Home Loans in Georgia

Buying a home in Atlanta, Savannah, Augusta or anywhere in Georgia? Choose a mortgage lender that helps you select the right home loan, not just the lowest teaser rate.

Truss Financial Group is a mortgage broker that serves borrowers statewide with Conventional, FHA, VA, USDA, Jumbo, HELOC and Non-QM options, including bank-statement loans, DSCR loans, and asset-depletion programs.

If you are a first-time home buyer, we will review Georgia Dream down-payment assistance and local programs so you do not miss available benefits. This guide is written for Georgia borrowers.

It explains the mortgage process in plain language, helps you compare mortgage programs, and shows you how to plan your down payment, closing costs, credit score, and DTI.

4.6 from 700+ reviews

4.6 from 700+ reviews

4.6 from 700+ reviews

Key Takeaways

- Truss Financial Group serves all of Georgia and works as a mortgage broker.

- Programs offered: Conventional, FHA, VA, USDA, Jumbo, HELOC, and Non-QM.

- Non-QM options include bank-statement loans, DSCR loans, and asset-depletion.

- TFG specialties: DSCR below 1.0 for investors and a fast Digital HELOC flow.

- First-time buyers may qualify for Georgia Dream down-payment assistance.

- Typical requirements: 580 to 620+ credit, two years of income history, DTI near or below 45 percent.

- Minimum down payments: Conventional from 3 percent, FHA 3.5 percent, VA and USDA 0 percent if eligible.

- The mortgage process: pre-approval, home search, appraisal, underwriting, closing.

- Rates change daily. Use a pre-approval for a personalized quote.

- Use the Georgia mortgage calculator to plan payment, taxes, insurance, and HOA.

- Compare total cash to close and monthly payment across loan types before you make an offer.

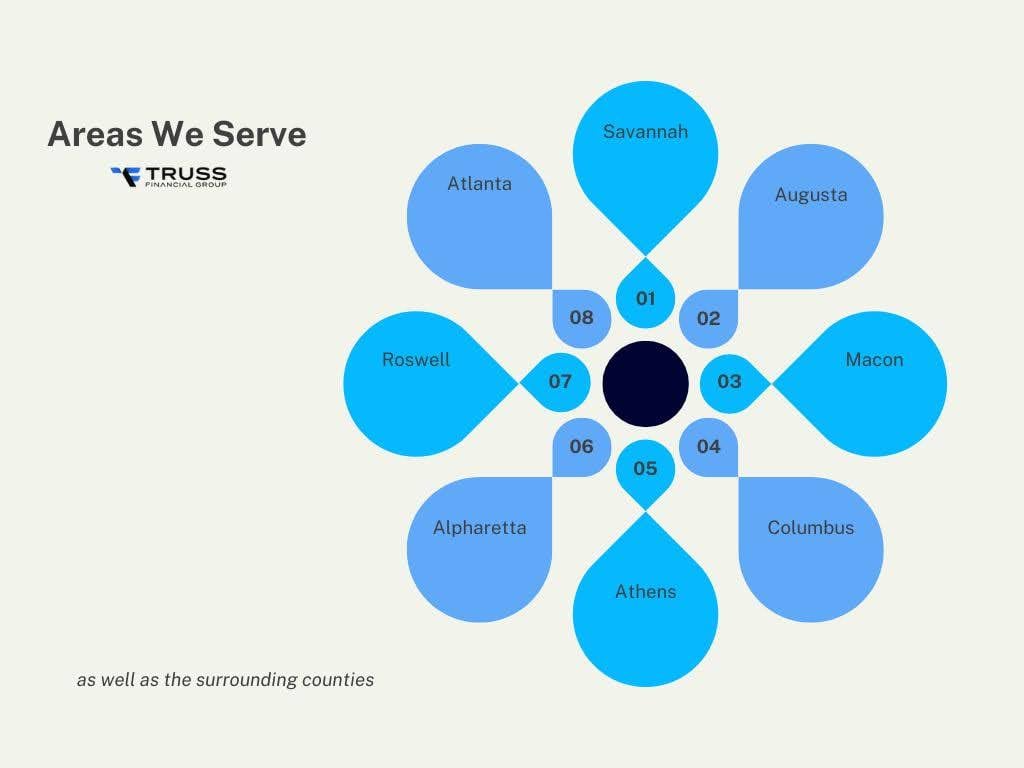

Areas We Serve

We lend across the State of Georgia. Our team regularly helps home buyers and homeowners in Atlanta, Savannah, Augusta, Macon, Columbus, Athens, Alpharetta, and Roswell, as well as the surrounding counties.

