Home Loans in Tennessee

Key Takeaways

- Today’s TN Mortgage Rates: As of mid-October 2025, average 30-year fixed mortgage rates in Tennessee are around 6.0% - 6.4%, with 15-year fixed near 5.3% - 5.5%. ARMs often start in the mid-5s to low-6s for the initial period. Rates change daily; your actual rate depends on credit, loan type, points, and lock period.

- Typical Down Payments: 3%, 20% depending on the program. 0% is possible with VA (eligible veterans) and USDA (rural areas). FHA minimum is 3.5%.

- Average Home Prices: Tennessee’s typical home value is in the low-to-mid $300Ks statewide. City medians vary widely: higher in Nashville, mid-range in Knoxville/Chattanooga, lower in Memphis.

- Buying with Bad Credit: Possible via FHA, VA, and select non-QM programs (often with higher down payments or pricing).

- Available Programs: Conventional, FHA, VA, USDA, THDA, DSCR, Bank Statement, ITIN, HELOC. Broad coverage for first-time buyers, veterans, rural buyers, self-employed, investors, and homeowners tapping equity.

4.6 from 700+ reviews

4.6 from 700+ reviews

4.6 from 700+ reviews

Tennessee Mortgage Snapshot

Metric |

Typical Range/Value |

Notes |

| 30-year fixed rate | ~6.3% | Averages; update weekly |

| Median home price | $330K - $340K (statewide) | City medians vary |

| Minimum down payment | 0% - 3.5% | 0% VA/USDA; 3.5% FHA |

| Minimum credit score | 580 - 640 | Program dependent |

Purchasing a home in Tennessee requires more than just finding the right property, you need the right financing. The Volunteer State’s housing market has its own quirks and opportunities.

Home prices here tend to be lower than in many coastal states, and Tennessee famously has no state income tax and relatively low property taxes (around 0.5% of a home's value on average). These factors make homeownership in Tennessee more affordable for many families.

However, buying a home is still a major endeavor. From Nashville’s booming urban market to quiet rural communities in the Smokies, it’s important to understand Tennessee-specific mortgage options, costs, and steps to homeownership.

In this guide, we’ll break down everything you need to know; loan types, qualification requirements, state programs, and the mortgage process to make your Tennessee home-buying journey as smooth as possible with Truss Financial Group (TFG) by your side.

What types of loans are available in Tennessee?

Homebuyers in Tennessee can choose from FHA loans for first-time buyers, VA loans for veterans, USDA loans for rural areas, conventional mortgages, jumbo loans for high-value properties, and flexible non-QM loans (e.g., bank statement or DSCR loans) for unique situations. Truss Financial Group offers all of these options to suit a wide range of borrower needs.

Loan Program comparison in Tennessee

Loan Type |

Best For |

Min Down |

Typical Credit |

Key Benefit |

| Conventional | Strong profiles | 3% - 20% | 620+ | Lower PMI with higher scores |

| FHA | Lower credit | 3.5% | 580+ | Flexible credit |

| VA | Eligible veterans | 0% | Flexible | No PMI |

| USDA | Eligible rural | 0% | 640+ | Low rate |

| THDA | TN residents | From 3% | 640+ | Down payment help |

| Bank Statement | Self-employed | 10% - 20% | Alt-doc | No tax returns |

| DSCR | Investors | 20%+ | Flexible | Income via rent |

| ITIN | Non-citizens | 15% - 20% | Alt-doc | No SSN |

| HELOC/HEL | Owners with equity | Varies | 660+ | Tap equity |

Areas We Serve

We offer Tennessee home loans statewide:

- Nashville and surrounding Middle Tennessee suburbs

- Memphis and the greater Shelby County area

- Knoxville in East Tennessee and nearby counties

- Chattanooga and the Southeast Tennessee corridor

- Clarksville, Murfreesboro, Franklin, Jackson, Johnson City, and more

What credit score do I need to buy a house in Tennessee?

A 620+ score is typical for conventional loans. FHA allows 580 with 3.5% down (or 500 with 10% down). VA and USDA don’t set hard minimums, but many lenders look for scores in the 580 - 620+ range. Higher scores generally earn better rates.

How much are closing costs in Tennessee?

Plan for about 2% - 5% of the purchase price. Tennessee also charges a state deed transfer tax of roughly 0.37% of the price, plus a small mortgage recording tax. The buyer typically pays the transfer tax at closing.

