Mortgage Loans in California That Work: Your 2025 Guide

Feeling overwhelmed by California’s sky-high home prices? You’re not alone. With median values double the national average, many face rejection in their homebuying journey.

4.6 from 700+ reviews

4.6 from 700+ reviews

4.6 from 700+ reviews

Feeling overwhelmed by California’s sky-high home prices? You’re not alone. With median values double the national average, many face rejection in their homebuying journey. We’ve turned countless rejection letters into house keys through innovative California mortgage loan options that you will find difficult to get elsewhere.

When mainstream lenders say “no”, we discover the “yes” by tapping into hidden programs and alternative qualification paths. Our guide below offers proven California mortgage solutions for first-time buyers, teachers, high-income professionals, investors, current homeowners, and self-employed individuals. You’ll also find up-to-date rates, step-by-step application guidance, and direct access to specialized loan officers who understand the unique challenges of the California housing market, helping you secure the best deal.

Key Takeaways

- California mortgage rates in 2025 are stabilizing near 6.5%, influenced by credit scores, loan types, and property location.

- A wide range of mortgage options are available including Conventional, FHA, VA, Jumbo, USDA, DSCR and specialized loans for self-employed and first-time buyers.

- State-specific programs like CalHFA and teacher homebuyer loans provide valuable down payment assistance and favorable loan terms.

- Jumbo loans are essential for financing high-cost California properties that exceed standard conforming loan limits.

- First-time homebuyers can leverage multiple assistance programs to overcome California’s high down payment and credit barriers.

- Partnering with experienced California mortgage lenders ensures access to competitive rates, personalized guidance, and a smoother approval process.

Areas We Serve

We serve the following areas:

- Southern California: Los Angeles, Orange County, San Diego, Riverside, San Bernardino

- Northern California: San Francisco Bay Area, Sacramento, Fresno

- Central Coast: Santa Barbara, San Luis Obispo, Monterey

- Central Valley: Bakersfield, Modesto, Stockton

At Truss Financial Group, we are dedicated to helping homebuyers across California find the right mortgage solutions tailored to their unique needs. Whether you're looking for a charming beachside bungalow, a mountain retreat, or a bustling urban loft, our expertise covers the entire state, ensuring you receive personalized service no matter where you are.

Wherever you choose to invest in California, our knowledgeable loan officers are here to guide you through every step of the mortgage process. Discover our favorable California mortgage programs today and take the first step toward your dream home.

How Do Mortgage Loans Work in California?

Mortgage loans in California function similarly to those in other states, but with important distinctions due to the state’s unique real estate market and regulations. Understanding how California work in terms of home loans is crucial, especially given the higher real estate costs in the state.

A mortgage loan is essentially a secured loan where the property serves as collateral. When you obtain a mortgage in California, you’re entering into a legal agreement with a lender who provides the funds to purchase your home. In return, you agree to repay the loan amount plus interest over a specified term, typically 15 to 30 years.

For those with an existing mortgage, refinancing options are available to homebuyers. Our team provides support to assist customers through the refinancing process, catering to both first-time buyers and those looking to improve their current mortgage situation.

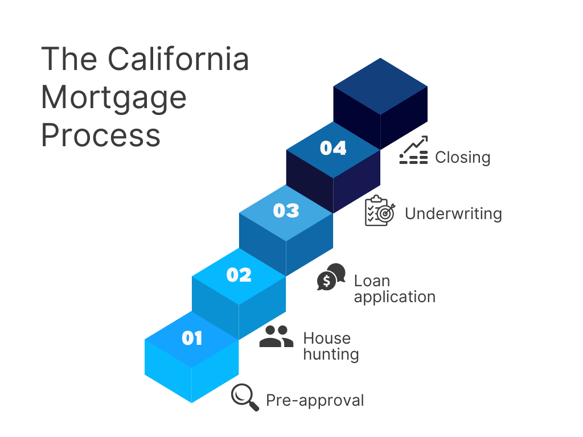

The California Mortgage Process:

- Pre-approval: Before house hunting, get pre-approved to understand your budget and strengthen your offer.

- House hunting: Find a property within your pre-approved amount.

- Loan application: Submit a formal application with your chosen lender.

- Underwriting: The lender verifies your financial information and property details.

- Closing: Sign final documents and receive your keys.

What makes California unique is the prevalence of high-cost areas that exceed standard conforming loan limits, triggering the need for jumbo loans. Additionally, California offers state-specific programs through agencies like the California Housing Finance Agency (CalHFA) that provide down payment assistance and favorable terms for qualified buyers.

