For many older homeowners in California, the house they live in has become their biggest financial asset. Years of rising property values have left retirees with a lot of equity tied up in their homes but not always enough cash on hand to cover everyday expenses. A reverse mortgage offers a way to unlock that value.

Instead of selling or taking on another monthly payment, homeowners can turn part of their equity into usable funds while continuing to live in their home.

How a Reverse Mortgage Works

A reverse mortgage is a loan that lets you borrow against the equity in your home. You retain ownership and continue living in the property. The loan is repaid when you no longer live in the home, typically through the sale of the property.

Payments can be received in different ways:

- Lump sum: One-time payout of available funds.

- Monthly payments: Regular income for a set period or lifetime.

- Line of credit: Draw funds as needed, with unused amounts growing over time.

- Combination: Mix of monthly payments and line of credit.

The most common reverse mortgage is the Home Equity Conversion Mortgage (HECM), which is federally insured and regulated by the FHA. California lenders also offer jumbo reverse mortgages, designed for high-value homes that exceed FHA loan limits.

California Home Values and Reverse Mortgages

California has some of the most expensive real estate in the country, which directly impacts reverse mortgage availability. As of 2025, the FHA lending limit for HECMs is $1,149,825 nationwide. In California’s luxury markets, many homes exceed this value, which is where jumbo reverse mortgages come into play.

|

Region

|

Median Home Price (2025)

|

Eligible for HECM?

|

May Need Jumbo Reverse Mortgage?

|

|

Los Angeles County

|

$860,000

|

Yes

|

Sometimes

|

|

Orange County

|

$1,400,000

|

No (above FHA cap)

|

Yes

|

|

San Francisco

|

$1,640,000

|

No (above FHA cap)

|

Yes

|

|

San Diego County

|

$930,000

|

Yes

|

Sometimes

|

|

Sacramento County

|

$550,000

|

Yes

|

No

|

|

Santa Clara County

|

$1,600,000

|

No (above FHA cap)

|

Yes

|

As the table shows, homeowners in markets like San Francisco, Orange County, and Silicon Valley typically need jumbo reverse mortgages, while those in areas like Sacramento or San Diego may qualify under FHA’s HECM cap.

Eligibility Requirements

Reverse mortgages aren’t for everyone. California borrowers must meet certain conditions:

- Age: Minimum age 55 for proprietary (jumbo) programs; 62 for FHA-insured HECMs.

- Primary residence: The home must be your main residence, not a second home or rental.

- Equity: Significant equity required (generally at least 50% ownership).

- Taxes and insurance: Borrowers must keep property taxes, insurance, and HOA dues current.

- Counseling: FHA requires borrowers to complete an independent counseling session.

