12 min read

.png)

Key Takeaways

- Traditional HELOCs need 2–3 months of personal statements; bank statement HELOCs for self-employed borrowers require 12–24 months.

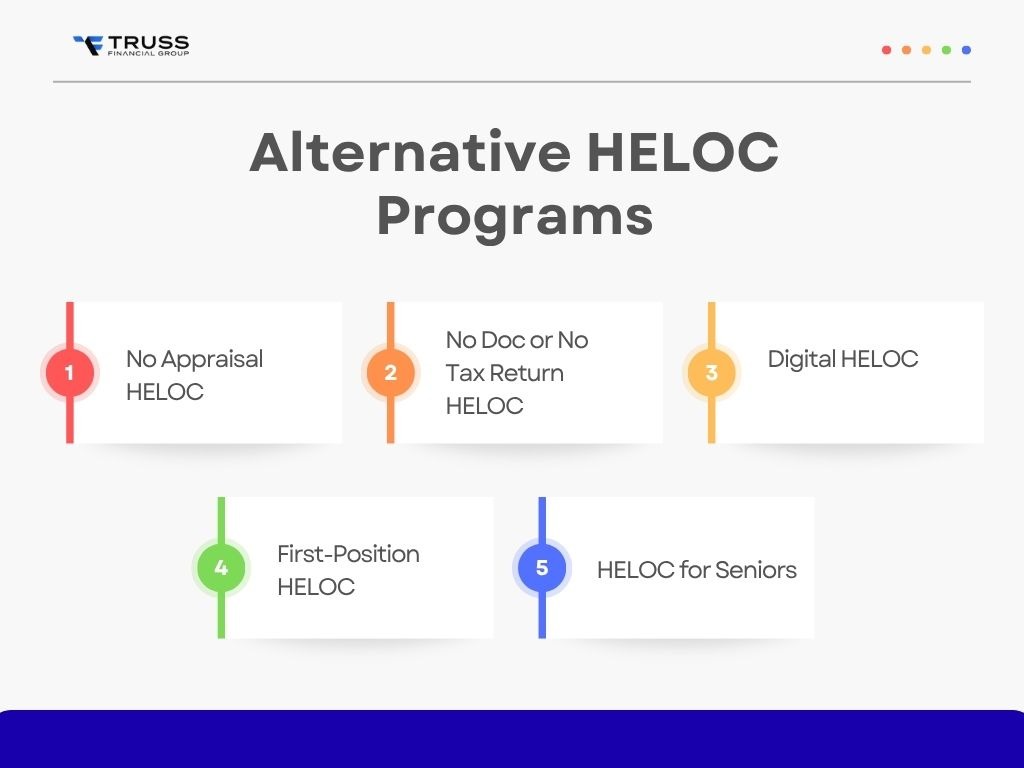

- Alternative programs like no-appraisal HELOCs, no-tax-return HELOCs, and digital HELOCs offer flexible qualification paths for non-traditional borrowers.

- HELOC amounts can go up to $750,000, depending on your home's equity, credit score, and loan-to-value ratio.

If you're exploring a home equity line of credit (HELOC), one of the first questions you'll face is: how many bank statements do I actually need? The answer isn't one-size-fits-all. It depends on your income source, employment type, and the specific HELOC program you're applying for.

Traditional W-2 employees might only need 2–3 months of personal bank statements. Self-employed borrowers, on the other hand, typically need 12–24 months of business bank statements to verify income. And if you're a retiree or investor? Some programs, like Truss Financial Group's Equity Select HELOC for seniors, don't require bank statements at all, relying instead on your home's equity and credit profile.

This guide breaks down exactly what lenders look for, how many months of statements you'll need, and which alternative documentation loans might work better for your situation.

Why Bank Statements Matter in a HELOC?

Bank statements act as a financial diary. They tell lenders the story of your income, spending habits, and financial stability. When you apply for a home equity line of credit, lenders need to verify that you can afford the monthly payments, and your bank statements provide that proof.

For traditional HELOC borrowers with W-2 income, verification is straightforward: a few months of statements plus recent pay stubs paint a clear picture. But for self-employed borrowers, freelancers, or business owners, the picture gets more complex. Your income might fluctuate month to month. You might reinvest profits back into your business, making your taxable income look lower than your actual cash flow.

That's where bank statement HELOC programs come in. Instead of relying on tax returns (which often don't reflect true business income), lenders like Truss Financial Group review 12–24 months of business deposits to calculate your average monthly income. This approach gives self-employed borrowers a fair shot at qualification, without penalizing them for strategic tax planning.

