10 min read

.png)

The New Age of Home Equity Access

Tapping into your home’s equity used to mean a full-blown refinance, mountains of paperwork, and tax returns dating back years. But the game has changed.

At Truss Financial Group (TFG), we specialize in flexible, borrower-first HELOC options built for the self-employed, equity-rich, and tax-doc-light borrower. Whether it’s our First Position HELOC, No Appraisal HELOC, Bank Statement HELOC, HELOC for Seniors, No doc HELOC or our fully Digital HELOC experience, we help homeowners access capital without resetting their entire mortgage.

Think of a First Position HELOC like a rechargeable credit card tied to your home, but with significantly lower rates and no need to refinance your existing loan.

What Is a First Position HELOC?

A First Position HELOC (also called a First Lien HELOC) replaces your primary mortgage and becomes the top lien on your property. Unlike second-lien HELOCs that sit behind your existing mortgage, this one takes its place entirely, combining your mortgage and equity line into a single loan with a revolving line of credit.

It works like this:

- Your existing mortgage is replaced

- You gain flexible access to funds during the draw period

- You make interest-only payments during that draw period

- You repay the principal over time during the repayment phase

- You get a line of credit that can be reused, just like a checking account with a loan attached

At TFG, our Digital First Position HELOC is fully online, no paperwork, no appraisals in most cases, and no tax returns required.

How First Position HELOCs Work

A First Position HELOC (also called a First Lien HELOC) functions as both a primary mortgage and a revolving line of credit, giving homeowners flexible access to their home’s equity, without the rigidity of a traditional mortgage or the limitations of a second lien loan.

|

Feature |

Description |

|

Structure |

Combines a mortgage loan and a home equity line into one unified product |

|

Lien Position |

Replaces your first mortgage and takes the first lien position on the property |

|

Draw Period |

Typically lasts 5 –10 years; borrowers make interest-only payments during this time |

|

Repayment Period |

Begins once the draw period ends, with monthly payments on both principal and interest |

|

Interest Rate |

Usually variable interest rates, tied to market indexes; may adjust monthly or quarterly |

|

Flexibility |

Works like a checking account for your home equity: borrow, repay, reuse as needed |

Why Borrowers Choose First Lien HELOCs?

This structure is ideal for homeowners who need ongoing access to capital and want to avoid refinancing their entire mortgage. It offers the same credit flexibility as a credit card, but backed by your home’s equity, often with much lower interest rates and tax-deductible benefits.

Ideal for:

- Self-employed borrowers looking for capital without full doc verification

- Homeowners consolidating debt from higher-interest sources

- Investors or renovators needing revolving access to large amounts

- Business owners needing cash flow without disrupting tax strategies

Unlike a cash-out refinance, you’re not starting your mortgage over from scratch. And unlike a second lien HELOC, you’re simplifying your finances into one primary loan with a built-in draw period and interest-only flexibility.