Current Mortgage Rates and Fees in California

As of May 2025, California mortgage rates mirror national trends, with current rates reflecting the latest interest rates for various fixed-rate mortgage products, such as 30-year fixed mortgages and 15-year fixed loans. These fixed-rate loans cater to different financial situations for borrowers, with factors like the Federal Reserve policy and market volatility impacting interest rates:

- 30-Year Fixed Mortgages: 6.81% to 7.06%

- 15-Year Fixed Loans: 5.94% to 6.14%

Key Influences:

- Federal Reserve Policy: The Fed has paused rate cuts, keeping rates elevated.

- Market Volatility: Trade uncertainty and inflation concerns affect rates.

Fees: Mortgage costs typically range from 2% to 5% of the loan amount, including:

- Loan Origination Fee: 0.5% to 1%

- Appraisal Fee: $450 to $650

- Title Insurance: $1,500 to $3,000

- Escrow Fees: $500 to $1,500

- Prepaid Items: Property taxes and insurance.

California-Specific Notes: Check the California Housing Finance Agency (CalHFA) for daily updates on rates and programs, as some may be temporarily unavailable.

Recommendation: For the most accurate rates, consult local lenders or CalHFA partners, as national averages may not reflect regional variations.

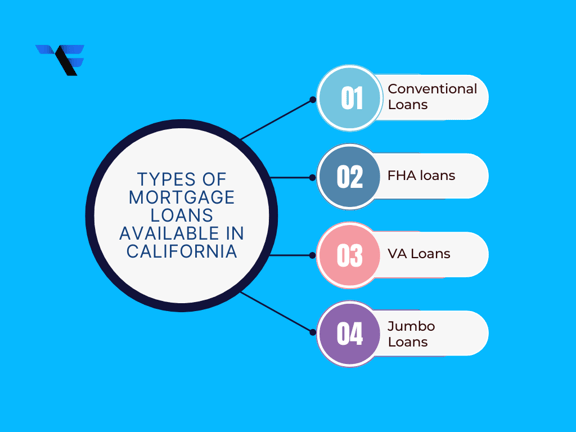

Types of Mortgage Loans Available in California

- Conventional Loans

Conventional loans are the most common mortgage type in California. They are not government-backed but conform to Fannie Mae and Freddie Mac guidelines.

Key Features:

- Down payment: Typically 3-20%

- Credit score: Minimum 620, ideally 700+ for best rates

- Loan limits: Up to $766,550 in most areas; higher in designated high-cost counties

- Private Mortgage Insurance (PMI): Required if down payment is less than 20%

- Debt-to-income ratio: Usually capped at 45%

These loans offer flexibility and often lower overall costs for borrowers with strong credit. They work for primary homes, second homes, and investment properties.

- FHA Loans

FHA loans are government-backed mortgages designed for borrowers with lower credit scores or smaller down payments.

Key Features:

- Down payment: As low as 3.5% with a 580+ credit score; 10% with scores between 500-579

- Credit score: Minimum 500 (most lenders prefer 580+)

- Loan limits: Vary by county, ranging roughly from $472,030 to over $1 million in high-cost areas

- Mortgage Insurance Premium (MIP): Required for most of the loan term

- Debt-to-income ratio: Generally up to 43%, with some exceptions

FHA loans, insured by the Federal Housing Administration, are ideal for first-time buyers or those rebuilding credit but can cost more over time due to mortgage insurance. Factors such as interest rates, credit history, and debt-to-income ratio significantly influence the monthly mortgage payment, making it crucial for budgeting and affordability assessments for potential homeowners.

- VA Loans

VA loans, backed by the Department of Veterans Affairs, benefit eligible veterans, active-duty service members, and certain spouses.

Key Features:

- Down payment: Usually 0%

- Credit score: No official minimum; lenders often look for 620+

- No private mortgage insurance

- Competitive interest rates, often better than conventional loans

- Funding fee: 1.4-3.6%, sometimes waived for disabled vets

- Loan limits: No limit with full entitlement; reduced limits apply otherwise

VA loans provide powerful benefits, including no down payment and no PMI.

- Jumbo Loans

Jumbo loans exceed conforming loan limits and are widely used in California due to high home prices.

Why Are Jumbo Loans Popular in California?

California’s housing market includes many high-cost areas, like San Francisco, Los Angeles, and Silicon Valley, where home prices often surpass the conforming loan limit ($766,550 in most areas for 2025). This makes jumbo loans essential for financing these properties.

