11 min read

.png)

In 2026, no-appraisal HELOCs are primarily approved using automated valuation models (AVMs) or hybrid valuations, allowing lenders to estimate property value without a physical inspection when equity, credit profile, and loan size fall within acceptable risk thresholds.

Appraisal waivers are most common on lower LTV HELOCs, first-lien positions, and properties with strong comparable sales data.

The best no-appraisal HELOCs are borrower-specific:

self-employed borrowers often qualify through bank statement or no-tax-return HELOCs;

seniors benefit from senior-focused HELOC programs that prioritize equity over income;

investors and high-DTI borrowers may qualify through DSCR-style HELOAN structures;

borrowers seeking speed benefit most from digital HELOCs with automated underwriting.

No-appraisal HELOCs may not be suitable for rural, unique, or highly upgraded properties where AVMs undervalue the home. Compared to home equity loans, personal loans, and cash-out refinances, HELOCs offer more flexible access to equity with fewer upfront costs when appraisal waivers apply.

Lenders such as Truss Financial Group illustrate how non-QM underwriting enables these structures.

INTRODUCTION

If you’ve ever tried to open a home equity line of credit, you already know the slowest and most annoying part of the process: the appraisal. Scheduling it, paying for it, waiting weeks, only to be told your home came in lower than expected.

The good news? In 2026, many homeowners can access a no-appraisal HELOC using modern valuation tools instead of a full in-person inspection.

.png?width=2240&height=1260&name=xxxxxx%20header%20(55).png)

This guide breaks down the best no-appraisal HELOC options, who they work best for, and how lenders decide whether an appraisal can be waived, without rehashing basic HELOC theory you’ve already heard a hundred times.

Think of a HELOC like a reusable credit card backed by your home’s value. The difference today is how that value gets determined.

What “No-Appraisal HELOC” Actually Means?

A “no-appraisal HELOC” doesn’t mean the lender ignores your home’s value. It means the lender uses automated valuation models (AVMs) or limited hybrid methods instead of a traditional full appraisal.

Instead of sending an appraiser to physically inspect your property, lenders may rely on:

- Recent comparable properties

- Local market data

- Prior recorded appraisals

- Algorithm-based property valuations

This can eliminate appraisal fees (often $350–$800) and reduce approval time from weeks to days.

If you want a deeper breakdown of how appraisal waivers work and when lenders allow them, see our detailed guide: Can You Get a HELOC Without an Appraisal?

This article assumes you already know it’s possible, and focuses on choosing the best option.

