19 min read

If you’re 55+ and “house-rich but cash-tight,” a Home Equity Line of Credit (HELOC) can help you access funds without selling your home.

Truss Equity Select is a flexible senior HELOC program with:

- Minimum payments as low as 1% of your loan balance,

- A 7-year draw period,

- Capped payments for up to 40 years, and

- Non-recourse protection, meaning you or your heirs never owe more than the home’s value.

This guide explains how it works, who qualifies, and how it compares to Digital HELOCs, Reverse Mortgages, and Non-QM Loans, so you can unlock your equity wisely.

Introduction: Home Equity, Your Key to Retirement Freedom

For many older homeowners, home equity represents a lifetime of effort, years of mortgage payments and steady appreciation that built lasting value. Instead of selling your home to unlock that wealth, a HELOC for seniors can transform it into a reliable cash flow for medical expenses, home renovations, or simply enhancing retirement income.

That’s exactly what Truss Equity Select offers. It’s a first-position Home Equity Line of Credit (HELOC) designed specifically for homeowners 55 and older, allowing you to tap into your home’s value with minimum payments starting around 1% of your balance, capped terms up to 40 years, and full non-recourse protection.

In short, it gives you control, flexibility, and predictability, helping you stay financially independent while keeping the home you love.

Understanding Your Home Equity Options

When it comes to unlocking the value of your home, there’s more than one way to do it. Each option offers different levels of flexibility, cost, and control, and the right choice depends on your age, income, and long-term goals.

|

Option |

How it Works |

Best For |

|

Home Equity Loan |

You receive a lump sum upfront at a fixed interest rate, repaid through equal monthly payments. |

Borrowers who know exactly how much they need, like funding home renovations, medical bills, or debt consolidation. |

|

A revolving line of credit that lets you borrow as needed and make interest-only payments during the draw period. |

Homeowners with steady income or strong credit who want flexible access to cash over time. |

|

|

Reverse Mortgage |

Available to older homeowners, it provides cash or a credit line with no required monthly payments, though fees and interest accumulate over time. They can be jumbo or proprietary or HECM. |

Retirees who meet age and occupancy guidelines and are looking for supplemental cash flow or to pay off an existing mortgage. |

|

Cash-Out Refinance |

You replace your existing mortgage with a larger one, receiving the difference as cash. |

Borrowers who want to refinance existing debt or access a large one-time payout while keeping a single monthly payment. |

Where Truss Equity Select Fits In?

Truss Equity Select bridges the gap between these programs.

It’s built for homeowners 55 and older who want the flexibility of a HELOC, the predictability of a fixed loan, and the security of staying in their home, all without resetting their primary mortgage.

With minimum payments starting at 1%, capped terms up to 40 years, and non-recourse protection, it gives you access to your home’s equity on your terms, not the bank’s.

