15 min read

-

Definition: An asset depletion mortgage qualifies borrowers based on assets (savings, retirement accounts, investments) rather than W-2s or pay stubs.

-

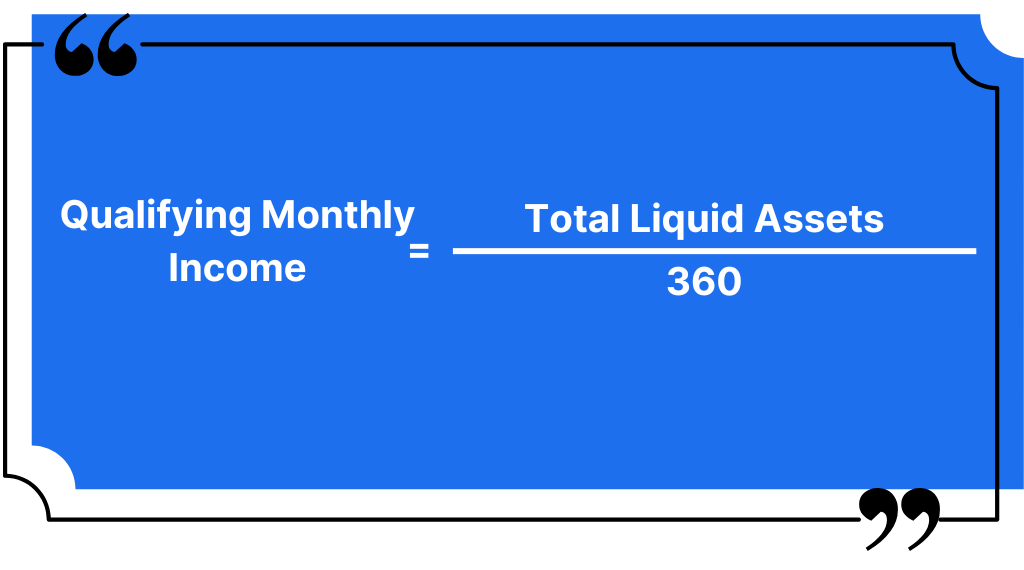

How it works: Lenders divide total liquid assets by 360 months (for a 30-year term) to determine qualifying monthly income.

-

Eligible assets: Cash, savings, retirement funds (counted at 70–80% value), stocks, and bonds (often 80% of value).

-

Benefits: No traditional income required, flexible use (primary, second home, or investment property), higher possible loan amounts.

-

Requirements: Strong credit (620–680+), significant liquid assets, and possibly a reviewed debt-to-income ratio.

-

Risks: Higher interest rates, stricter terms (20–30% down), limited lender availability, and potential long-term impact on assets.

-

Application process:

-

Gather documentation (bank, investment, and retirement statements).

-

Find a non-QM lender experienced in asset depletion loans.

-

Apply and undergo review of assets, credit, and property details.

-

Close the loan with standard disclosure and funding steps.

-

-

FAQs: Covers use for investment or second homes, refinancing, acceptable asset types, and down payment expectations.

-

Conclusion: Asset depletion mortgages provide flexibility for wealthy borrowers without steady income, despite higher costs and stricter requirements.

Suppose you’re a high-net-worth individual, retiree, or self-employed borrower with significant assets but limited traditional income. In that case, you may have wondered how to qualify for a mortgage without a steady paycheck.

The answer you’ve been looking for is an asset depletion mortgage. It allows you to qualify based on your liquid assets rather than your income. Lenders calculate your qualifying monthly income by dividing your savings, retirement accounts, or investment portfolios over a set period.

By the end of this guide, you’ll understand how asset depletion mortgages work, who they’re best for, and whether this loan type is right for you.

____________________________________________________________________________

Key Takeaways

![]() An asset depletion mortgage allows borrowers to qualify based on their liquid assets rather than traditional income sources like W-2s, pay stubs, or tax returns.

An asset depletion mortgage allows borrowers to qualify based on their liquid assets rather than traditional income sources like W-2s, pay stubs, or tax returns.

![]() This type of loan is ideal for retirees, self-employed individuals, and high-net-worth borrowers who have substantial savings but may not have a steady paycheck.

This type of loan is ideal for retirees, self-employed individuals, and high-net-worth borrowers who have substantial savings but may not have a steady paycheck.

![]() Lenders calculate qualifying monthly income by dividing total liquid assets by 360 months (for a 30-year loan), providing a structured way to determine eligibility.

Lenders calculate qualifying monthly income by dividing total liquid assets by 360 months (for a 30-year loan), providing a structured way to determine eligibility.

![]() Eligible assets include cash, savings accounts, retirement funds, stocks, and bonds, though some may be discounted based on liquidity and lender guidelines.

Eligible assets include cash, savings accounts, retirement funds, stocks, and bonds, though some may be discounted based on liquidity and lender guidelines.

![]() Asset depletion mortgages can be used for primary residences, second homes, and investment properties, but loan terms and down payment requirements vary by lender.