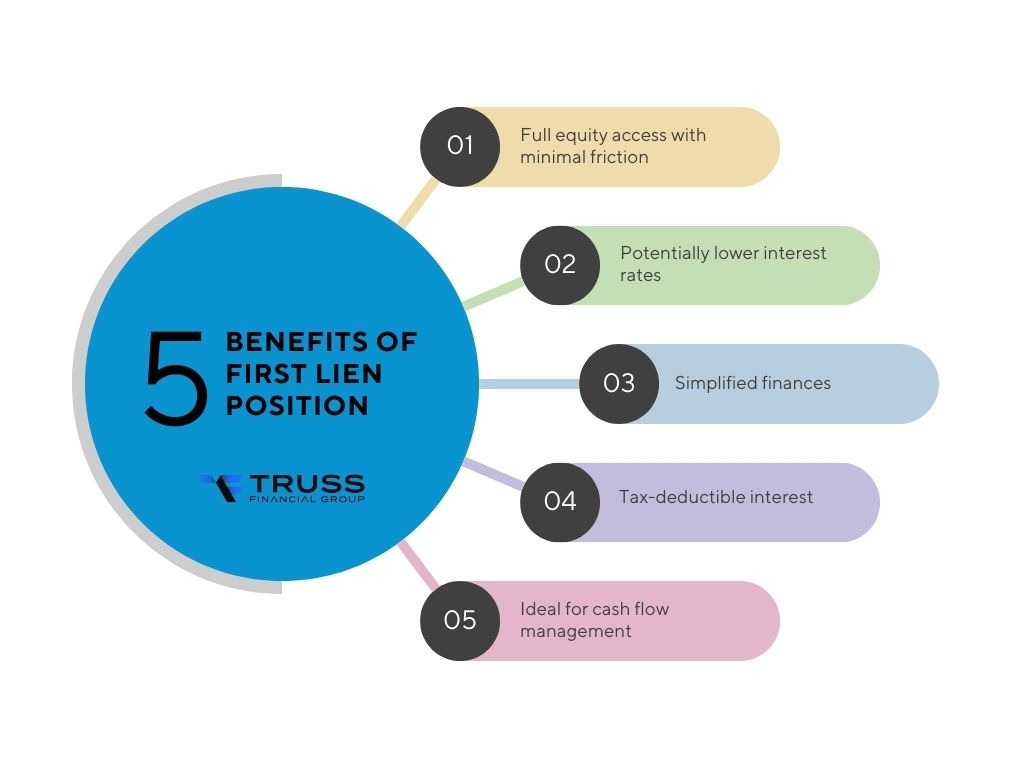

Benefits of First Lien HELOC

A First Lien HELOC isn’t just a flexible way to access your equity, it offers several strategic advantages over traditional mortgage products:

Full equity access with minimal friction

Unlike second-lien loans, a First Position HELOC gives you front-of-the-line access to your home’s value.

Potentially lower interest rates

Because it replaces your primary mortgage, rates are often lower than credit cards or personal loans.

Simplified finances

Consolidate your mortgage and other debts into one flexible, interest-only monthly payment.

Tax-deductible interest

When used for qualifying home improvements, the interest paid may be deductible (always consult your CPA).

Ideal for cash flow management

Especially beneficial for self-employed individuals and real estate investors who need liquidity without restructuring their entire mortgage.

With Truss Financial Group’s no-doc, no-appraisal, and digital HELOC options, these benefits become even more accessible, without the headaches of traditional underwriting.

Drawbacks and Considerations

As with any loan product, First Lien HELOCs come with trade-offs. It’s important to weigh the pros against these potential risks:

Variable interest rates

Monthly payments may rise over time, depending on market conditions.

Risk of foreclosure

Because your home serves as collateral, missing payments can lead to serious consequences.

Qualification requirements

While TFG uses flexible underwriting, most lenders still require solid credit, equity, and income verification (or strong bank statements).

Upfront costs

Appraisal fees (unless waived), title charges, and other closing costs may apply.

Discipline required

The revolving nature of a HELOC can tempt some borrowers into overspending. Smart financial management is essential.

TFG helps mitigate these risks by offering transparent terms, streamlined approval, and tailored options for borrowers who don’t fit into the traditional mortgage box.

First Position HELOC vs. Other Financing Options

When it comes to tapping your home’s equity, not all loan products are created equal. Whether you’re self-employed, equity-rich, or simply looking for flexibility, understanding the differences between a First Position HELOC and other financing options is key to making a smart financial move.

|

Option |

Fixed Loan? |

Appraisal Required? |

Tax Returns? |

Flexibility |

|

First Position HELOC |

No |

Sometimes Waived |

Not with TFG |

Very High |

|

Cash-Out Refinance |

Yes |

Always |

They are Required |

Low |

|

Second Lien HELOC |

No |

Usually |

Full Docs |

Medium |

|

Personal Loan |

Yes |

No |

Proof of income |

Medium |

With TFG, our No Doc First Position HELOC means:

- No paystubs

- No W-2s

- No CPA letter

- Just equity + credit + common sense

With TFG, you’re not just another file in a banker’s stack. We approve over 80% of loans that other lenders reject. Our process is designed for today’s borrowers, those who need access to equity, not outdated paperwork.

Who Qualifies for a First Lien HELOC?

Qualifying for a First Position HELOC is easier than you think, especially with Truss Financial Group.

Most lenders require:

- A 620+ credit score

- At least 30–40% remaining home equity

- Stable monthly income or a strong bank statement history

- A primary residence or eligible investment property

But here’s the difference: TFG doesn’t stop at the paperwork.