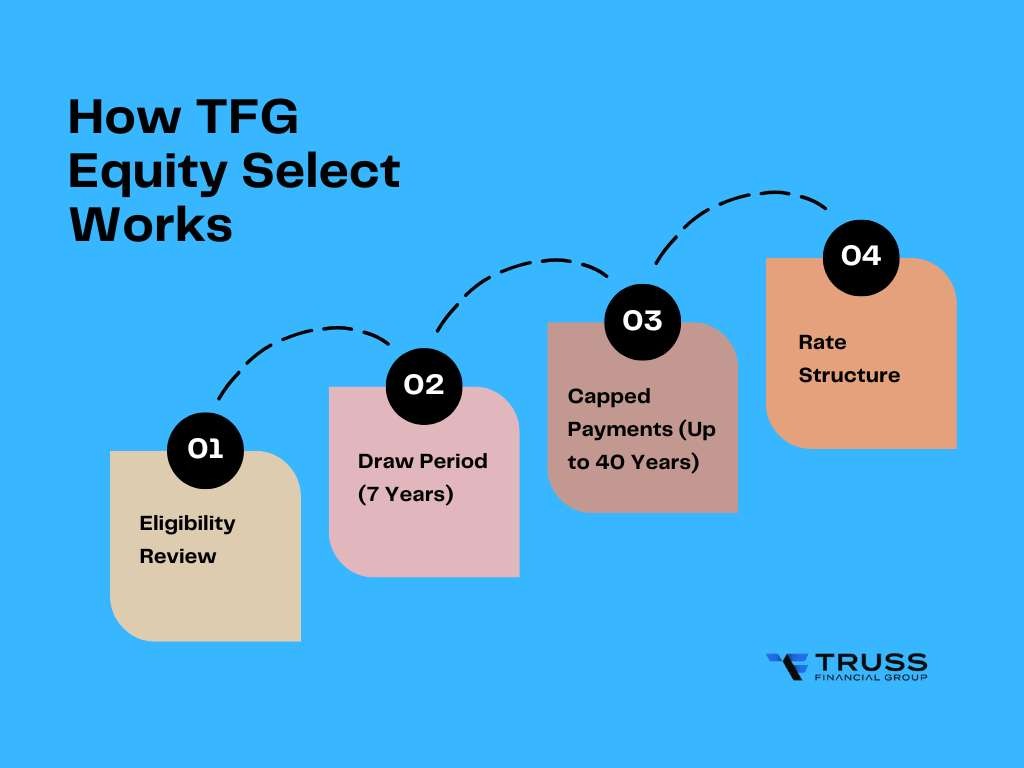

How Our HELOC For Seniors Program Works?

Truss Equity Select is designed to make home equity work for you, not the other way around. It combines the flexibility of a home equity line of credit (HELOC) with the stability of long-term, capped payments, allowing homeowners to access cash confidently during retirement while keeping ownership of their home.

1. Eligibility Review

To qualify, applicants generally need to meet these baseline criteria:- Age: Both borrowers must be 55 or older.

- Credit: A minimum credit score of 650+ is recommended.

- Property: The loan must be in first position and secured by your primary residence.

- Income Verification: Flexible documentation accepted, such as Social Security income, pension, or verified assets.

2. Draw Period: Access as You Need It

For the first seven years, you can draw funds from your line of credit as needed, whether for home improvements, medical expenses, or debt consolidation. You’ll make interest-only payments on the funds you use, preserving cash flow while maintaining equity in your property.

3. Capped Payments for Long-Term Stability

Once the draw period ends, Truss Equity Select transitions into a long-term repayment schedule, with capped payments that can extend up to 40 years.

This structure keeps payments steady, predictable, and affordable:

-

Minimum payments can start at roughly 1% of your outstanding balance.

-

Payments adjust with your balance, but never exceed the maximum cap set during application.

-

Non-recourse protection ensures you or your heirs never owe more than the home’s value, even if the market declines.

4. Rate Structure

-

Index: Based on the Secured Overnight Financing Rate (SOFR) plus a margin (variable APR).

-

Options: Borrowers may choose to convert part or all of their balance to a fixed rate for budgeting stability.

-

No annual fees and no prepayment penalties, allowing you to repay or refinance on your own timeline.

-

Closing costs and origination fees are disclosed upfront during application.

Example for Payment Scenarios

|

Line Balance |

Approx. 1% Minimum Payment |

Typical Use |

|

$150,000 |

$125/month |

Home repairs, debt consolidation |

|

$200,000 |

$167/month |

Medical expenses |

|

$500,000 |

$417/month |

Home renovations, tuition |

|

$1,000,000 |

$834/month |

Investment or family support |

(The above figures are for illustration only. Actual payment amounts and rates depend on your approved terms, loan size and property value.)