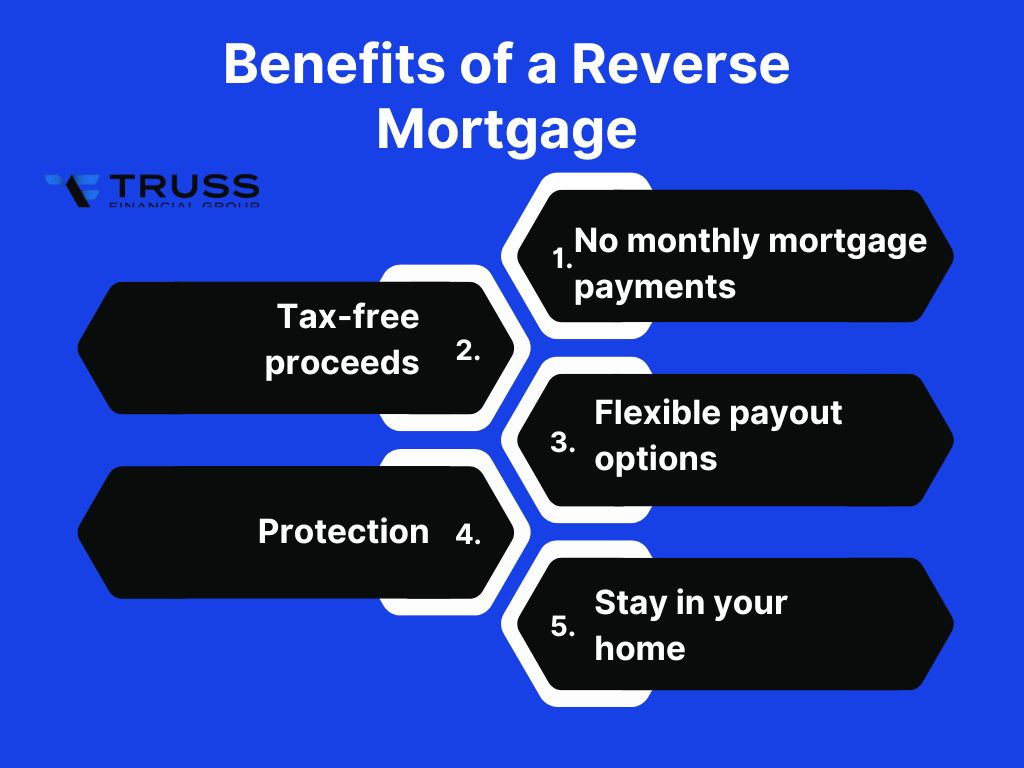

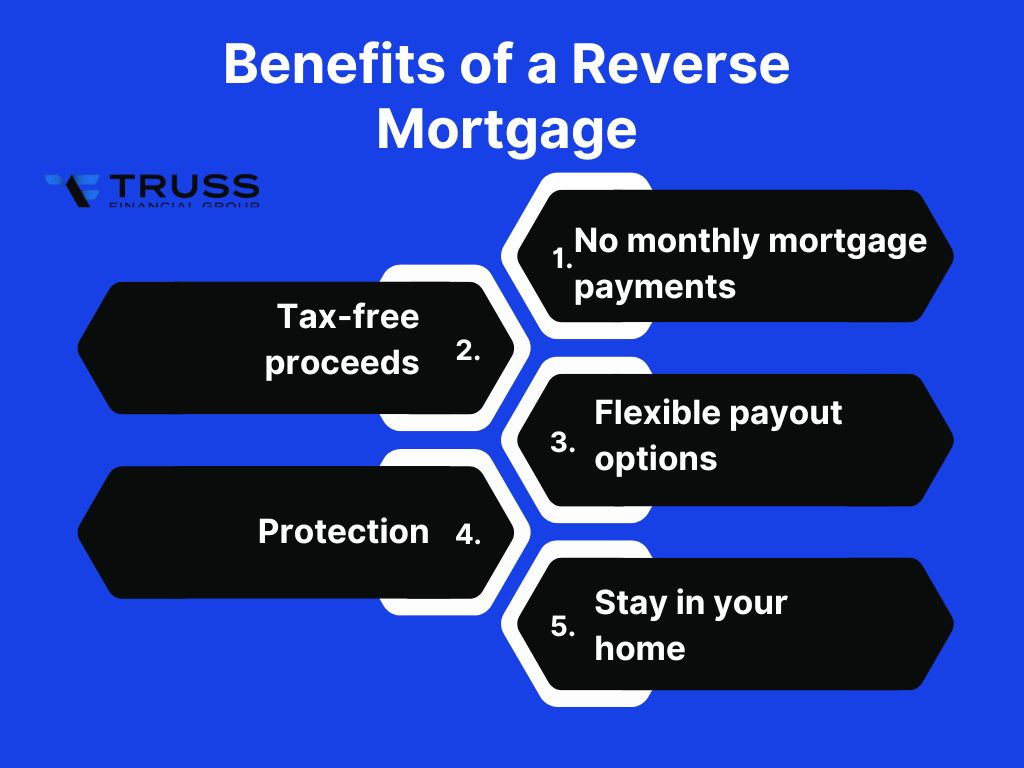

Benefits of a Reverse Mortgage

Reverse mortgages can provide important advantages for California retirees:

- No monthly mortgage payments while you live in the home.

- Tax-free proceeds since funds are considered loan advances, not income.

- Flexible payout options (lump sum, line of credit, monthly checks).