Key Features:

- Loan amounts: Above $766,550 (higher limits in some counties)

- Down payment: Usually 10-20%

- Credit score: Generally 700+, with 740+ preferred

- Debt-to-income ratio: Typically capped at 43%

- Cash reserves: Often 6-12 months of mortgage payments required

Jumbo loans usually have slightly higher interest rates and stricter qualification criteria but are necessary for many California buyers.

Additional Mortgage Options

USDA Loans: For rural, low- to moderate-income buyers; no down payment required and competitive rates.

Bank Statement Loans: For self-employed borrowers using bank statements instead of traditional income proof.

Adjustable-Rate Mortgages (ARMs): Lower initial rates that adjust after a set period, ideal if you plan to move or refinance.

Home Equity Loans: Borrow against your home’s equity for major expenses like renovations or debt consolidation.

Home Equity Lines of Credit (HELOCs): Revolving credit line based on equity, offering flexible access to funds.

Interest-Only Mortgages: Pay only interest for a period, lowering initial payments.

Special Mortgage Programs in California

Mortgage Loans for Teachers

ECTP offers low-interest loans with 3% down payment assistance for K-12 staff, subject to county income limits. The School Employee Housing Program provides reduced-rate loans in select districts.

CalHFA Programs

The CalHFA Conventional Loan starts at 3% down, while the FHA Loan requires 3.5% down and flexible credit. MyHome offers deferred loans up to 3.5% of the purchase price.

Low-Income Buyer Programs

The CalHome Program provides grants for down payments and rehab. The Dream for All Program offers 20% shared appreciation loans with zero interest for first-generation buyers.

ITIN Loans

Accepts Individual Tax Identification Number (ITIN) instead of SSN, requires 15-20% down, and has higher rates. Available for primary and some investment properties.

First-Time Buyer Assistance

The First-Time Homebuyer Tax Credit offers $2,000 annually for those without property ownership in three years. Forgivable Equity Builder Loans provide 10% assistance, forgiven after five years.

These programs offer loans, grants, tax credits, and down payment assistance to help new buyers. Finding the best mortgage lender involves considering individual circumstances, indicating that personal preferences and situations play a significant role in the decision-making process.

Mortgage Options for First-Time Homebuyers in California

First-time homebuyers in California face high property values and competitive markets, but targeted programs help ease these challenges. It is important to understand the qualification requirements for these programs, as they can vary based on the type of loan or assistance being sought. The rates provided are applicable when purchasing a primary residence and various factors such as loan product and property value can influence the final rate.

Key Programs:

- Conventional 97 Loan: Requires 3% down payment, no income limits in most areas, with PMI removable after 20% equity.

- FHA First-Time Homebuyer: Offers 3.5% down with 580+ credit score, flexible credit standards, and mandatory mortgage insurance.

- CalHFA Zero Interest Program (ZIP): Provides up to 3% closing cost assistance at zero interest, repayable over the loan term, and can be combined with other CalHFA offers.

How to Qualify for a Mortgage Loan in California

Here are the list of requirements that can help you qualify for a mortgage loan in the golden state:

- Credit Score Requirements

Credit score requirements vary by loan type and lender:

|

Loan Type |

Minimum Credit Score |

Score for Best Rates |

Average Approved Score in CA |

|

Conventional |

620 |

740+ |

735 |

|

FHA |

500 (with 10% down) |

580+ (with 3.5% down) |

675 |

|

VA |

No official minimum |

620 (typical lender) |

710 |

|

Jumbo |

700 |

760+ |

765 |

|

Bank Statement Loans |

Varies, generally 620+ |

Varies |

N/A |

Refinancing an existing home loan can help achieve savings on monthly payments. A lower rate can lead to significant financial benefits over time.

Other factors such as loan product, credit profile, property value, and geographic location can also influence the final interest rate.

- Income Verification

Lenders will verify your income to ensure you can afford your mortgage payment. However, for a No Documentation Mortgage, lenders do not require the borrower to produce proof of income. Standard documentation includes:

- Two years of W-2s or tax returns

- Recent pay stubs (covering 30 days)

- Two months of bank statements

- Employment verification

Several factors come into play during income verification, making it essential to provide accurate and comprehensive documentation.

Your debt-to-income ratio (DTI) should typically not exceed 43%, though some loan programs allow up to 50% in certain circumstances.