Is there first-time homebuyer assistance in Tennessee (2025)?

Yes. The Tennessee Housing Development Agency (THDA) offers the Great Choice loan and Great Choice Plus down payment assistance. Great Choice generally requires a 640+ score and can be paired with assistance to cover down payment and closing costs.

What is the minimum down payment for a house in Tennessee?

Twenty percent down removes PMI on conventional loans, but many TN buyers successfully purchase with much less.

Program |

Min Down |

Can I Use Gifts? |

DPA Compatible? |

| Conventional | 3% - 5% | Yes | Yes |

| FHA | 3.5% | Yes | Yes |

| VA | 0% | N/A | Yes |

| USDA | 0% | N/A | Yes |

| THDA | From 3% | Yes | N/A (THDA provides assistance) |

- Gift Funds: Common and allowed with proper documentation and a gift letter.

- Seller Concessions: Can cover closing costs within program caps (e.g., conventional 3% with <10% down; FHA/USDA 6%; VA allows standard costs plus limited concessions).

Costs to Buy a Home in Tennessee Right Now

City |

Median Price |

Est. 10% Down |

Est. P&I at ~6% |

| Nashville | $486,000 | $48,600 | ~$2,620 (loan ~$437K) |

| Knoxville | $305,000 | $30,500 | ~$1,650 (loan ~$274K) |

| Chattanooga | $349,000 | $34,900 | ~$1,880 (loan ~$314K) |

| Memphis | $185,000 | $18,500 | ~ $1,000 (loan ~$166K) |

What are the current mortgage rates in Tennessee?

As of late 2025, typical 30-year fixed rates hover in the mid 6% range, with 15-year fixed near the upper 5% range. Your exact rate depends on credit, loan type, points, and daily market movements.

Typical Ranges (late 2025)

- 30-year Fixed: mid-6%

- 15-year Fixed: upper-5%

- 5/6 ARM: mid-6% (introductory)

How to Shop Rates Well

- Compare APR and total fees, not just rate

- Get 3+ same-day quotes with matching lock periods

- Model points vs. credits to find your breakeven

- Lock under contract; ask about float-down options

Should I Buy Now or Wait for Rates to Drop?

- Buying now Pros: Less competition than peak frenzies, start building equity, lock today’s price, refinance later if rates improve.

- Buying now Cons: Higher monthly payments today; reduced purchase power.

- Waiting Pros: Potentially lower future rate; time to save and improve credit.

- Waiting Cons: Prices may rise; more buyer competition if rates fall; rent builds no equity.

Balanced approach: buy when the home and payment fit your budget. Consider temporary buydowns and plan to refinance if/when rates ease.