How Many Bank Statements Do You Really Need?

The number of bank statements required for a HELOC depends entirely on your borrower profile. Here's a quick breakdown:

|

Borrower Type |

Typical Bank Statements |

Used For |

Example Program |

|

W-2 Employee |

2–3 months personal |

Verify consistent income |

Traditional HELOC |

|

Self-Employed |

12–24 months business |

Determine the average income |

Bank Statement HELOC |

|

Investor / LLC |

6–12 months business |

Rental or property income |

|

|

Retired (55+) |

None or limited asset proof |

Equity-based qualification |

Most bank statement HELOC lenders use 12 months of business statements to calculate income. If your income fluctuates seasonally, say you're a wedding photographer earning more in summer, lenders may review 24 months to establish a stable average. This protects both you and the lender by ensuring the loan is based on realistic, sustainable income.

The Rise of Alternative HELOC Programs

Today's HELOC programs go far beyond the traditional "show us your W-2 and tax returns" model. Let's explore the flexible home equity line options that match modern borrower needs.

No Appraisal HELOC

Waiting weeks for an appraiser to visit your home? Not anymore. A no appraisal HELOC uses an automated valuation model (AVM), which is like a sophisticated algorithm that analyzes recent sales, property records, and market trends to estimate your home's value.

This approach is ideal for homeowners with:

- Strong equity positions (typically 30%+ equity)

- Good credit scores (680+)

- Properties in areas with robust sales data

By eliminating the traditional appraisal, you can cut 2–3 weeks off your closing timeline. No scheduling hassles, no waiting for reports, just faster access to your home's equity.

No Doc or No Tax Return HELOC

If you're self-employed, you know the frustration: your tax returns show minimal income because you've maximized deductions, but your bank account tells a different story. A no-doc or no-tax return HELOC solves this disconnect.

Here's how it works:

- Lenders review 12–24 months of business bank statements

- They calculate your average monthly deposits (typically counting 50%–100% as qualifying income)

- No W-2s, pay stubs, or personal tax returns required

Loan-to-value ratios (LTV) typically cap around 75% for these programs, reflecting the alternative documentation approach. But for borrowers with strong cash flow and healthy bank balances, this trade-off is worth the simplicity.

Digital HELOC

Imagine applying for a HELOC entirely from your phone, no paper statements, no faxing documents, no visiting a branch. That's the promise of a digital HELOC.

Digital HELOC exemplifies this modern approach:

- Instant income verification through secure platforms like Plaid

- Automated asset verification by linking your bank accounts

- Funding up to $750,000 with flexible draw options

- Same-week approvals for qualified borrowers

The digital process doesn't sacrifice accuracy; it enhances it. Real-time bank connections provide lenders with up-to-the-minute financial data, reducing fraud risk while accelerating approvals.

First-Position HELOC

Most people think of HELOCs as second liens, lines of credit that sit behind your primary mortgage. But a first-position HELOC flips this model.

Instead of having a traditional mortgage plus a HELOC, your HELOC becomes your primary loan. This structure offers unique advantages:

- Replace your existing mortgage with a flexible credit line

- Pay interest only on what you draw, not your entire credit limit

- Reuse funds as you pay down the balance, like a reusable credit card backed by your home's value

First-position HELOCs work especially well for:

- Homeowners with substantial equity and no existing mortgage

- Borrowers consolidating multiple debts into one flexible line

- Real estate investors need quick access to capital for property purchases

HELOC for Seniors (Truss Equity Select)

Retirement changes your financial picture. You might have significant home equity but limited monthly income. Traditional lenders see "no W-2" and immediately decline, but that's shortsighted.

Truss Equity Select, designed exclusively for homeowners 55 and older, takes a different approach:

- Qualification based primarily on equity, not income

- Capped payment options that protect against payment shock

- Non-recourse protection in most cases

- No required monthly repayment until you choose to draw funds

It’s like a financial safety net that grows with your home's value. You maintain full ownership, control when and how you access funds, and preserve your estate for heirs.

What Lenders Review in Your Bank Statements?

When underwriters review your bank statements for a bank statement loan, they're looking for more than just big numbers. Here's what matters:

- Average monthly deposits: Lenders typically count 50%–100% of business deposits as qualifying income, depending on expense ratios. A self-employed borrower depositing $15,000 monthly might qualify based on $10,500–$15,000 in income.