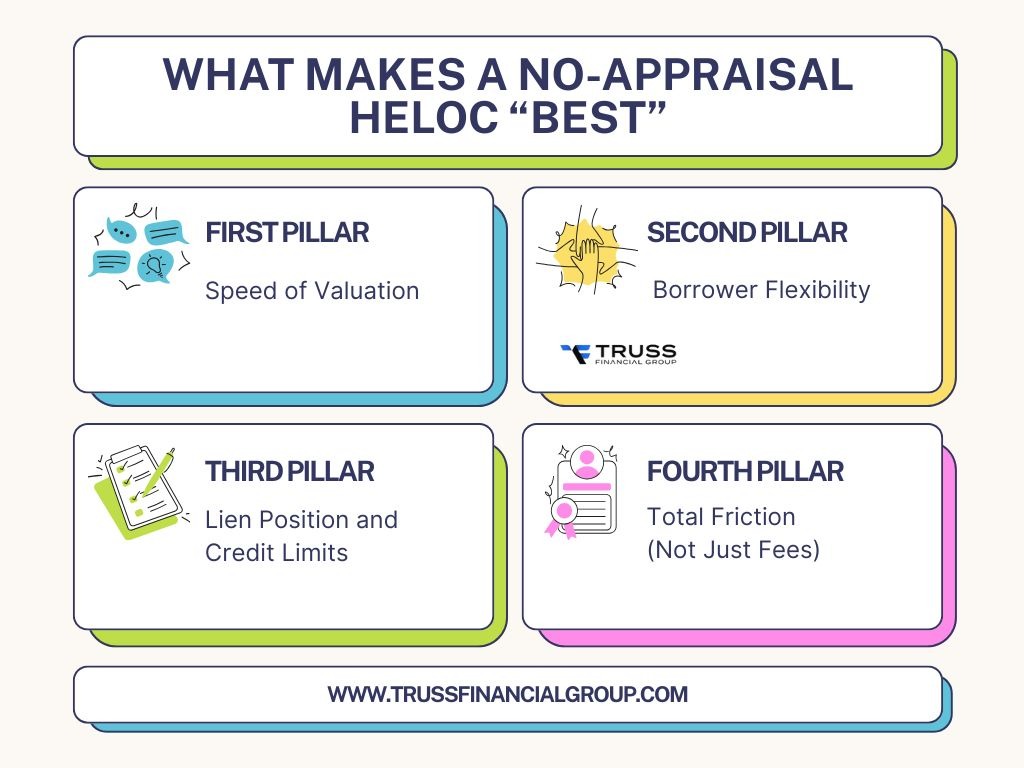

What Makes a No-Appraisal HELOC “Best”?

Not all no-appraisal HELOCs are created equal. The “best” option depends less on rates and more on who the loan is designed for.

Here’s what actually matters.

Speed of Valuation

AVM-based HELOCs can complete property valuation in minutes or hours instead of 1–3 weeks. Faster valuation usually means faster funding.

Borrower Flexibility

Some lenders only waive appraisals for borrowers with pristine credit and low debt-to-income ratios. Others design programs for self-employed borrowers, seniors, or high-DTI profiles.

Lien Position and Credit Limits

First-position HELOCs and lower loan-to-value requests are more likely to qualify for appraisal waivers. Most lenders cap borrowing at around 85% of the home’s current market value minus existing mortgage balance.

Total Friction (Not Just Fees)

“No appraisal” loses its meaning if the lender replaces it with excessive income verification, documentation requests, or slow manual underwriting.

Best No-Appraisal HELOC Options by Borrower Type

This is where most comparison articles fail. The best no-appraisal HELOC depends on who you are, not who has the biggest marketing budget.

Best No-Appraisal HELOC for Self-Employed Borrowers

Self-employed homeowners often get stuck twice, once on income verification and again on property valuation.

Some lenders allow:

- Bank statement income instead of tax returns

- AVM-based property valuations

- No personal income documentation in certain cases

This structure works well for business owners, freelancers, consultants, and 1099 earners who have strong equity but inconsistent taxable income.

Programs like No Tax Return HELOCs and Bank Statement Mortgages are often paired with digital valuation methods to streamline approvals.

Best No-Appraisal HELOC for Seniors and Retirees

Seniors frequently have:

- Significant home equity

- Fixed or limited income

- A need for flexible monthly payments

A Senior HELOC may allow appraisal waivers when equity is strong and credit history is stable, even if income is limited. In some cases, lenders focus more on available equity and credit profile than traditional debt-to-income ratios.

This makes HELOCs a useful alternative to personal loans or asset liquidation for retirees managing ongoing expenses or unexpected costs.

Best No-Appraisal HELOC for Investors and High-DTI Borrowers

Real estate investors and high-DTI borrowers are often excluded by traditional banks, even with strong assets.

Some lenders structure HELOCs similarly to DSCR HELOAN programs, where the focus shifts away from personal income and toward asset performance or equity position.

When loan amounts are conservative and equity is strong, AVM-based valuations can still be used, especially for single-family homes in active markets.

Best No-Appraisal HELOC for Fast Access to Equity

If speed matters, digital underwriting is the differentiator.

Digital HELOCs combine:

- Automated valuation models

- Online document collection

- Streamlined underwriting

This approach reduces approval timelines dramatically compared to traditional credit unions and large banks.

Lenders like Truss Financial Group specialize in these alternative-friendly structures, offering digital HELOC programs that serve seniors, self-employed borrowers, and high-DTI homeowners without relying on old-school appraisal bottlenecks.

