Buying property in Florida isn’t always simple if your income doesn’t fit neatly into W-2s or tax returns. Many self-employed professionals, real estate investors, retirees with assets, and even foreign buyers face roadblocks with traditional mortgages. That’s where No Doc Loans come in.

In 2025, Florida’s lending landscape continues to embrace non-QM loans like bank statement programs, DSCR loans, and true “no ratio” products. These options don’t require traditional income documentation and instead look at your credit, assets, and property value.

What Is a No Doc Loan?

A No Documentation Loan, often shortened to No Doc Loan, is a mortgage that does not require standard proof of income such as pay stubs, W-2s, or tax returns.

Instead, lenders focus on:

- Credit score

- Down payment or home equity

- Bank statements or assets

- Property cash flow (for rental properties)

They fall under the category of non-qualified mortgages (non-QM), designed for borrowers who can afford a home but can’t document income in the traditional way.

How No Doc Loans Work in 2025

Here’s what you can generally expect in Florida’s 2025 market:

- Down payment: Often 20–30% (more than FHA or VA loans).

- Loan amounts: Can range from conforming sizes to jumbo loans for luxury properties.

- Interest rates: Typically 1–3% higher than conventional loans to reflect higher risk.

- Approval focus: Strong credit, large reserves, or property income (for DSCR).

- Flexibility: Tailored to self-employed borrowers, retirees, and investors.

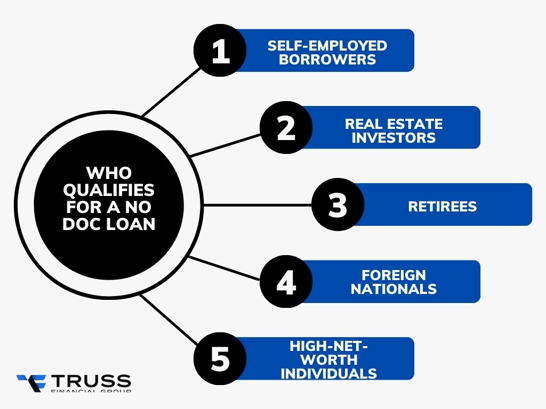

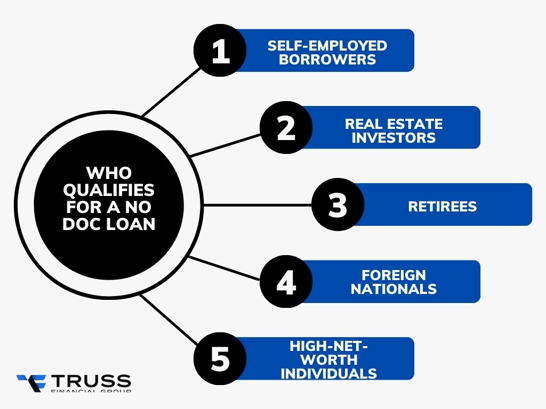

Who Qualifies for a No Doc Loan in Florida?

- Self-employed borrowers who don’t show strong taxable income but have strong deposits or assets.

- Real estate investors using rental income

- Retirees relying on assets to qualify. or savings rather than current employment.

- Foreign nationals investing in Florida real estate without U.S. tax returns.

- High-net-worth individuals who prefer to qualify through liquid assets.

Typical requirements:

- Credit score: 640–700+ (varies by lender).

- Down payment: 20–30%.

- Reserves: 6–12 months of payments in savings, retirement, or investment accounts.

- Documentation: ID, proof of assets, property appraisal.

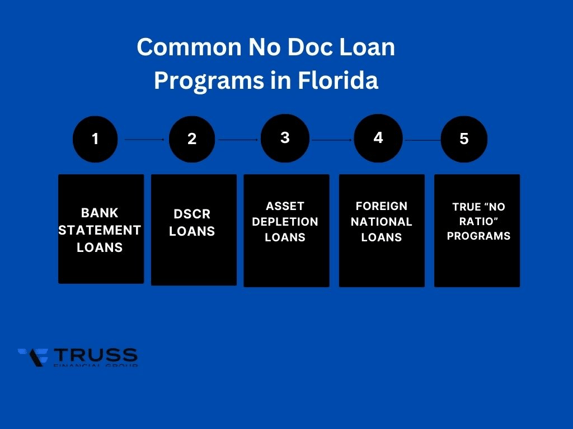

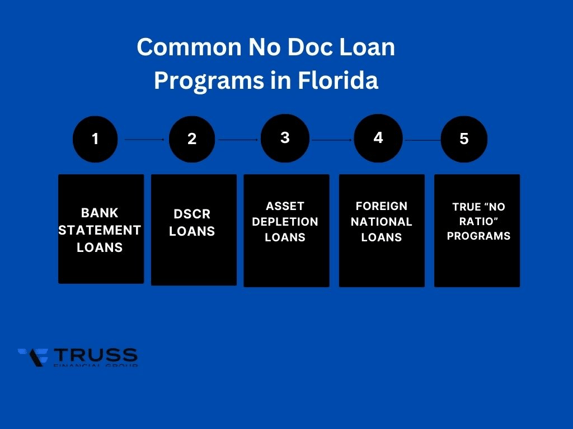

Common No Doc Loan Programs in Florida (2025)