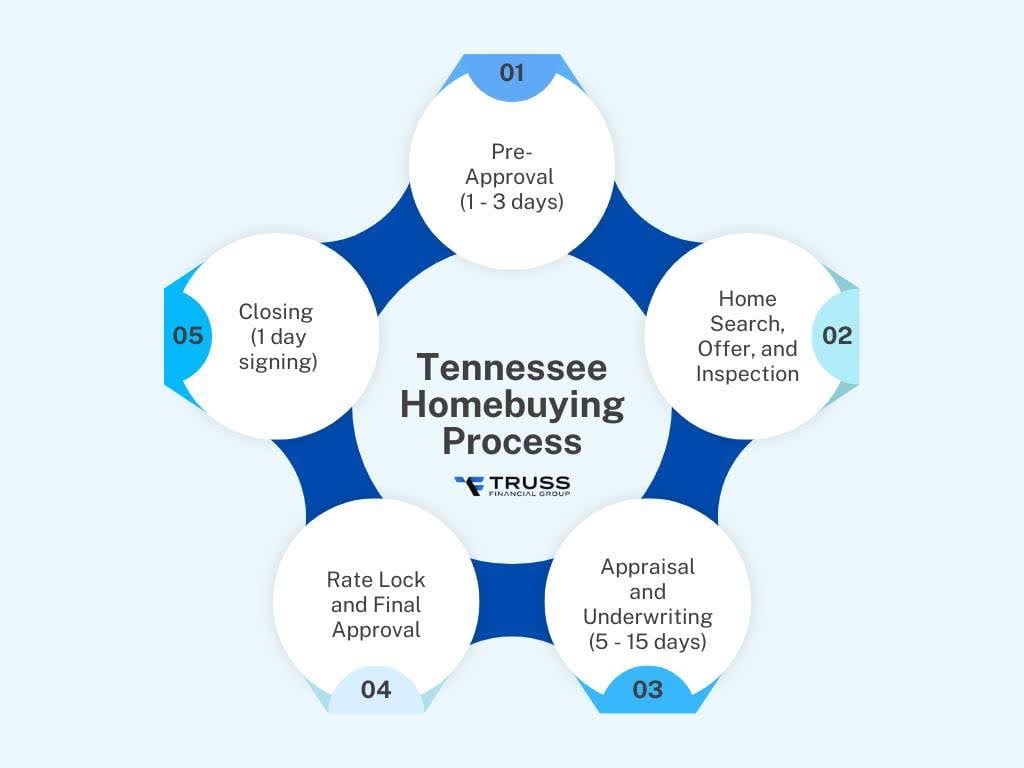

Tennessee Homebuying Process: Step-by-Step

1) Pre-Approval (1 - 3 days):

Apply, authorize a credit pull, and provide income/asset/ID documents. You’ll receive a pre-approval letter showing your qualified price range crucial in Tennessee markets.

2) Home Search, Offer, and Inspection:

Shop within budget and go under contract with an earnest money deposit. Schedule a home inspection (strongly recommended) and, if needed, add termite, radon, well, or septic checks depending on location.

3) Appraisal and Underwriting (5 - 15 days):

The appraisal validates market value. Underwriting verifies your income, assets, credit, and the property. Expect occasional conditions (e.g., a letter of explanation or updated bank statement).

4) Rate Lock and Final Approval:

Lock your rate for the closing window (e.g., 30 - 45 days). Review your Closing Disclosure (CD) at least three business days before closing; it itemizes your final numbers, including state and county fees.

5) Closing (1 day signing):

Sign the loan documents at a title company or closing attorney’s office. Bring ID and any funds to close. The title company records the deed and mortgage; then you receive the keys.

Typical Timeline Table

Step |

Typical Duration |

Key Documents/Tasks |

| Pre-Approval | 1 - 3 days | Application, income/asset docs, ID |

| Underwriting | 5 - 15 days | Appraisal, title, verifications |

| Closing | 1 day | Final CD review, signing, IDs |

Closing Costs in TN: 2% - 5% of price, plus state transfer and mortgage recording taxes. Seller credits and THDA assistance can offset cash to close.

Home Loan Qualifications in Tennessee

To approve your mortgage, lenders evaluate several key factors. Here are the standard qualification requirements for most Tennessee home loans (these mirror national guidelines):