If you live outside these cities, we can still assist you with the same care and speed. Speak with a Truss Financial Group loan advisor for local guidance and a clear next step.

How Do Home Loans Work in Georgia?

The mortgage process in Georgia follows a clear path. You begin with a pre-approval, choose a home, complete the appraisal, move through underwriting, and then attend closing. Throughout the process we explain your credit score, DTI, down payment, closing costs, and available mortgage programs. First-time buyers may also qualify for Georgia Dream or local down-payment assistance.

| Step | Typical Duration | Description |

| Pre-approval | 1–3 days | We review your credit, income, assets, and DTI to set a clear budget and issue a pre-approval letter. |

| Home search | Varies | You work with your agent to select a property and make an offer based on your approved price range. |

| Appraisal | 5–10 days | A licensed appraiser estimates market value to confirm the home supports the loan amount. |

| Underwriting | 1–2 weeks | We verify documents, clear conditions, and confirm program eligibility for your loan type. |

| Closing | 1 day | You sign final documents, pay funds due at closing, and receive the keys once the loan funds. |

What Are the Requirements to Buy a Home in Georgia?

Buying in Georgia is straightforward once you know what lenders review. These are the essentials:

Credit score

- FHA is usually available from 580+ with 3.5% down. Borrowers in the 500–579 range may still qualify with 10% down.

- Conventional loans typically expect 620+.

- VA and USDA do not set a hard minimum score at the agency level, but lenders apply their own standards and look at the full file.

Income verification

- W-2 employees use pay stubs, W-2s, and tax returns.

- Self-employed borrowers may qualify with bank-statement or asset-depletion programs, depending on the lender’s rules.

Debt-to-Income (DTI) ratio

- Most programs aim for 45% or lower. Some Conventional approvals reach up to 50% with strong compensating factors such as high credit scores, solid reserves, or lower loan-to-value.

Down payment

- Conventional: typically 3%–5% for many first-time or well-qualified buyers.

- FHA: 3.5% with scores ≥580.

- VA/USDA: 0% down if you are eligible and the property meets program rules.

| Requirement | Standard | Notes |

| Credit Score | 580–640 | Varies by loan type |

| DTI Ratio | ≤45% | Can go higher with strong reserves |

| Down Payment | 0–5% | Depending on program |

| Employment | 2 years | Same line of work preferred |

What Are the Current Mortgage Rates in Georgia?

Mortgage rates change every day. They move with the bond market and they also depend on your profile. Lenders price your rate using your credit score, down payment, debt-to-income ratio, loan amount, loan type, points paid, property type, and the lock period.

Georgia rate pages show local snapshots, while the Freddie Mac Primary Mortgage Market Survey gives a national weekly benchmark. Use those sources for trend awareness, then get a personalized quote with a pre-approval.

How to read a rate quote?

- Rate vs APR: Rate affects the monthly principal and interest. APR wraps in certain costs so you can compare offers.

- Points vs credits: Paying discount points can lower the rate. Taking lender credits can raise the rate but reduce cash to close.

- Lock period: Longer locks can cost more. Ask for 30, 45, and 60 day comparisons.

- Occupancy and property type: Second homes, condos, and investment properties price differently.

Do Georgia rates differ from national averages?

They usually track the national trend. Local competition, credit profile, points paid, and lock terms can place your offer a little above or below the national benchmark. Check the Freddie Mac survey for the national context, then compare written quotes from lenders serving Georgia.

What Mortgage Programs Are Available in Georgia?

| Loan Type | Ideal For | Down Payment | Typical Credit | Key Benefit |

| Conventional | Well-qualified borrowers | 3%–20% | 620+ | Broad use, competitive PMI at higher scores. |

| FHA | First-time or credit-rebuilding | 3.5% at ≥580 | 580+ | Flexible credit and DTI guidelines. |

| VA | Eligible service members and veterans | 0% | Lender-set | No monthly PMI, powerful benefit. |

| USDA | Rural-eligible areas and incomes | 0% | Lender-set | 100% financing if home and income qualify. |

| Jumbo | Homes above FHFA county limits | 10%–20% | 700+ typical | Higher amounts for high-cost homes. |

| Georgia Dream (DPA) | Eligible GA buyers | Second-lien assistance up to program caps | Program-set | Down-payment and closing-cost help. |

| Bank-Statement (Non-QM) | Self-employed | 10%–20% | Alt-doc | Qualify with deposits instead of tax returns. |

| DSCR (Non-QM) | Investors | 20%+ | Alt-doc | Qualify using property cash flow. |

| HELOC / HELOAN | Owners with equity | Varies | Varies | Tap equity for renovations or debt consolidation. |

Conventional Loans (Conforming)

Conventional loans work well for borrowers with solid credit, steady income, and a moderate down payment. A 620+ representative credit score is the common floor for Desktop Underwriter approvals. County loan limits matter in Georgia. If the price exceeds your local limit, you move into Jumbo territory.

