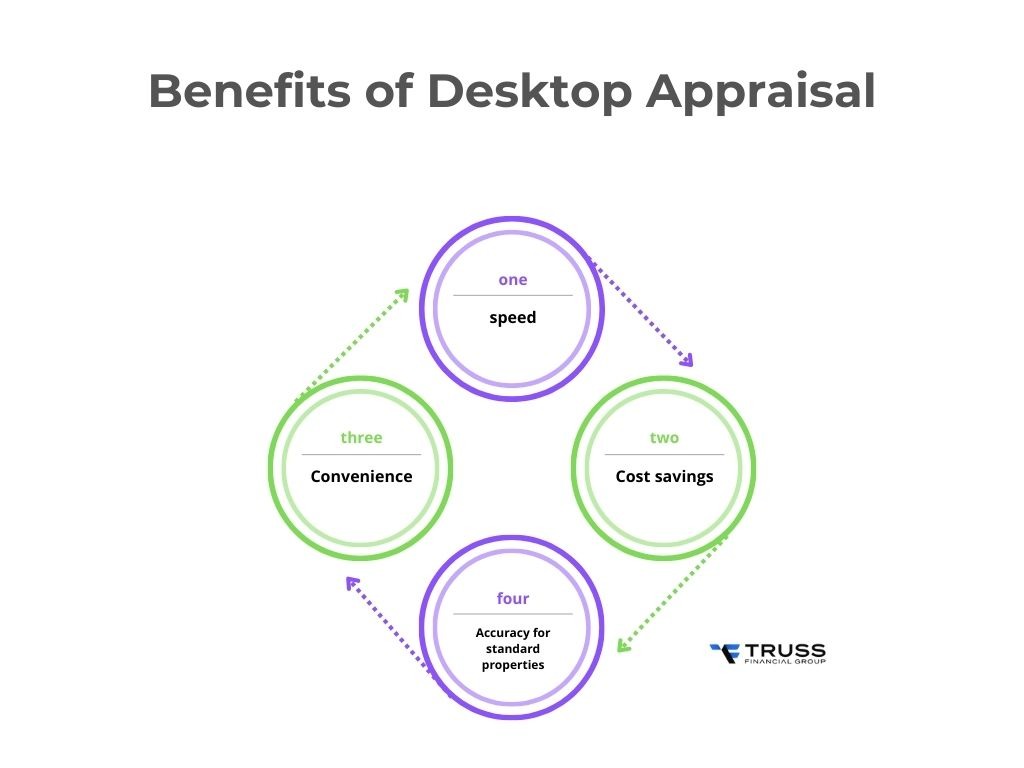

Benefits of Desktop Appraisal

Desktop appraisals offer a faster and less expensive alternative to traditional full appraisals. They are completed remotely using electronic data and can provide a quick estimate of a home's value within 1-3 days.

This method is beneficial for low-risk loans or when a precise valuation is not necessary, such as in the initial stages of a HELOC application. Desktop appraisals can help streamline the lending process, reducing the time and cost associated with traditional appraisals.

Key advantages include:

- Speed – Results delivered in 1-3 days versus 1-3 weeks for full appraisals

- Cost savings – Typically $75-$200 compared to $350-$800 for full appraisals

- Convenience – No need to schedule property visits or prepare your home for inspection

- Accuracy for standard properties – Reliable valuations when recent comparable sales data is available

However, desktop appraisals may not capture recent interior improvements or unique property features that could increase your home's value.

How The HELOC Appraisal Process Works?

For borrowers going through traditional appraisal routes, knowing what to expect helps you prepare effectively and avoid delays.

The HELOC appraisal process typically follows these steps:

- Lender orders the appraisal – Your lender contacts a licensed appraiser or appraisal management company to schedule the property inspection.

- Appraiser inspects the property – The appraiser visits your home to assess its condition, measure square footage, photograph rooms, and note any upgrades or deficiencies.

- Research comparable properties – The appraiser researches recent sales of similar homes in the area to establish market value benchmarks.

- Compile appraisal report – The appraiser creates a detailed report with an estimated value of the home, which lenders use to determine the available equity and set the HELOC limit.

Understanding the appraisal process is crucial for borrowers, as it directly affects the amount of equity they can access and the terms of their HELOC. A higher appraised value means more available equity and potentially better loan terms.