Asset depletion mortgages can be used for primary residences, second homes, and investment properties, but loan terms and down payment requirements vary by lender.

____________________________________________________________________________

What Is an Asset Depletion Mortgage?

An asset depletion mortgage is a non-qualified mortgage (non-QM loan) that allows you to qualify for a home loan based on your liquid assets rather than traditional income sources like pay stubs, W-2s, or tax returns. This type of loan is ideal for individuals with substantial assets but irregular or limited employment income.

Key Features of Asset Depletion Mortgages

1. No Traditional Income Required

You don’t need to provide W-2s, pay stubs, or tax returns to prove income.

2. Liquid Assets as Income

Lenders calculate qualifying monthly income by dividing your savings, retirement accounts, or investment portfolios over a set period (typically 360 months for a 30-year loan).

3. Flexible Terms

Commonly used by retirees, self-employed individuals, and high-net-worth borrowers who may not meet the income requirements of traditional loan programs but have substantial assets.

This loan program provides an alternative financing option for those with strong financial reserves who don’t meet conventional loans' standard income verification requirements.

Benefits of Asset Depletion Mortgages

Asset-based mortgages are an excellent option for retirees, self-employed individuals, and high-net-worth borrowers who have significant assets but may not have a steady paycheck. Here are some of the most important benefits:

1. No Need for Traditional Income

Unlike conventional loans, asset depletion mortgages don’t require W-2s, pay stubs, or tax returns. This is especially beneficial for retirees living off savings or entrepreneurs with fluctuating incomes who might struggle to meet traditional income qualifications.

2. Uses Liquid Assets to Qualify

Instead of focusing on employment income, lenders calculate qualifying monthly income by dividing your savings, retirement accounts, or investment portfolios over a set period. This allows you to leverage your wealth rather than provide consistent earnings.

3. Flexible Loan Options

These loans can be used for primary residences, second homes, or investment properties, giving you more freedom to purchase or refinance based on your financial goals.

4. Higher Loan Amounts

Since qualification is based on total assets rather than income limits, borrowers with substantial assets may qualify for larger loans than they would under conventional financing. This is especially useful for those looking to purchase high-value properties or secure better loan terms.

Eligibility and Requirements for an Asset Depletion Mortgage

An asset-based mortgage is designed for borrowers with significant assets but may not have steady employment income. Instead of examining pay stubs or tax returns, lenders assess liquid assets to determine eligibility.

Who Qualifies for an Asset Depletion Mortgage?

1. Retirees

Those with large retirement savings but no regular paycheck can qualify through their retirement accounts, savings, and investments.

2. Self-Employed Borrowers

Entrepreneurs and freelancers with irregular income streams who might not meet traditional income requirements.

3. High-Net-Worth Individuals

Investors, business owners, and professionals with substantial liquid assets but limited documented income.

Requirements for an Asset Depletion Mortgage

1. Substantial Liquid Assets

Borrowers must have significant savings, investment accounts, or retirement funds that can be used to cover mortgage payments.

2. Credit Score

Most lenders require a minimum credit score of 620–680, though higher scores can lead to better loan terms and lower interest rates.

3. Debt-to-Income (DTI) Ratio

While DTI is less important for asset depletion loans, some lenders still evaluate it to ensure borrowers can manage their overall debt obligations.

Lenders typically calculate qualifying income by dividing a borrower’s total liquid assets by a set period (often 360 months for a 30-year loan). This makes asset-based mortgages a great solution for those with wealth but without a traditional paycheck.

How to Calculate Income for an Asset Depletion Mortgage

Lenders use a simple formula to calculate a borrower’s qualifying monthly income based on their liquid assets.

The Formula:

- Liquid assets include savings, retirement accounts, and investments.

- Lenders divide total liquid assets by 360 months (30 years) to determine monthly qualifying income.

Example For Calculation

If a borrower has $1 million in liquid assets:

1,000,000 / 360 = 2,777

This means the lender would consider $2,777 per month as the borrower’s income for mortgage qualification.

Types of Assets That Can Be Used

- Cash and Savings Accounts: 100% of the balance is counted.

- Retirement Accounts (401(k), IRAs): Typically, 70% of the value can be used since early withdrawals may incur penalties.

- Stocks and Bonds: Generally, 80% of the market value is considered, accounting for potential fluctuations.

Lenders may apply different discount rates based on the asset type to ensure borrowers have sufficient funds for the loan term.

Asset Depletion Mortgage vs. Traditional Mortgage

An asset depletion mortgage offers a more flexible way to qualify for a home loan, especially for those with substantial assets but limited traditional income.

In contrast, a traditional loan program relies on steady employment and documented income for approval.

Below is a side-by-side comparison of the key differences.

Risks and Considerations of Asset Depletion Mortgages

While an asset-depletion mortgage provides an alternative to homeownership, borrowers should be aware of potential downsides before applying.

1. Higher Interest Rates

Since asset depletion loans fall under non-QM (non-qualified mortgage) loans, they typically come with higher interest rates than conventional mortgages. Lenders charge more due to the lack of traditional income verification, making it important for borrowers to compare rates and assess affordability.