- Protection: With HECM loans, you can never owe more than the home’s value when sold.

- Stay in your home: Retain ownership and remain in your house while using its equity.

Risks and Considerations

Like any financial product, reverse mortgages carry risks:

- Home equity decreases over time as loan balance grows.

- Heirs may need to sell the home to repay the loan after you pass away.

- Costs: Upfront fees, mortgage insurance (for HECMs), and servicing charges can be higher than traditional mortgages.

- Responsibility: You must continue paying property taxes, insurance, and upkeep. Failing to do so can trigger foreclosure.

- Not for short-term needs: Works best for those planning to remain in their home long-term.

Jumbo Reverse Mortgages in California

Because California has many luxury markets, jumbo reverse mortgages are especially important. These private loans allow homeowners with properties valued well above the FHA cap to access much larger payouts.

Because California has many luxury markets, jumbo reverse mortgages are especially important. These private loans allow homeowners with properties valued well above the FHA cap to access much larger payouts.

For example:

- A 70-year-old homeowner in San Francisco with a $2.5 million property and no mortgage could access well over $1 million in available reverse mortgage funds through a jumbo program.

- In comparison, the same homeowner using an FHA HECM would be limited to the $1,149,825 lending cap, significantly reducing available funds.

Jumbo reverse mortgages often come with more flexible terms, such as:

- Lower minimum ages (starting at 55).

- Larger loan amounts, sometimes up to $4–5 million.

- No federal mortgage insurance premiums.

Reverse Mortgage Example in California

Let’s consider a 68-year-old retiree in Los Angeles with a home valued at $1,000,000 and no mortgage balance:

- Available equity (approximate): $500,000

- Loan type: FHA HECM

- Payout option chosen: Line of credit

- Monthly cost responsibilities: Property tax $9,000/year, insurance $1,800/year

This borrower could set up a line of credit worth several hundred thousand dollars, using it as needed to cover living expenses. Because the unused line grows over time, their available funds could increase each year.

Reverse Mortgage Refinancing

Many California homeowners refinance their reverse mortgage if conditions change. Reasons include:

- Higher home values allow access to more equity.

- Lower interest rates improving payout amounts.

- Switching to a jumbo reverse mortgage when property values rise beyond FHA limits.

Is a Reverse Mortgage Right for You?

A reverse mortgage can be a smart solution for Californians who:

- Are “house rich but cash poor.”

- Plan to remain in their home long-term.

- I want to improve cash flow without selling property.

It may not be the best fit for those who:

- Expect to move within a few years.

- Wish to leave their home debt-free to heirs.

- Struggle to keep up with taxes and insurance.

Frequently Asked Questions

Do I still own my home with a reverse mortgage?

Yes, you remain the legal owner. The lender places a lien, but ownership stays with you.

What happens when I pass away?

Your heirs can repay the loan and keep the home, or sell the property to satisfy the debt. With FHA HECMs, they are protected from owing more than the home’s value.

Can I get a reverse mortgage on a condo in California?

Yes, if the condo is FHA-approved (for HECMs) or meets lender criteria (for jumbo reverse mortgages).

Are reverse mortgage proceeds taxable?

No, funds are not taxed because they are loan advances, not income.

What is the minimum age for a reverse mortgage in California?

For FHA HECMs, 62. For jumbo reverse mortgages, as low as 55.

Conclusion

California homeowners often hold substantial equity due to high property values. A reverse mortgage offers a way to convert that equity into usable funds without selling the home. With both FHA HECMs and jumbo reverse mortgages available, options exist for properties of nearly any value.

For retirees seeking financial flexibility, a reverse mortgage can provide steady income, cash for emergencies, or simply peace of mind. As with any major decision, consulting with a trusted lender and weighing the long-term impact is essential.

Because California has many luxury markets, jumbo reverse mortgages are especially important. These private loans allow homeowners with properties valued well above the FHA cap to access much larger payouts.

Because California has many luxury markets, jumbo reverse mortgages are especially important. These private loans allow homeowners with properties valued well above the FHA cap to access much larger payouts.