1. Bank Statement Loans

- Use 12–24 months of business or personal bank statements instead of tax returns.

- Popular with freelancers, contractors, and small business owners.

2. DSCR Loans (Debt Service Coverage Ratio)

- Based on the rental property’s ability to cover its mortgage.

- Approval depends on property cash flow, not personal income.

- Popular among Florida’s short-term rental and vacation property investors.

3. Asset Depletion Loans

- Qualify by converting assets like savings, stocks, bonds, or retirement accounts into monthly income for underwriting.

4. Foreign National Loans

- Designed for international buyers of Florida real estate.

- Require higher down payments (often 30–35%).

5. True “No Ratio” Programs

- Some lenders don’t require any income verification, only credit, assets, and equity.

- Limited availability, usually higher rates.

Why Florida Is a Hotspot for No Doc Lending

- High self-employment rate: Florida has one of the largest populations of small business owners, freelancers, and contractors.

- Investor demand: Strong rental markets (Miami, Orlando, Tampa, Naples) drive interest in DSCR loans.

- Retirement hub: Many retirees live off savings rather than employment income.

- Foreign investment: Florida is one of the top states for international property buyers.

Pros and Cons of No Doc Loans

Pros

- No tax returns or W-2s required.

- Flexible approval for non-traditional borrowers.

- Faster closings with simplified paperwork.

- Access to higher loan amounts, including jumbo.

- Ideal for investors and self-employed borrowers.

Cons

- Higher down payments (20–30%).

- Interest rates above conventional loans.

- Fewer lenders offer them (non-QM space).

- Not government-backed (FHA, VA, USDA).

- Complex terms require experienced guidance.

Comparison: No Doc vs. Conventional Loan

|

Feature

|

Conventional Loan

|

No Doc Loan (Non-QM)

|

|

Income documentation

|

W-2s, pay stubs, tax returns

|

Bank statements, assets, or property cash flow

|

|

Down payment

|

3–20%

|

20–30%

|

|

Interest rates

|

Lower

|

Higher (1–3% above conventional)

|

|

Approval speed

|

Slower (full underwriting)

|

Faster (less paperwork)

|

|

Best for

|

Traditional employees

|

Self-employed, investors, retirees, foreign buyers

|

How to Qualify for a No Doc Loan in Florida

To strengthen your application, be prepared with:

- Strong credit history (ideally above 680).

- 20–30% down payment or equivalent equity.

- Bank statements, investment accounts, or retirement funds for reserves.

- Property appraisal (required for all loan types).

- Foreign buyers: valid passport/visa and U.S. bank account.

Tip: The more equity and reserves you bring, the more flexibility lenders will offer

.

FAQs About No Doc Loans in Florida

1) Can I get a No Doc Loan with bad credit?

Possible, but expect higher down payments and rates. Most lenders prefer 640–680+ credit scores.

2) Are No Doc Loans legal in 2025?

Yes. After 2008, regulations tightened, but lenders created non-QM programs like bank statements and DSCR loans that meet compliance standards.

3) Do I need income at all for a No Doc Loan?

Not necessarily. Some programs qualify you based on assets or property income alone.

4) Can foreign nationals buy property with No Doc Loans?

Yes. Many Florida lenders offer foreign national programs, usually requiring 30–35% down.

5) Are interest rates much higher?

Typically 1–3% above conventional rates. The trade-off is easier qualification.

6) Do No Doc Loans work for condos in Florida?

Yes, but condos must meet the lender’s approval list. Some programs work even if the condo isn’t FHA-approved.

Why Choose Truss Financial Group

At Truss Financial Group, we specialize in non-QM lending tailored to Florida’s unique market. With access to No Doc, DSCR, bank statement, and asset depletion programs, we help:

- Self-employed borrowers without W-2s.

- Investors growing Florida rental portfolios.

- Retirees using savings to qualify.

- Foreign buyers seeking Florida property.

With the merger of Equity Access Group, Truss Financial Group combines broad lending expertise with deep experience in specialty mortgage programs, giving Florida borrowers more ways to qualify than ever before.