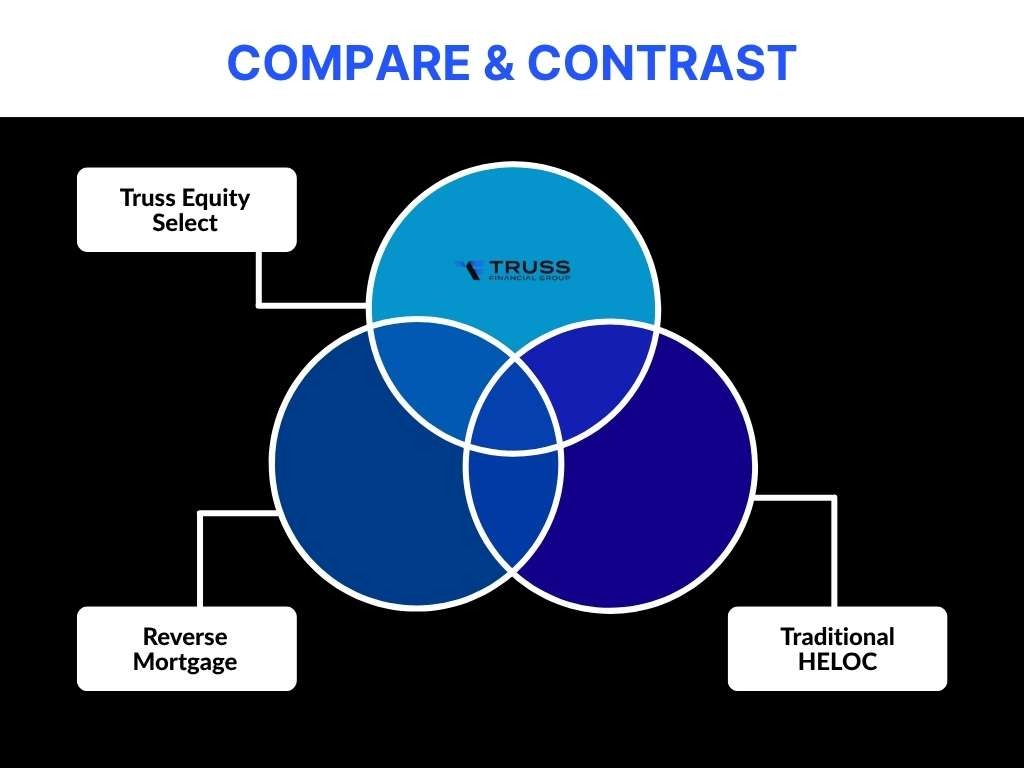

Truss Equity Select vs Reverse Mortgage vs Traditional HELOC

Before choosing how to tap into your home’s equity, it helps to see how the major programs compare side by side. Each option has a different structure, age requirement, and payment flexibility.

Here’s what sets them apart:

|

Feature |

Our Truss Equity Select (55+): HELOC for Seniors |

FHA Reverse Mortgage (HECM) |

Traditional HELOC |

|

Minimum Payments |

As low as 1% annually |

Optional |

Interest-only for 5–10 years |

|

Term |

40 years (capped) |

N/A |

15–30 years |

|

Age Requirement |

55+ (both borrowers) |

62+ |

None |

|

Lien Position |

First |

First |

Usually second |

|

Credit Requirement |

650+ |

Must prove ability to pay expenses |

Varies |

|

Annual Fees |

None |

FHA insurance |

Some lenders charge |

|

Payments on Draw |

Optional / flexible |

None |

Required monthly |

Key takeaways from the above table:

If you’re comparing your options:

-

A Reverse Mortgage removes payment obligations but is limited to borrowers 62+ and may reduce equity over time.

-

A Traditional HELOC offers flexibility but can lead to payment shocks when the draw period ends.

-

Truss Equity Select sits comfortably in the middle, offering predictable payments, flexible access, and non-recourse protection for borrowers 55 and older.