- Down Payment Options

Down payment requirements in California vary by loan type:

- Conventional Loans: For most buyers, the down payment starts at 3% if you’re a first-time buyer, or 5% for others. To avoid paying private mortgage insurance (PMI), you generally need to put down at least 20%. On average, California buyers put down about 12%.

- FHA Loans: If your credit score is 580 or higher, you can put down as little as 3.5%. If your score is between 500 and 579, the minimum down payment is 10%.

- VA Loans: Eligible veterans and service members usually don’t need a down payment at all.

- Jumbo Loans: For higher-priced homes, down payments typically range from 10% to 20%, depending on the lender and loan amount. In California, jumbo loan buyers often put down around 25%.

Factors such as loan product, loan size, credit profile, property value, and geographic location influence the rates offered for purchasing a home.

- Bank Statement Loans

If you’re self-employed or have income that’s hard to document traditionally, bank statement loans let you qualify using 12 to 24 months of bank deposits instead of tax returns. These loans usually require a 10-20% down payment and come with higher interest rates. They’re ideal for freelancers, business owners, and commission-based workers.

See if you qualify for a California mortgage →

Apply for a California Home Loan: Approval Process and Timeline

The Application Process

- Pre-qualification (1 day): Get a general estimate of what you might qualify for based on self-reported information.

Understanding your monthly mortgage is crucial to managing your overall financial health. It factors into the broader context of mortgage rates, fees, and budgeting.

- Pre-approval (3-5 days): Receive a conditional commitment letter after submitting documentation and undergoing a credit check.

- Home search and purchase agreement: Find your home and make an offer with your pre-approval in hand.

- Formal loan application (1 day): Complete the official application once your offer is accepted.

- Processing (1-2 weeks): Lender verifies your information and orders necessary reports.

- Underwriting (1-2 weeks): Detailed review of your application, documentation, and property appraisal.

- Conditional approval: Address any underwriter conditions or requests for additional information.

- Final approval (Clear to Close): Receive final loan approval.

- Closing (1-2 days): Sign documents and receive your keys.

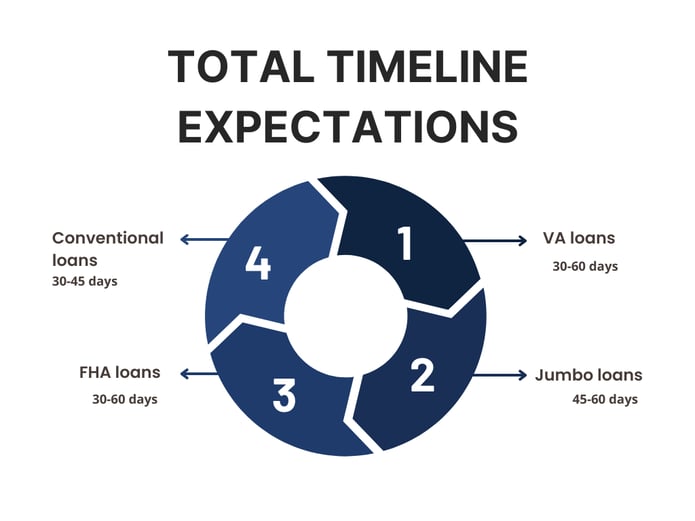

Total Timeline Expectations

From application to closing, expect:

Homeowners insurance is typically included in the monthly mortgage payment along with principal, interest, and property taxes, highlighting its relevance to the total cost of homeownership.

California’s high transaction volume and complex real estate market can sometimes extend these timelines, particularly during busy seasons.

Quick Tips to Get a California Home Loan

- Check your credit report before applying and address any errors.

- Avoid major purchases or new credit during the application process.

- Gather documentation early, including tax returns, W-2s, bank statements, and pay stubs.

- Stay responsive to lender requests for additional information.

- Consider locking your rate when you’re comfortable with the offered terms.

- Work with a local California lender who understands the state’s unique market conditions.

- Compare offers from multiple lenders to ensure competitive terms.

When considering mortgage rates for the purchase of a single-family primary residence, factors like loan product, credit profile, and property value play a crucial role in determining the rates. These rates are subject to change and are based on a specific lock period and conditions.

FAQ for Mortgage loans in California

How to become a mortgage loan officer in California?

To become a mortgage loan officer in California, you must complete 20 hours of NMLS-approved education, pass the national exam, and apply for an MLO license through the NMLS. This process includes background checks, fingerprinting, and associating with a licensed mortgage company. Additionally, you’ll need to complete 8 hours of continuing education annually and renew your license each year.