- Business consistency: Are deposits regular and predictable, or wildly erratic? Lenders prefer seeing steady patterns, even if amounts vary. A landscaper earning $8,000 in summer and $3,000 in winter shows seasonality, not instability.

- No NSF or overdrafts: Excessive overdrafts signal poor cash management. One or two minor incidents won't disqualify you, but a pattern of negative balances raises red flags about your debt-to-income ratio and repayment ability.

- Seasonality trends: If your income fluctuates predictably (tax preparers in spring, retail businesses during holidays), lenders account for this. That's why they review 12–24 months, to capture your complete earnings cycle.

- Digital verification: Clean PDF statements or secure Plaid connections work best. Blurry photos or incomplete printouts slow the process and may trigger additional verification requests.

Other Key HELOC Qualification Factors

Bank statements tell part of your story, but lenders consider several factors when determining HELOC approval:

- Credit Score: Most programs require 650+ credit scores, though 720+ unlocks better interest rates. Higher scores also increase your maximum LTV ratio, letting you borrow more against your property value.

- Loan-to-Value (LTV): Traditional HELOCs allow up to 85% combined LTV (your mortgage plus HELOC divided by home value). No-doc options typically cap at 60%–75% LTV, reflecting higher perceived risk.

- Property Type: Single-family homes qualify most easily. Second homes and investment properties work with many programs, though expect slightly higher rates. Condos and multi-unit properties may have additional restrictions.

- Income Type: Beyond W-2 and self-employment income, lenders consider rental income, retirement distributions, Social Security, disability payments, and investment returns. Each income source requires different documentation.

How to Prepare Your Bank Statements Before Applying?

Smart preparation accelerates your HELOC approval and prevents last-minute scrambling. Follow these steps:

- Keep accounts separate: Business income should flow through business accounts, personal expenses through personal accounts. Commingling funds complicates income calculations and may reduce your qualifying amount.

- Maintain healthy balances: Avoid running near zero. Lenders want to see reserves, typically 2–6 months of mortgage payments, remaining after closing costs and any draws you plan to make immediately.

- Avoid large unexplained transfers: Moving $50,000 between accounts right before applying triggers questions. Are you borrowing the down payment? Hiding debt? Document any unusual activity proactively.

- Save clean digital copies: Download statements directly from your bank's website as PDFs. These verify authenticity better than screenshots or printouts. Many digital HELOC platforms also let you connect accounts via Plaid for instant verification.

- Be ready to explain irregularities: Did you receive a one-time insurance payout? Sell equipment? Lenders will ask. A brief written explanation prevents delays and demonstrates transparency.

Frequently Asked Questions About Bank Statement HELOCs

Can I qualify for a HELOC without tax returns?

Yes. Programs like Truss Digital HELOC and Bank Statement HELOC use income deposits from bank statements instead of tax forms, making them ideal for self-employed borrowers with complex tax strategies.

How many bank statements do I need for a HELOC?

Typically, 12–24 months for self-employed borrowers using a bank statement HELOC, or just 2–3 months for traditional W-2 employees. The exact requirement depends on your lender and income stability.

Do I need an appraisal for a HELOC?

Not always. Some lenders offer no-appraisal HELOCs using automated valuation models (AVMs) that estimate your home's value through data analysis rather than physical inspections.

What is the maximum HELOC amount available?

Truss HELOCs go up to $750,000, depending on your home's equity, credit score, and loan-to-value ratio. Some specialized programs for high-value properties may offer even higher limits.

Can seniors qualify for a HELOC without income verification?

Yes, The Truss Equity Select HELOC for homeowners 55+ offers equity-based qualification with flexible draws and non-recourse protection, minimizing traditional income documentation requirements.

Take the Next Step with Truss Financial Group

Whether you're a self-employed borrower tired of being penalized for smart tax planning, a retiree sitting on substantial equity, or a traditional employee seeking the fastest path to approval, Truss Financial Group offers HELOC solutions designed for your specific situation.

From no-appraisal options that close in days to bank statement programs that honor your true earning power, our flexible home equity line products put you in control.

Connect with lending specialists who understand non-traditional income. Or explore conventional refinance options if a DSCR cash-out refinance better suits your goals.

Your home's equity is waiting. Get a quote today!

Table of Content

Take your pick of loans

Experience a clear, stress-free loan process with personalized service and expert guidance.

Get a quote

.png?width=352&name=xxxxxx%20header%20(55).png)

.png?width=352&name=xxxxxx%20header%20(13).png)