Good fits: Primary homes, second homes, and many investment properties.

FHA Loans

FHA helps buyers who are building or rebuilding credit. With a score of 580 or higher, the minimum down payment is 3.5%. Borrowers with 500–579 may qualify with 10% down. FHA has friendly DTI allowances and flexible credit history rules, which is why many first-time buyers start here.

Good fits: Thin credit files, shorter work histories, past credit events that are now seasoned.

VA Loans

For eligible veterans and service members, VA offers true zero-down financing in many cases and no monthly PMI. VA credit standards are set by lenders, but the program’s guarantee is very strong, which is why VA terms are often excellent.

Good fits: Eligible borrowers buying a primary residence, including many who want to minimize cash to close.

USDA Loans

USDA offers 0% down in eligible rural areas, subject to income limits and property maps. It is a great path for buyers who qualify based on geography and income.

Good fits: Buyers open to USDA-eligible ZIP codes who meet income guidelines.

Jumbo Loans

When the loan amount exceeds your FHFA county limit, you are in Jumbo territory. These loans usually ask for stronger reserves, higher scores, and conservative DTIs. We will show you several investor options so you can balance cash to close with payment.

Good fits: High-value homes, larger acreage, luxury condos with additional review needs.

Georgia Dream Down-Payment Assistance

The Georgia Dream program provides down-payment and closing-cost assistance through a deferred, 0% second lien when eligibility is met. Program caps, income limits, and purchase price limits apply and are updated by the Georgia Department of Community Affairs. We will confirm the current assistance level for your county and profile.

Good fits: First-time buyers and other eligible households who need help with cash to close.

Non-QM and Investor Solutions (TFG Specialties)

Some borrowers do not fit agency boxes. That is where our Non-QM menu helps:

Bank-Statement Loans

Qualify using business or personal bank deposits instead of tax returns. This is popular with self-employed professionals whose reported net income does not reflect cash flow.

DSCR Loans for Investors

Qualify based on the Debt Service Coverage Ratio of the property, not your personal W-2 income. We underwrite the rent and the projected PITI.

TFG specialty: DSCR below 1.0

If your property is temporarily cash-flow negative, ask about our DSCR < 1.0 options. With strong compensating factors such as reserves, equity, or short-term rent trends, we may still structure a deal. Not all lenders offer this. Terms and availability vary; we will walk you through scenario-by-scenario.

Asset-Depletion Programs

Turn verified assets into qualifying income using program formulas. Useful for retirees or high-asset households.

Interest-Only Options

Lower the required payment for a set period while preserving flexibility, often used by investors planning improvements or a sale.

Home Equity Options

HELOC and Fixed-Rate HELOAN

Use your home equity for renovations, debt consolidation, or cash management. We will help you weigh variable-rate HELOC versus fixed-rate HELOAN based on your timeline and risk tolerance.

Digital HELOC (TFG Specialty)

Apply online, upload documents, and track progress in a streamlined digital flow. This is designed to move quicker than a traditional process while keeping full underwriting integrity. If speed matters, ask for our Digital HELOC route.

Buying a House in Georgia

Home prices in Georgia vary by region. The Atlanta suburbs often sit higher, while many smaller cities remain more affordable.

Your total monthly mortgage payment will depend on price, down payment, interest, property taxes, homeowners insurance, and any HOA dues. Use our mortgage calculator for Georgia to see your exact number before you make an offer.

Tips for shoppers

- Get a pre-approval first so you know your budget by city and county.

- Ask us to compare Conventional vs FHA and see if Georgia Dream can reduce your cash to close.

- If you plan a renovation, we can also review HELOC and fixed-rate home equity options.

What Mortgage Assistance Programs Are Available in Georgia?

Georgia Dream Homeownership Program

Georgia Dream helps eligible buyers with down-payment and closing-cost assistance. The support is provided as a deferred, 0% second lien that is repaid if you sell, refinance, or move out of the home. Assistance levels and income limits are updated by the Georgia Department of Community Affairs.

