Not every borrower fits into the traditional mortgage box. In Florida, where entrepreneurs, investors, and retirees make up a large share of homebuyers, proving income with tax returns or W-2s is not always simple. That is where stated income loans come in.

A stated income loan allows borrowers to qualify for a mortgage by declaring their income instead of documenting it through traditional paperwork. While these loans are not as common as they once were, they remain an important option for people with strong assets, high cash flow, or non-traditional financial profiles.

What Is a Stated Income Loan?

A stated income loan, sometimes called a "no income verification loan," is designed for borrowers who may not have standard proof of earnings. Instead of showing W-2s, pay stubs, or full tax returns, the borrower states their income, and the lender reviews other factors such as credit score, assets, and property value.

These loans are considered part of the non-QM (non-qualified mortgage) category, meaning they do not follow strict Fannie Mae or Freddie Mac guidelines. Instead, private lenders and specialized institutions offer them.

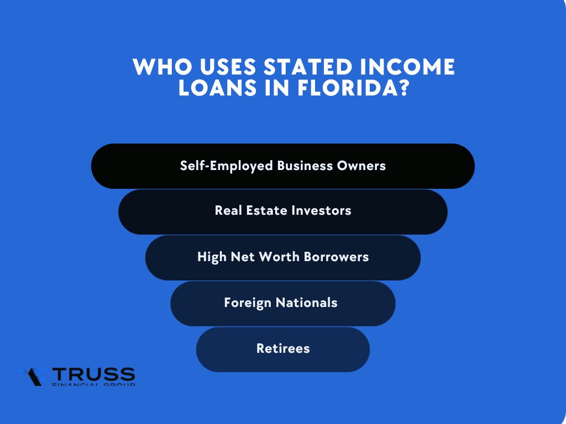

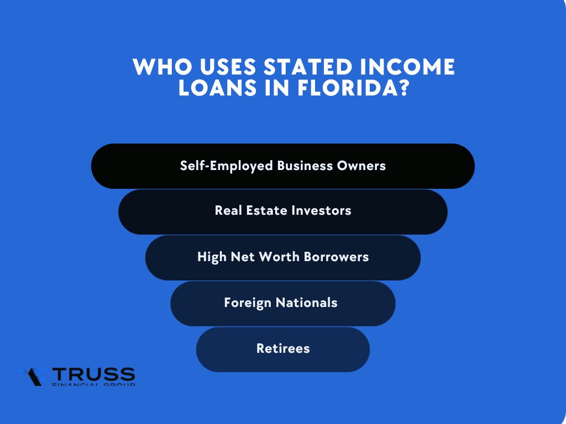

Who Uses Stated Income Loans in Florida?

Florida has one of the largest populations of self-employed workers and retirees in the country, making it a prime state for stated income financing. Borrowers who often turn to these loans include:

- Self-Employed Business Owners whose tax returns may not reflect true cash flow after deductions.

- Real Estate Investors with rental income that is difficult to document.

- High Net Worth Borrowers who rely more on assets than salary.

- Foreign Nationals buying second homes or investment properties.

- Retirees with strong savings but limited current income.

How Stated Income Loans Work

While every lender has slightly different requirements, most stated income loans in Florida follow a similar framework:

- Income Declaration The borrower provides a written statement of monthly or annual income.

- Verification Alternatives Instead of tax returns, the lender may review bank statements, asset accounts, or rental property cash flow.

- Higher Down Payment Most lenders require at least 20 to 30 percent down.

- Credit Standards A credit score of 620 or higher is usually required, with better terms for 700 and above.

- Loan Purpose These loans can be used for primary residences, second homes, and investment properties.

Florida Market Factors in 2025

Florida continues to attract buyers from across the country and abroad. As of early 2025:

- The median home price statewide is about $415,000.

- Condos in Miami, Tampa, and Orlando remain in high demand, especially among investors.

- Many buyers are cash-rich but not easily able to show traditional income, fueling the demand for stated income loans.

- With rising insurance premiums, lenders are also weighing housing expenses carefully, making flexibility in underwriting even more valuable.