Requirement |

Target |

Notes |

| Credit score | 580, 740+ | Program dependent |

| DTI | ≤ 45% - 50% | Exceptions exist |

| Reserves | 0, 6 months | More for investors |

| Appraisal | Required | Program/loan type |

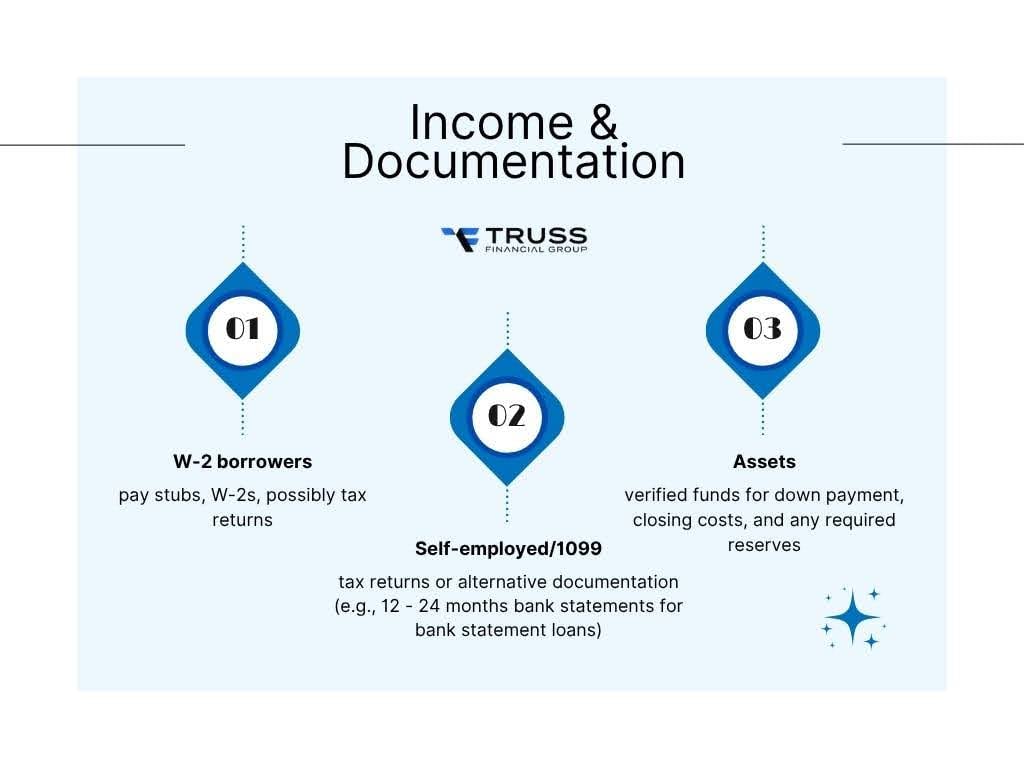

Income & Documentation

You’ll need to prove your income to the lender. Traditionally, this means providing pay stubs, W-2 forms, and tax returns if you’re a W-2 employee. Lenders want to see a stable two-year work history in the same field. If you’re self-employed or a 1099 contractor, you may have to provide the last two years of full federal tax returns (including business returns if applicable) to document your income.

However, Truss Financial Group also specializes in alternative documentation loans for self-employed borrowers. For instance, a bank statement loan uses 12, 24 months of your personal or business bank statements to verify income in lieu of tax returns. These programs are great for Tennessee entrepreneurs, gig workers, or small business owners whose taxable income on paper is lower than their actual cash flow.

The key is that you must disclose all sources of income (salary, bonuses, self-employment earnings, alimony, etc.) and provide supporting documents. We’ll also verify your assets (for down payment, closing costs, and reserves) via bank statements or investment account statements.

During underwriting, avoid making large unexplained deposits or cash transfers between accounts, as those can require explanation. Rest assured, TFG will guide you on exactly which documents are needed , and our streamlined digital application makes it easy to upload everything securely.

- W-2 borrowers: pay stubs, W-2s, possibly tax returns

- Self-employed/1099: tax returns or alternative documentation (e.g., 12 - 24 months bank statements for bank statement loans)

- Assets: verified funds for down payment, closing costs, and any required reserves

Non-QM Loans in Tennessee: Flexible Solutions for Self-Employed & Investors

Not every Tennessee homebuyer fits neatly into the traditional mortgage boxes. If you’re self-employed, an entrepreneur, a real estate investor, or someone with unconventional income or credit circumstances, Non-QM (Non-Qualified Mortgage) loans may be the solution. TFG specializes in no-doc and low-doc loans that look beyond the standard W-2 income model. Here are some of our popular Non-QM offerings in Tennessee:

- Bank Statement Loans:

Designed for self-employed borrowers (freelancers, business owners, consultants, gig workers) whose tax returns might not reflect their true cash flow. Instead of tax forms, we use 12, 24 months of bank statements (business or personal) to calculate your income. We add up your deposits to gauge what you really earn.

This program is great for entrepreneurs in Tennessee’s growing sectors, for example, a musician in Nashville, a startup owner in Chattanooga, or a farm owner in rural TN. No tax returns are required. Down payments typically range from 10% to 20%, and credit scores as low as 600 can be accepted in some cases.

Truss Financial Group has helped many self-employed Tennesseans buy homes with bank statement loans, you get to qualify based on your actual cash flow, not your taxable income after write-offs.

- DSCR Loans (Debt Service Coverage Ratio):

Perfect for real estate investors purchasing rental properties. A DSCR loan lets you qualify based on the property’s cash flow instead of your personal income. Lenders look at the expected monthly rent versus the monthly mortgage payment (including taxes and insurance). If the rent covers or exceeds the payment (DSCR ≥ 1.0), you can likely qualify. Essentially, the property’s income can support itself.

This is incredibly useful for investors who might own multiple properties or don’t want to document personal income. For example, an investor buying a duplex in Memphis can use the projected rent from both units to qualify, without needing W-2 income. DSCR loans usually require 20-25% down for best rates, and a mid-range credit score (usually 660+).