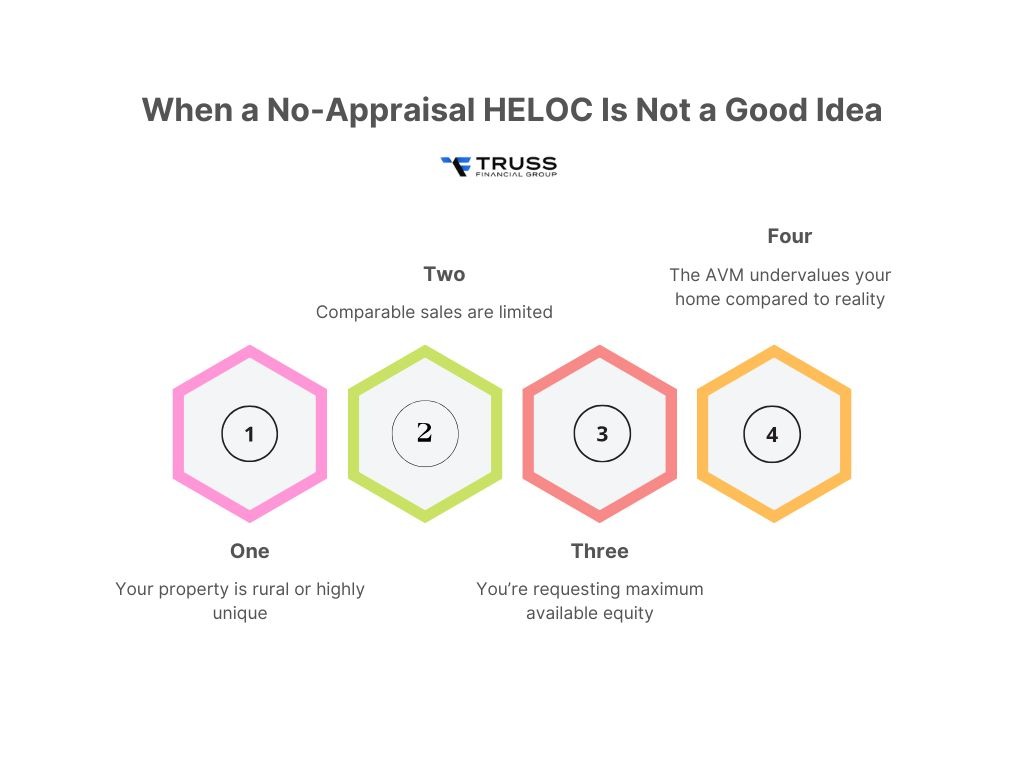

When a No-Appraisal HELOC Is Not a Good Idea?

No-appraisal doesn’t mean no-risk. In some cases, a full appraisal is actually the better option.

You may not qualify for an appraisal waiver if:

- Your property is rural or highly unique

- Comparable sales are limited

- You’re requesting maximum available equity

- The AVM undervalues your home compared to reality

Automated models can sometimes be conservative. If your home has custom upgrades or unusual features, a full appraisal may unlock a higher credit limit.

No-Appraisal HELOC vs Other Equity Options

Before committing, it helps to understand alternatives.

HELOC vs Home Equity Loan

A HELOC offers flexible access and variable rates, while a home equity loan provides a lump sum with fixed payments. Appraisal requirements vary for both.

HELOC vs Personal Loan

Personal loans don’t require appraisals but often carry higher interest rates and shorter loan terms.

HELOC vs Cash-Out Refinance

Cash-out refinancing replaces your existing mortgage and almost always requires a full appraisal making it slower and more expensive in many cases.

How to Qualify for a No-Appraisal HELOC Faster?

While every lender differs, borrowers most likely to receive appraisal waivers typically have:

- Solid credit history

- Meaningful available equity

- Lower borrowing limits relative to home value

- Properties in active, data-rich markets

- Clean title and mortgage history

Preparing documents early and understanding your equity position can significantly speed up the process.

Final Thoughts: Choosing the Best No-Appraisal HELOC

A no-appraisal HELOC can be a powerful financial tool, but only when the structure fits your situation.