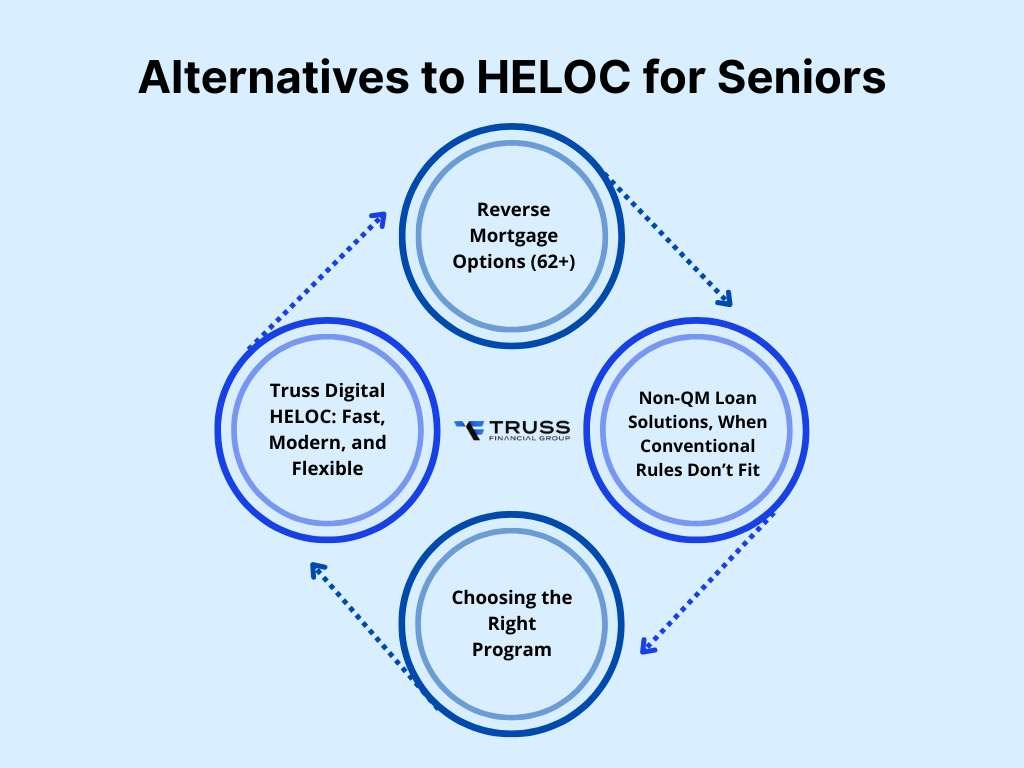

Alternatives to HELOC for Seniors

While Truss Equity Select is designed for borrowers 55 and older, Truss also offers other programs for borrowers of different ages, income types, or financial goals.

Each option gives you a way to use your home’s equity wisely, depending on what stage of life you’re in.

1. Truss Digital HELOC: Fast, Modern, and Flexible

If you prefer a fully online experience, the Truss Digital HELOC offers a quick and paperless way to access up to $750,000 in your home’s equity.

This digital line of credit uses secure technology and automated valuation models (AVMs) to verify your property and income, no heavy documentation required. You can borrow what you need, make interest-only payments, and enjoy variable rates with flexible repayment options that fit your budget.

|

Program |

Max Loan Amount |

Minimum Age |

Key Benefit |

|

Truss Equity Select |

Up to $750,000 |

55+ (both borrowers) |

Capped payments, non-recourse protection |

|

Up to $750,000 |

None |

100% online process with fast approval without talking to a loan officer |

2. Reverse Mortgage Options

For older homeowners, Truss also provides reverse mortgage programs that help turn your home equity into available funds without adding new monthly payments.

You can explore:

These options can help supplement retirement income or pay off an existing mortgage. However, they may involve higher borrowing costs and closing fees, so it’s wise to compare them carefully before deciding.

3. Non-QM Loan Solutions

If your income comes from investments, rental properties or business earnings rather than W-2 employment, Non-QM (Non-Qualified Mortgage) loans may be a better fit for you.

Truss offers several flexible options:

-

Bank Statement Mortgage: Qualify using verified income from your bank deposits.

-

Asset Depletion Loan: Use savings, investments, or retirement assets to demonstrate repayment ability.

-

DSCR Loan: Ideal for investors, qualification is based on property cash flow, not personal income.

These alternative loan programs provide financial flexibility for retirees or self-employed borrowers who want to manage existing debts or access home equity responsibly.

4. Choosing the Right Program

|

Your Situation |

Best Fit |

|

55+ and want to access equity safely |

|

|

Younger borrower or prefer online setup |

|

|

Older and want no required monthly payments |

|

|

Retired, self-employed, or unique income mix or non-traditional income |

Every program supports financial stability, predictable payments, and control over your equity in its own way. A Truss advisor can help you review your income, age, and goals to choose what fits best.