What credit score do you need for a mortgage in California?

The minimum credit score requirement depends on the loan type. Conventional loans require 620+, but 740+ secures the best rates. FHA loans accept scores as low as 500 with a higher down payment, or 580 with 3.5% down. VA loans typically require 620+, and jumbo loans usually demand 700+ with 760+ preferred for the lowest rates.

What's the average mortgage loan amount in California?

The average mortgage loan amount is around $625,000, reflecting California’s high home prices. In coastal areas like San Francisco, the average is $950,000+, while Los Angeles averages $750,000+. Inland regions generally see lower averages.

What is the current mortgage interest rate in California?

As of May 2025, rates range from 5.5% for a 15-year fixed loan to 6.75% for a 30-year jumbo loan. Rates vary daily based on economic factors, your credit profile, and the property location.

How can I get the best mortgage rate in California?

To secure the best rate, improve your credit score (aim for 740+), save for a larger down payment, reduce your debt-to-income ratio, and compare offers from multiple lenders. Additionally, consider shorter loan terms or first-time buyer programs that may offer special rates.

How much does it cost to get a mortgage in California?

Closing costs typically range from 2% to 5% of the loan amount. On a $600,000 mortgage, this translates to $12,000–$30,000. Costs include origination fees, appraisal fees, title insurance, and prepaid taxes or insurance. Some costs may be negotiable or offset by assistance programs.

What factors influence mortgage rates in California?

Rates are influenced by national economic conditions, Federal Reserve policies, inflation, and your personal financial profile (credit score, debt-to-income ratio, loan type). California-specific factors, like high property values and risks such as wildfires, can also affect rates.

What benefits do VA loans offer to veterans and active-duty service members?

VA loans provide no down payment, no private mortgage insurance (PMI), competitive interest rates, and limited closing costs. They also feature lenient credit requirements, higher allowable debt-to-income ratios, and streamlined refinancing options for eligible veterans and service members.

How can I improve my chances of securing a mortgage loan in California?

Boost your credit score by paying down debt and correcting credit report errors. Save for a larger down payment, maintain steady employment for at least two years, and reduce your debt-to-income ratio. Getting pre-approved strengthens your position, while avoiding new credit applications during the process ensures stability.

Are there any payment assistance programs available for California homeowners?

Yes, programs like the California Mortgage Relief Program and Keep Your Home California offer support for homeowners facing financial hardship. Additionally, the Property Tax Postponement Program provides relief for eligible seniors and disabled homeowners by deferring property taxes.

Is California giving away $150,000 for first-time home buyers?

No, California is not giving away $150,000. However, the California Dream for All Program offers shared equity loans up to 20% of the purchase price. In high-cost areas, this can total up to $150,000. These loans must be repaid upon sale or refinancing of the home.

Conclusion

Whether buying a starter home or a luxury property, understanding mortgage loans in California helps you make smart decisions that save money and offer flexibility.

At Truss Financial Group, we guide Californians through every step: from pre-approval to closing, with tailored mortgage solutions and deep regional expertise. The Golden State offers a unique array of financial products for home buyers and real estate investors.

Why Choose Truss Financial Group?

- Local expertise across California’s varied markets

- Personalized mortgage solutions for your unique needs

- Access to exclusive California mortgage programs

- Competitive rates through trusted lending partners

- Smooth, transparent loan process with dedicated support

Don’t navigate California mortgage loans alone. Contact Truss Financial Group today for expert guidance and start your journey to homeownership. If you're in the cannabis industry, mortgages tailored for marijuana business owners are available, offering solutions you can depend on.

Get started with your California mortgage by calling us today!

Disclaimer: This information is provided for general educational purposes only. Loan limits and guidelines may vary based on lender, location, and borrower qualifications. Please consult a licensed mortgage professional or financial advisor to understand how these limits apply to your specific situation.

Trusted by 1,964 people

Get a free custom rate quote

- 81% approval rate

- No commitment

👉 Filling out this form won’t affect your credit score.

Get the information you need to make confident decisions

Discover your borrowing power and plan your mortgage journey with knowledge on your side.

Get a quote- No documents required

- No commitment

- No commitment

Get a quote in 3 easy steps

Tell us what you want

Fill out our online form to help us understand your financial situation and loan needs.

We get to work for you

We review your info and look for competitive rates that match your specific goals.

You get a personalized quote

You’ll receive a customized rate quote that meets your unique profile.