Appraisal requirements vary by lender

The appraisal process for a HELOC can vary depending on the lender and the type of appraisal required. Key considerations include:

- Appraisal type – Traditional lenders often mandate a full appraisal, while some may accept alternative methods like AVMs or desktop appraisals.

- Appraisal fees and costs – The appraisal fee and other costs associated with the appraisal process should be factored into your budget when applying for a HELOC.

- Documentation needed – Borrowers should be aware of requirements, including property deed, recent tax assessments, and receipts for major improvements.

- Property preparation – Simple steps like cleaning, making minor repairs, and compiling renovation receipts can help ensure an accurate valuation.

- Timeline expectations – Full appraisals typically take 1-3 weeks, while AVMs provide same-day results.

Top Banks vs. Online HELOC Lenders vs. Truss Financial Group

The HELOC market has fragmented into distinct categories, each with strengths and limitations.

Traditional banks like Bank of America, Chase, and Wells Fargo offer established reputations but rigid underwriting criteria, lengthy approval processes (3-6 weeks typical), and nearly always require traditional appraisals.

Online HELOC lenders provide faster approvals (1-2 weeks typical), often use AVMs to eliminate traditional appraisals, and offer competitive rates due to lower overhead.

Truss Financial Group specializes in no-documentation approvals through their No Tax Return HELOC program, senior-friendly terms via their Senior HELOC, same-week funding capability (7-10 days for qualified borrowers using their Digital HELOC), and flexible qualification criteria, including higher debt-to-income ratios and alternative income documentation.

HELOC Lender Comparison Chart

|

Feature |

Traditional Banks |

Online Lenders |

Truss Financial Group |

|

Approval Timeline |

3-6 weeks |

1-2 weeks |

7-10 days |

|

Appraisal Method |

Usually, a full appraisal |

Often AVM |

Primarily AVM |

|

Tax Returns Required |

Nearly always |

Usually |

Not for No Tax Return HELOC |

|

Min. Credit Score |

700-740 |

680-720 |

640-680 (program dependent) |

|

Self-Employed Friendly |

Limited |

Moderate |

Highly accommodating |

|

Senior Programs |

Standard criteria |

Standard criteria |

Specialized Senior HELOC |

|

High DTI Acceptance |

Rarely (max 43%) |

Sometimes (max 45%) |

Yes (up to 50%) |

Frequently Asked Questions

Can you get a HELOC without an appraisal?

Yes, absolutely. Many lenders now use Automated Valuation Models (AVMs) or offer appraisal waivers for qualified borrowers. Your eligibility typically depends on credit score (700+), substantial equity (40%+), loan amount (often under $100,000), property type (standard homes in data-rich areas), and lender selection.

How to avoid an appraisal for a HELOC?

Choose the right lender (target online and alternative lenders like Truss Financial Group), strengthen your application (boost your credit score above 750, increase equity, request smaller loan amounts), apply soon after purchasing or refinancing if you have a recent appraisal, and ensure your property is a standard home in a suburban neighborhood with abundant comparable sales.

What is the monthly payment on a $50,000 HELOC?

During the draw period, most HELOCs require interest-only payments. If you borrowed the full $50,000 at a 9% rate, your monthly payment would be approximately $375 (interest only). During the repayment period, you pay principal plus interest – approximately $450/month with a $50,000 balance at 9% over 20 years.

What disqualifies you from a HELOC?

Several factors can prevent approval: insufficient equity (most lenders require at least 15-20% remaining after the HELOC), poor credit (scores below 640), high debt-to-income ratio (exceeding 43-50%), unstable income or employment, property issues (declining markets, serious condition problems), recent mortgage delinquencies, bankruptcy or foreclosure, and existing liens.

Final Thoughts: Getting a HELOC Without Appraisal in 2026

Appraisal-free HELOCs have evolved from rare exceptions to mainstream solutions in 2026. Thanks to Automated Valuation Models and digital-first lenders, qualified homeowners can now access their equity faster and more affordably than ever before.

Whether you're self-employed, a senior on a fixed income, or simply need quick funding, specialized programs exist to serve your unique situation. The key is finding the right lender who matches your specific needs rather than forcing you into a one-size-fits-all process.

Ready to access your equity without the appraisal wait? Apply now at Truss Financial Group for a fast-track approval process with no upfront fees and no hard credit pull. Get a quote today!

Table of Content

Take your pick of loans

Experience a clear, stress-free loan process with personalized service and expert guidance.

Get a quote

.png?width=352&name=xxxxxx%20header%20(55).png)