The “best” option isn’t about chasing the lowest advertised rate. It’s about:

- How your home is valued

- How your income is reviewed (or not reviewed)

- How quickly and realistically the lender can approve you

Lenders like Truss Financial Group focus on modern underwriting, digital valuation, and alternative borrower profiles, making them a practical choice for homeowners who don’t fit inside a traditional bank box.

If you’re exploring a Digital HELOC, Senior HELOC, or No Tax Return HELOC, understanding these distinctions upfront can save you time, money, and unnecessary frustration.

FAQs

Who has the best HELOC right now?

Who has the best HELOC right now?

There isn’t a single best HELOC for every borrower. The right option depends on how much equity you have, how your income is documented, and how flexible the lender is with appraisals and underwriting. Borrowers who prioritize no-appraisal options, no-documentation programs, and faster digital approvals often work with alternative lenders rather than traditional banks.

In fact, an independent comparison by LendEDU listed Truss Financial Group among the top no-documentation lenders, highlighting its focus on non-QM, senior-friendly, and digital HELOC structures. The best HELOC is ultimately the one that aligns with your equity position, borrowing needs, and long-term financial goals, not just headline rates or marketing claims.

Is it possible to get a HELOC without an appraisal?

Yes, it is possible in some cases. Certain lenders approve HELOCs without a traditional in-person appraisal by using automated valuation models (AVMs) or hybrid valuation methods instead. These tools estimate a home’s current market value using recent sales data, comparable properties, and market trends.

However, not all borrowers or properties qualify. Approval depends on factors such as available equity, credit profile, loan amount, and property type.

How can I avoid an appraisal for a HELOC?

You may be able to avoid a full appraisal by meeting conditions that lower risk for the lender, including:

- Having substantial home equity

- Requesting a conservative credit limit

- Owning a single-family home in a data-rich market

- Maintaining a strong credit history

- Applying with a lender that supports digital HELOCs and AVM-based valuations

Even when an appraisal is waived, lenders still verify property value using market data and internal valuation models.

Is an appraisal required on a HELOC?

Not always. While many traditional banks and credit unions require a full appraisal, some lenders waive it when automated or hybrid valuation methods provide sufficient accuracy.

Appraisal requirements vary by lender and are influenced by loan-to-value ratio, property characteristics, and borrower risk profile.

Do all HELOCs require an appraisal?

No. Some HELOCs are approved without a full appraisal, particularly when the lender can confidently determine the property’s value through AVMs or recent comparable sales. Others, especially higher loan amounts or unique properties may still require a full appraisal.

Can I get a home equity loan with no appraisal?

Yes, Lenders like Truss Financial Group offer home equity loans using automated or hybrid valuations instead of a full appraisal. However, appraisal waivers are more common with HELOCs than with lump-sum home equity loans. Eligibility depends on equity, credit strength, and property type.

What disqualifies you from getting a home equity loan?

Common disqualifiers include:

- Insufficient home equity

- Poor or limited credit history

- High debt-to-income ratio

- Unstable or unverifiable income

- Title issues or existing liens

- Properties that are hard to value or non-warrantable

Each lender sets its own qualification standards.

What is the HELOC 65% rule?

The “65% rule” refers to a conservative guideline used by some lenders, where the total loan balance (existing mortgage + HELOC) cannot exceed 65% of the home’s current market value.

This rule isn’t universal, but lower loan-to-value ratios often increase the chances of approval, especially for no-appraisal or fast-track HELOCs.

What disqualifies you from getting a HELOC?

You may be disqualified from a HELOC if you have:

- Very limited available equity

- Poor credit or recent major delinquencies

- Excessive existing debt obligations

- Inconsistent or unverifiable income (with traditional lenders)

- Property types that don’t meet lender guidelines

- Unresolved title or ownership issues

Some alternative lenders, such as Truss Financial Group, offer more flexible underwriting for seniors, self-employed borrowers, and high-DTI profiles, but minimum standards still apply.

Table of Content

Take your pick of loans

Experience a clear, stress-free loan process with personalized service and expert guidance.

Get a quote