The Truss Advantage: Approvals When Others Say No

Over 80% of our borrowers were previously turned down by traditional banks or credit unions. Why? Because most lenders rely solely on tax returns, paystubs, and outdated verification models.

We don’t.

With our Bank Statement HELOC and No Tax Return HELOC, we look at the full picture:

- Cash flow in your checking account

- Strong home equity position

- Low debt-to-income ratio (DTI)

- Responsible credit usage, even if your income is unconventional

Whether you’re a self-employed consultant, real estate investor, retiree, or small business owner, our first lien HELOC programs are built for you, not just W-2 earners.

Pro tip: Even if you've been denied a HELOC, Truss Financial Group may still say yes. We use common-sense underwriting, not outdated checklists.

Truss HELOC Programs at a Glance

- First Position HELOC

Consolidate your mortgage and line of credit into one smart, revolving financial tool. - No Tax Return HELOC

Use bank statements instead of full tax documents. Perfect for consultants, freelancers, and small business owners.

- No W-2s

- No 4506-C

- Just bank statements - No Appraisal HELOC

No in-person inspections. We use AVMs (Automated Valuation Models) and public records to estimate value.

- Faster closings

- No appraisal delays - Digital HELOC

24-hour approvals. 100% online application. All docs e-signed.

- Apply from your phone

- Instant document uploads

- Fast-track closings - HELOC for Seniors (Reverse HELOC)

If you're 62+, tap equity with no monthly payments. Works like a reverse mortgage HELOC.

- Tax-free cash

- No income or credit score requirements

Strategic Uses + Tax Implications

HELOCs aren't just for home renovations. Smart borrowers use them for:

- Real estate investing

- College tuition

- Business capital

- Debt consolidation

- Bridge financing

- Emergency reserves

Depending on how you use the funds, interest payments may be tax-deductible, consult your CPA.

Bonus: With a First Position HELOC, you can pay off high-interest personal loans or credit cards and consolidate all debt into a single, interest-only payment.

Final Thoughts: Why Borrowers Choose Truss

At Truss Financial Group, we know that life doesn’t always fit into a bank’s checkbox form.

Maybe your tax returns don’t reflect your true income.

Maybe you’re between CPA filings or just sold your business.

Maybe you’re 60% into your mortgage and want flexible access to equity, without starting over.

That’s where we come in.

Our First Position HELOC, Digital No Doc HELOC, and other non-QM loan options are tailored for real borrowers with real goals, not just ideal paperwork.

Ready to Access Your Equity?

Apply online in minutes, no paperwork, no tax returns, no waiting.

Or talk to a senior loan officer for a personalized walkthrough.

Your equity. Your terms. Powered by Truss.

FAQ

What is the first position of a HELOC?

The first position (or first lien position) means the HELOC replaces your primary mortgage and becomes the top lien on your property. Instead of sitting behind your existing mortgage like a second-lien HELOC, a First Position HELOC takes over the spot your original mortgage held.

Why this matters:

- The lender in first lien position gets paid first during a sale or refinance

- You can use the HELOC like a revolving line of credit, not a fixed loan

- You avoid doing a full cash-out refinance

- You gain more flexibility and often a higher credit limit because equity is fully leveraged

What is the monthly payment on a $50,000 HELOC?

Monthly payments on a $50,000 HELOC depend on:

- The interest rate (usually variable)

- Whether the HELOC is in the draw period or repayment period

- Whether the lender requires interest-only or principal + interest payments

A simple example:

If your rate is 8% APR during the draw period and payments are interest-only, your monthly payment would roughly be:

$50,000 × 0.08 ÷ 12 ≈ $333/month

If principal repayment is required, the payment would be higher depending on the remaining loan term.

What are the benefits of a first lien Heloc?

A First Lien HELOC lets you tap into your home’s equity without doing a full refinance. Key benefits include:

- Replaces your mortgage without restarting a 30-year term

- Revolving credit line with interest-only payments during the draw period

- No tax returns required with TFG’s No Doc HELOC

- Ideal for debt consolidation, business cash flow, or large expenses

- Faster access with TFG’s Digital, No Appraisal, and No Tax Return HELOC options

- Potential tax deductions when funds are used for qualifying home improvements

Table of Content

Take your pick of loans

Experience a clear, stress-free loan process with personalized service and expert guidance.

Get a quote

.png?width=352&name=xxxxxx%20header%20(61).png)