Important Reminders

-

Interest rates are variable (SOFR + margin) and subject to market conditions.

-

Non-recourse protection means you will never owe more than your home’s value, confirm this in your final loan documents.

-

Always review property taxes, insurance, and existing mortgage obligations before borrowing against your equity.

-

This post is for educational purposes only, not legal, tax, or financial advice.

Are You Ready to Explore Your Options?

Access your home equity, without the stress. Learn more about Truss Equity Select or explore the Digital HELOC and Reverse Mortgage programs to find your best fit.

FAQs: HELOC For Seniors Edition

1. Is a HELOC a good idea for seniors?

A Home Equity Line of Credit (HELOC) can be a great financial tool for older homeowners who have significant home equity but want to keep their property. It allows seniors to access funds as needed, for medical expenses, home renovations, or debt consolidation, without selling their home.

Programs like Truss Equity Select, designed specifically for borrowers 55 and older, offer low monthly payments, capped terms, and non-recourse protection, making it one of the most secure HELOC for seniors options available today.

2. Why do both borrowers need to be 55+ for Truss Equity Select?

The Truss Equity Select program is a proprietary HELOC for seniors 55 and older, built around retirement-stage income patterns and homeownership goals.

Both husband and wife (or co-borrowers) must be at least 55 years old to qualify for the program’s payment flexibility, non-recourse protection, and retirement-focused underwriting.

This ensures that monthly payments, draw periods, and loan terms remain stable and suitable for fixed-income households.

3. What is the monthly payment on a $50,000 home equity line of credit?

With Truss Equity Select, monthly payments depend on your draw amount and selected payment plan. If you choose the 1% minimum payment option, a $50,000 balance would result in a monthly payment of around $42, not including taxes or insurance. Because the HELOC interest rate is variable (SOFR + margin), your actual monthly payment may adjust slightly over time. All payments are capped for predictability, helping senior borrowers manage cash flow with ease.

4. What is the HELOC for seniors program?

A HELOC for seniors is a type of home equity line of credit that lets older homeowners tap into their home’s equity without selling the property.

The Truss Equity Select program is one such option, tailored for borrowers 55+, offering flexible draw access, low monthly payments, and long-term capped repayment terms. Unlike traditional loans, this senior HELOC focuses on financial flexibility and retirement stability, using verified income, pension, or social security benefits to determine eligibility.

5. Can a retired person qualify for a HELOC?

Yes. Many retired homeowners qualify for a home equity line of credit using retirement income, pension payments, or verified assets. With Truss Equity Select, you don’t need active employment, instead, your financial stability and home equity position determine eligibility. Lenders evaluate credit score, debt-to-income ratio, and verified income amount from reliable sources like retirement accounts, annuities, or social security income.

6. Can you get a HELOC if you are on Social Security income?

Yes, seniors who receive Social Security income can qualify for a HELOC, provided they meet credit and equity requirements. Programs like Truss Equity Select are designed for retirees on fixed income, allowing them to use social security benefits as part of their income verification. This approach makes it possible to access home equity funds while maintaining affordable monthly payments and protecting your financial security in retirement.

7. What’s the maximum amount I can borrow for a HELOC as a senior?

Through Truss Financial Group, eligible borrowers can access up to $750,000 in home equity, depending on their property value, credit score, and verified income. This upper limit applies to both Truss Equity Select and the Digital HELOC program.

Loan amounts range based on loan-to-value (LTV) ratios and state-specific limits, but Truss programs are structured to help senior borrowers maximize their borrowing power responsibly, without overextending their finances.

8. What is the monthly payment on a $50,000 HELOC?

For most HELOC programs, including Truss Equity Select, the monthly payment on a $50,000 balance depends on your interest rate and payment plan. At a minimum payment of 1%, you may pay approximately $42 per month, although this amount can vary if your draw amount or interest rate changes. What sets Truss Equity Select apart is its capped payment structure: even if interest rates rise, your payment will not exceed the maximum cap determined during application.

Table of Content

Take your pick of loans

Experience a clear, stress-free loan process with personalized service and expert guidance.

Get a quote

.png?width=352&name=xxxxxx%20header%20(61).png)