There is no limit on the number of properties financed, and no personal DTI calculation, making it much easier to expand your portfolio. TFG has deep expertise in DSCR financing (which has become one of the fastest-growing loan types for investors nationwide). We can often close these loans quickly since documentation is straightforward: you need a rent schedule from appraisal and basic credit/assets documentation.

- Asset-Based Loans:

For high-net-worth borrowers (such as retirees or those who have substantial assets but little traditional income), an asset-utilization loan might be ideal. We use your liquid assets, like savings, investments, retirement accounts, to qualify you in lieu of W-2 income. Essentially, the lender derives a hypothetical income stream from your asset balances.

For instance, a couple in Knoxville who sold a business and has $1 million in investments but minimal monthly income could still qualify for a mortgage by leveraging their asset portfolio. Asset-based loans often require significant assets (e.g. enough to cover the loan amount or a multiple of the loan), and credit requirements can vary, but they enable homeownership or refinancing for those living off investments.

- Interest-Only and Other Niche Loans:

We also offer interest-only mortgages (including for jumbos or investment properties), 1099 income loans (qualify using 1099 forms for contract workers), P&L statement loans (qualify based on a CPA-prepared Profit & Loss statement for your business), and other creative financing options.

These non-QM loans do not conform to standard Fannie Mae/Freddie Mac rules, but they are legitimate financing tools provided by specialty investors. They typically carry slightly higher interest rates due to the added risk, but they fill a crucial gap, allowing creditworthy people to buy homes even if their situation isn’t cookie-cutter.

Renovation Loans: Fixer-Upper Financing

Tennessee’s real estate includes everything from brand-new builds in suburbia to historic homes full of character. If you fall in love with a house that needs some work, a renovation loan can be an excellent option.

Renovation mortgages allow you to finance the home purchase (or refinance) and the renovation costs into one loan, so you don’t have to pay for improvements out of pocket at high interest rates. Two popular renovation programs are:

- FHA 203(k) Loan:

The 203(k) is an FHA-backed renovation loan perfect for older homes or properties in need of repair. You can borrow enough to cover the purchase plus rehab costs up to $35,000 (for a streamlined 203k) or more for a full 203k. For example, if you buy a fixer-upper in Memphis for $150,000 and it needs $30,000 of updates, you could take one FHA 203k loan for $180,000 to cover it all.

Requirements are similar to standard FHA (3.5% down, 580+ credit). The work must be completed by licensed contractors and can include things like a new roof, flooring, kitchen remodel, or even adding energy-efficient upgrades. This is a great way to build instant equity by improving a home right after purchase.

- Fannie Mae HomeStyle Loan:

This is a conventional renovation loan for those who qualify for conventional financing. It allows renovations for primary residences, second homes, or investment properties. You generally need a bit higher credit (recommend 680+). The HomeStyle can finance virtually any improvement as long as it adds value to the home, including luxury items that FHA won’t cover (like installing a pool). It’s a one-time close, fixed-rate loan.

An example use case: you own a home in East Nashville that appraises low due to needed repairs, a HomeStyle refinance could fund the repairs and potentially raise your property value significantly.

Renovation loans do require more coordination (you’ll need contractor bids and a clear plan), and they take slightly longer to close as the appraisal is based on the “after-improved” value.

But Truss Financial Group has experience guiding buyers through these projects. In many Tennessee neighborhoods, finding a move-in ready home is tough in your price range, but a fixer-upper might be more affordable.

If you’re considering a fixer-upper, let us know, we’ll explain your options so you can decide if a renovation loan is the right fit.