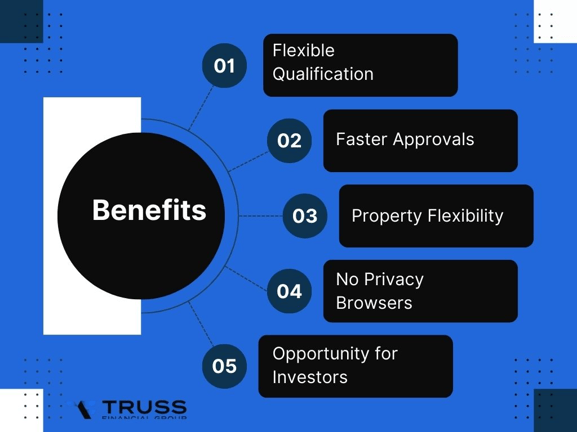

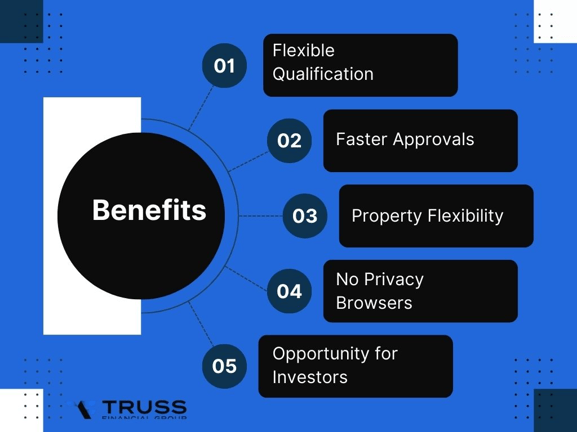

Benefits of Stated Income Loans

- Flexible Qualification Perfect for borrowers with non-traditional income sources.

- Faster Approvals Less paperwork can shorten the approval process.

- Property Flexibility Can be used for second homes, condos, or investment properties.

- Privacy Browsers are not required to disclose full tax returns.

- Opportunity for Investors Easier to scale rental property portfolios.

Risks and Considerations

- Higher Interest Rates These loans often carry higher rates than conventional mortgages.

- Larger Down Payment Expect to put down 20 to 30 percent.

- Limited Availability Only non-QM lenders offer them.

- Stricter Reserves Many lenders require several months of cash reserves.

- Not Ideal for All Borrowers Buyers who can qualify for conventional or FHA loans may find those more affordable.

Stated Income vs Conventional Loans

|

Feature

|

Stated Income Loan

|

Conventional Loan

|

|

Income Verification

|

Borrower states income

|

W-2s, pay stubs, tax returns

|

|

Down Payment Requirement

|

20–30%

|

3–20%

|

|

Credit Score Requirement

|

620+

|

620+ (680+ preferred)

|

|

Loan Type Availability

|

Primary, second, rental

|

Primarily primary and some second homes

|

|

Interest Rates

|

Higher

|

Lower for strong borrowers

|

How to Qualify for a Stated Income Loan in Florida

To qualify, lenders will usually ask for:

- Government-issued ID

- Credit report and history

- Bank statements or proof of assets

- Statement of income

- Down payment funds (20–30%)

- Property appraisal

Having a larger reserve of liquid assets, such as savings or investment accounts, can strengthen your approval chances.

Common Uses in Florida

- Buying a condo in Miami or Tampa as a second home.

- Purchasing rental properties in Orlando’s vacation market.

- Downsizing into a retirement home without relying on W-2 income.

- Acquiring coastal property when income sources are complex or international.

FAQs About Stated Income Loans in Florida

Can I really qualify without tax returns?

Yes. Lenders may allow you to state your income, but they will still check your credit, assets, and down payment strength.

Are interest rates much higher?

Rates are usually higher than conventional loans but vary depending on credit and equity.

Can foreign nationals use stated income loans in Florida?

Yes. Many lenders specifically design these programs for overseas buyers.

What properties are eligible?

Most property types, including single-family homes, condos, townhouses, and investment properties, are eligible.

Is PMI required?

Private mortgage insurance is not usually required because these loans come with higher down payments.

Why Choose Truss Financial Group

Navigating non-traditional lending options requires experience. Truss Financial Group has worked with Florida borrowers for over a decade, helping self-employed buyers, retirees, and investors secure stated income loans tailored to their goals. With access to multiple non-QM programs and a commitment to clear guidance, Truss Financial Group makes it easier to qualify for the right loan without unnecessary hurdles.