2. Stricter Loan Terms

Some lenders may impose higher down payments (often 20%–30%), require larger cash reserves, or have shorter loan terms compared to conventional loans. Borrowers should be prepared for stricter approval criteria and fewer lender options.

3. Limited Availability

Not all mortgage lenders offer asset depletion mortgage programs, so finding a lender may take more time. You may need to look for specialized lenders or private mortgage providers that cater to high-net-worth individuals or those with substantial liquid assets.

4. Impact on Assets and Long-Term Planning

Using savings, retirement accounts, or investment funds to qualify for a mortgage could affect long-term financial security. Depleting assets for home financing may reduce liquidity, affect investment growth, or require adjustments to retirement plans. Borrowers should weigh the impact on their overall financial strategy before committing.

Understanding these risks ensures you make an informed decision that aligns with your financial future.

Applying for an Asset Depletion Mortgage

Applying for an asset depletion mortgage is different from the traditional mortgage process.

Here’s a step-by-step guide to help you navigate the process:

Step 1: Gather Financial Documents

Since asset depletion loans rely on bank accounts, retirement savings, and investments, you’ll need to provide detailed documentation of your liquid assets.

The documents you’ll need include:

- Bank Statements: Typically from the last 3–12 months to show available cash.

- Investment Accounts: Includes stocks, bonds, and mutual funds that can be considered for income calculations.

- Retirement Accounts (401(k), IRAs, Pensions): Some lenders allow 70–80% of retirement funds to be counted.

- Real Estate Holdings: If applicable, proof of any additional investment properties or rental income.

Having these documents ready will streamline the process and show lenders you have the necessary assets to cover the mortgage payments.

Step 2: Find a Lender That Offers Asset Depletion Mortgages

Not all mortgage lenders provide asset depletion loans, as they fall under the non-QM (non-qualified mortgage) category. Since these loans have different underwriting guidelines, it’s important to:

- Work with a mortgage broker experienced in non-QM loans to help find the best lender.

- Compare lenders to evaluate loan terms, interest rates, down payment requirements, and asset calculation methods.

- Ask about asset eligibility. Some lenders may discount certain assets (e.g., retirement funds, stocks) when calculating qualifying income.

Step 3: Submit Your Application

Once you choose a lender, you’ll need to complete the mortgage application and submit documentation for review.

Lenders will evaluate:

- Total liquid assets: To calculate your qualifying monthly income (typically by dividing total assets by 360 months for a 30-year loan).

- Credit history and score: Most lenders require a minimum credit score of 620–680 to qualify.

- Debt-to-income (DTI) ratio: While less important for asset depletion loans, some lenders may still consider existing debts in the approval process.

- Property details: Information on the home, purchase price, and down payment will be required.

Demonstrating strong financial reserves and responsible asset management is crucial for approval.

Step 4: Close the Loan

Once approved, the lender will provide a loan estimate and final closing disclosure detailing the following:

- Loan terms (interest rate, repayment period, and monthly payments).

- Closing costs (appraisal fees, lender fees, title insurance, etc.).

- Down payment requirements (typically 20–30% of the home’s purchase price).

At closing, you will review and sign the final paperwork. Once everything is completed, the lender will fund the loan. You are now officially a homeowner!

Frequently Asked Questions

Can I use an asset depletion mortgage for an investment property?

Yes, many lenders allow asset-depleting mortgages for investment properties, but the loan terms, down payment requirements, and interest rates may be different from those for primary residences.

What types of assets can I use to qualify?

Lenders typically accept cash, savings, retirement accounts (401(k), IRAs), stocks, bonds, and mutual funds. However, some assets may be discounted based on liquidity (e.g., retirement funds are often counted at 70–80% of their value).

Do I need a down payment?

Yes, most lenders require a down payment of 20–30%, though higher loan amounts or lower credit scores may require a larger mortgage payment.

Can I refinance into an asset depletion mortgage?

Yes, if you meet the eligibility requirements, you can refinance an existing mortgage into an asset depletion loan. This is a good option for self-employed individuals, retirees, or high-net-worth borrowers who want to use their assets, such as mutual funds, instead of employment income to qualify.

Are asset depletion mortgages available for second homes?

Yes, you can use an asset depletion mortgage to finance a second home or vacation property, but lenders may have stricter requirements for credit scores, down payments, and asset reserves.

Conclusion

An asset-depletion mortgage is an excellent option for retirees, self-employed individuals, and high-net-worth borrowers with significant assets but limited traditional income.

While higher interest rates, down payment requirements, and lender availability are important considerations, an asset depletion mortgage provides flexibility for those who may not meet the strict income requirements of a traditional mortgage.

Are you ready to explore your financing options?

Contact Truss Financial Group today to learn more about asset depletion mortgages and how they can help you achieve your homeownership goals.

Table of Content

Take your pick of loans

Experience a clear, stress-free loan process with personalized service and expert guidance.

Get a quote