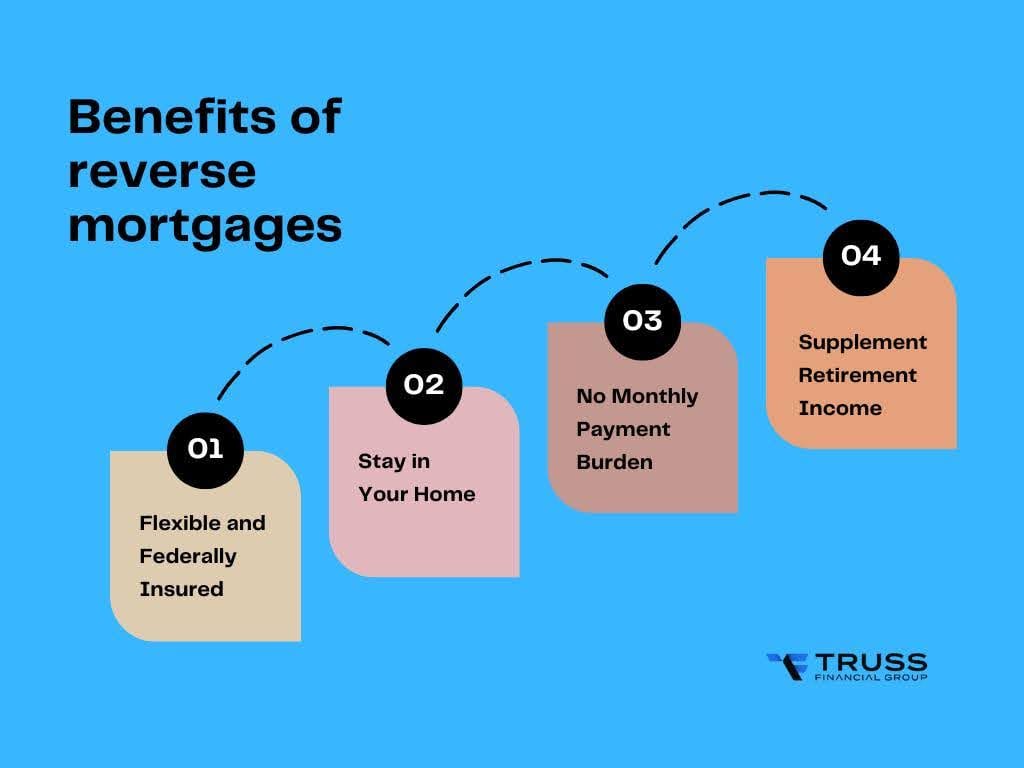

Reverse Mortgages: Accessing Home Equity for Seniors

For Tennessee homeowners age 62 or older, a reverse mortgage is a useful financial tool to tap into your home’s equity. A reverse mortgage (formally known as a HECM, Home Equity Conversion Mortgage) allows seniors to convert the equity in their home into cash, while still retaining ownership.

No monthly mortgage payments are required, instead, the loan balance comes due only when the borrower sells the home, moves out, or passes away.

Here are some key points and benefits of reverse mortgages in TN:

- Supplement Retirement Income:

Many retirees in Tennessee are “house rich and cash poor,” meaning a large portion of their net worth is tied up in their home. A reverse mortgage provides cash (either as a lump sum, monthly payments, a line of credit, or a combination) that can be used for any purpose , living expenses, medical bills, home repairs, travel, etc. This can significantly improve one’s quality of life in retirement without needing to sell the house.

- No Monthly Payment Burden:

You do not have to make mortgage payments on a reverse loan. You remain responsible for property taxes, homeowner’s insurance, and maintenance, but there’s no monthly loan bill. Interest accrues over time on the drawn balance. The loan is typically repaid when the home is eventually sold (often from the sale proceeds), and importantly, it’s a non-recourse loan, meaning you or your heirs will never owe more than the home’s value at time of sale.

- Stay in Your Home:

The whole point of a reverse mortgage is to allow senior homeowners to age in place. As long as at least one borrower (62+) continues to occupy the home as a primary residence, keeps up taxes/insurance, and maintains the property, the loan cannot be called due. This gives peace of mind that you won’t be forced out of your home.

- Flexible and Federally Insured:

The most common reverse mortgages are HECMs insured by FHA, which come with consumer protections. The amount you can borrow depends on your age (older borrowers can access a higher percentage), home value (max claim amount is around ~$1.25 million in 2025), and current interest rates.

Many Tennessee seniors use a reverse mortgage line of credit as a safety net , you only tap it if needed, and the unused line actually grows over time. It can also be used to purchase a new primary home (HECM for Purchase) if, say, you want to downsize to a one-level home in retirement, you make a substantial down payment and a reverse mortgage covers the rest, with no monthly payments thereafter.

Truss Financial Group can help you determine if a reverse mortgage suits your needs. We’ll provide a detailed analysis of how much you qualify for and what the costs are (there are upfront FHA insurance fees and closing costs that can be financed into the loan).

Reverse mortgages aren’t right for everyone, for example, if you plan to leave the home within a few years, or if you want to preserve maximum equity for your heirs, you’ll want to weigh those factors.

But for many Tennessee seniors, a reverse mortgage is a lifeline that allows them to comfortably afford staying in their longtime home and enjoying retirement with less financial stress. We are happy to answer all your questions about this program with no obligation.