Current structure at a glance

- Standard Assistance: up to $10,000

- Protectors/Educators/Nurses (PEN): up to $12,500 for qualifying professions

- Homebuyers Choice: up to $10,000 for eligible first-time or repeat buyers

Basic eligibility

- Meet program income limits and purchase-price caps

- Minimum credit score set by the program and lender

- Complete required homebuyer education

- Occupy the property as your primary residence

How we help

- We verify eligibility, model your cash to close with and without assistance, and pair Georgia Dream with FHA or Conventional financing when it makes sense.

- If you do not qualify, we will look at local city and county programs that may layer with your first mortgage.

Other Options

- USDA loans for eligible rural areas with 0% down and income limits

- Local credit union and city programs that offer grants or forgivable seconds

- Employer assistance where available

What is the Georgia Dream Program?

It is a state-backed down-payment assistance program that helps qualifying homebuyers cover part of the cash needed to close. Funds are typically a deferred, 0% second lien with rules on repayment, occupancy, and eligibility.

What Should I Know About Mortgage Tax in Georgia?

Understanding the state’s mortgage-related taxes will help you plan your closing costs.

- Real estate transfer tax: Calculated as $1 for the first $1,000 of property value and $0.10 for each additional $100. This is commonly paid at closing.

- Intangible recording tax on the mortgage: Assessed at $1.50 per $500 of the loan amount, up to the state cap. This applies when the security deed is recorded.

- Property taxes: Effective property tax rates in Georgia are lower than the national average, but they vary by county and city. Always budget with local figures from the tax assessor rather than a statewide estimate.

Before you write a contract, ask for our county closing-cost summary covering transfer tax, intangible tax, title fees, and prepaid items

Apply for a Georgia Mortgage

Ready to begin with Truss Financial Group?

Get a fast pre-approval, compare Conventional, FHA, VA, USDA, Jumbo, HELOC and Non-QM options and see if you qualify for Georgia Dream. TFG can give you a clear budget, a plain explanation of fees and timelines and a path to closing.

Frequently Asked Questions

What are the main Georgia mortgage loan requirements?

Most buyers qualify with a credit score of 580 to 620 or higher, a two-year employment or income history, and a debt-to-income ratio near or below 45%. Some approvals go higher with strong credit, reserves, or a larger down payment. Your exact requirements depend on the loan type.

Who are the top Georgia mortgage lenders?

You can compare Truss Financial Group with banks and credit unions that serve Georgia. The smart move is to request the same scenario from each lender and compare total cash to close, monthly payment, mortgage insurance, and fees on one sheet.

How do I use the Bank of Georgia mortgage calculator?

Enter the home price, down payment, loan term, and an estimated interest rate, then add property taxes, home insurance, and HOA dues for a realistic monthly payment. Adjust the numbers until you find a comfortable budget, then ask us to verify with a pre-approval.

How does the Georgia Dream program differ from FHA loans?

FHA is your first mortgage with a low down payment and flexible credit rules. Georgia Dream is additional down-payment and closing-cost assistance that can be paired with FHA or some Conventional loans if you meet state guidelines.

Are Georgia mortgage rates affected by property taxes or location?

Your interest rate comes from the lender and the market, not from property taxes. However, your total monthly payment changes with county taxes, insurance, and HOA, and those vary by location. Use the calculator for estimates, then ask for a county-specific closing-cost review.

Which loan should I choose as a first-time buyer in Georgia?

Many first-time buyers compare Conventional 3% down and FHA 3.5% down, and then check if Georgia Dream can reduce the cash required at closing. If you are eligible, VA or USDA may offer zero down. We will model each option side by side.

Do lenders in Georgia offer programs for self-employed buyers or investors?

Yes, at Truss Financial Group, we offer Bank-Statement mortgages for self-employed borrowers and DSCR loans for investors that qualify based on the property’s cash flow. Ask about DSCR below 1.0 scenarios and our Digital HELOC for fast equity access where eligible.

Trusted by 1,964 people

Get a free custom rate quote

- 81% approval rate

- No commitment

👉 Filling out this form won’t affect your credit score.

Get the information you need to make confident decisions

Discover your borrowing power and plan your mortgage journey with knowledge on your side.

Get a quote- No documents required

- No commitment

- No commitment

Get a quote in 3 easy steps

Tell us what you want

Fill out our online form to help us understand your financial situation and loan needs.

We get to work for you

We review your info and look for competitive rates that match your specific goals.

You get a personalized quote

You’ll receive a customized rate quote that meets your unique profile.