Apply for a Tennessee Home Loan with Truss Financial Group

Buying a home in Tennessee doesn’t need to feel overwhelming. With Truss Financial Group as your lending partner, you’ll have expert guidance at every step. We understand the ins and outs of Tennessee’s market and will tailor your mortgage to your specific situation, whether you’re purchasing a lakeside cabin in East Tennessee, a suburban family home in Middle Tennessee, or a condo in downtown Nashville.

Why Truss Financial Group?

As a locally involved lender with a national presence, we combine personalized service with a broad range of loan products and competitive rates. Our loan officers will take the time to explain your options (in plain language), so you know exactly what’s covered by each loan program we’ve discussed, FHA, VA, conventional, and beyond. We’re also proud to be a leader in no-doc loans and creative financing, which means we find solutions for clients that other banks might turn away.

Fast, hassle-free process:

We know you’re eager to close on your dream home. Truss has a streamlined application and underwriting process, our goal is to get most loans closed within 30 days or less whenever possible. In many cases, we can reach the “clear to close” stage in just 2, 3 weeks (assuming you promptly provide required documents).

From there, we coordinate closely with your realtor and the title company to ensure a smooth closing. Our team keeps you informed with regular updates, so you’re never left wondering about your loan status. We handle the heavy lifting so you can focus on preparing for your move.

Ready to take the next step?

It’s easy to get started with Truss Financial Group. You can apply online in minutes through our secure portal, or give us a call to chat about your needs and get pre-qualified. There’s no cost or commitment to get a personalized rate quote.

We’ll review your information and provide a free custom rate quote along with a breakdown of estimated payments and closing costs for the loan options that fit you best. Even if you’re just exploring, we welcome your questions. Our mission is to empower Tennessee homebuyers with knowledge and confidence.

Don’t let the mortgage process intimidate you.

Truss Financial Group (TFG) is here to be your trusted advisor and advocate. We’ve helped countless clients across Tennessee, from Memphis to Mountain City, achieve their homeownership goals, and we’d love to help you next.

Contact us today to discuss your scenario and let us build a solid financing “truss” for your new Tennessee home!

Frequently Asked Questions (Tennessee)

Are seller concessions allowed and how much can I get?

Yes. Conventional typically allows 3% with <10% down (6% with 10, 24.99% down; 9% with ≥25%; investors 2%). FHA/USDA allow up to 6%. VA allows standard closing costs plus a capped concessions bucket. Concessions reduce cash to close but cannot exceed actual allowable costs.

Do I need a real estate attorney to close in Tennessee?

No. Closings are typically conducted by a title company or closing attorney. You may hire your own attorney if you want independent advice, but it isn’t required.

Will my taxes and homeowners insurance be escrowed?

Usually yes. Escrow is required on FHA/VA/USDA. Conventional may allow waivers with 20% down and strong credit (often with a fee or small pricing adjustment).

Can I use gift funds for my down payment?

Yes. Most programs allow gifts from eligible donors with a signed gift letter and documentation of the transfer. Entire down payments can be gifted on many owner-occupied loans.

What inspections are recommended or required in Tennessee?

Strongly recommend a general home inspection. Termite is common and required for VA loans in TN. Consider radon testing (especially with basements) and well/septic inspections where applicable. Appraisals are always required; FHA/VA include minimum property standards.

How long does it take to close a deal in Tennessee?

Typical purchases close in about 30 - 45 days. Straightforward conventional loans can close faster; government loans or assistance programs may add time. TFG aims for efficient, on-time closings.

Can I refinance with Truss Financial Group?

Yes. Refinance to lower your rate, remove FHA MIP by switching to conventional, shorten your term, or tap equity via cash-out or a HELOC. The process is similar to a purchase but without a seller timeline.

Trusted by 1,964 people

Get a free custom rate quote

- 81% approval rate

- No commitment

👉 Filling out this form won’t affect your credit score.

Get the information you need to make confident decisions

Discover your borrowing power and plan your mortgage journey with knowledge on your side.

Get a quote- No documents required

- No commitment

- No commitment

Get a quote in 3 easy steps

Tell us what you want

Fill out our online form to help us understand your financial situation and loan needs.

We get to work for you

We review your info and look for competitive rates that match your specific goals.

You get a personalized quote

You’ll receive a customized rate quote that meets your unique profile.