19 min read

- Both are GSEs purchase mortgages from lenders but target different borrower profiles with distinct systems

- Fannie Mae favors W-2 employees at large banks; Freddie Mac suits self-employed borrowers better

- Non-QM mortgage options provide alternative paths when traditional GSE programs don't fit your profile

If you're navigating the homebuying process, you've likely encountered two names: Fannie Mae and Freddie Mac.

These government-sponsored enterprises operate behind nearly every conventional mortgage in America, yet most borrowers don't understand how they differ or why it matters.

Here's the truth: while both buy mortgages from lenders and stabilize the mortgage market, they serve different borrower profiles and use distinct underwriting systems.

For borrowers with non-traditional income or complex finances, understanding these distinctions can mean the difference between approval and rejection.

Most conforming loans fall under one of these entities. Understanding their criteria helps you get approved faster and avoid wasted applications. And even when neither fits? We at Truss Financial Group step in with flexible Non-QM mortgage options.

What Are Fannie Mae and Freddie Mac?

Think of Fannie Mae and Freddie Mac as the financial plumbing of America's housing market. They don't originate mortgages or hand you cash at closing. Instead, they operate in what's called the secondary mortgage market: buying completed loans from banks and credit unions.

Fannie Mae

Fannie Mae (officially the Federal National Mortgage Association, or FNMA) was created in 1938 during the Great Depression as part of the New Deal. Its mission was to inject liquidity into a frozen housing market by purchasing mortgages from larger commercial banks.

Freddie Mac

Freddie Mac (the Federal Home Loan Mortgage Corporation, or FHLMC) came along in 1970 under the Emergency Home Finance Act. Congress designed it to expand the secondary market and introduce competition, particularly by purchasing loans from smaller banks and credit unions that Fannie Mae often overlooked.

When a lender sells your loan to Fannie Mae or Freddie Mac, it frees capital to issue more mortgages. This cycle keeps mortgage funds flowing even during economic uncertainty. Both entities then package these loans into mortgage-backed securities and sell them to investors, spreading risk across the financial markets.

Since the 2008 financial crisis, both Fannie Mae and Freddie Mac have operated under government conservatorship, overseen by the Federal Housing Finance Agency. While technically private companies, they function with federal government backing: a safety net that keeps competitive rates accessible to millions of American homebuyers.

How Fannie Mae and Freddie Mac Differ?

While both government-sponsored enterprises serve the mortgage market, their operational differences can significantly impact your loan approval. Here's a side-by-side comparison:

|

Criteria |

Fannie Mae |

Freddie Mac |

|

Target Borrowers |

Salaried professionals, W-2 employees |

Self-employed, variable income earners |

|

Automated System |

Desktop Underwriter (DU) |

Loan Product Advisor (LPA) |

|

Down Payment |

3% (HomeReady) |

3% (Home Possible) |

|

Income Flexibility |

Stricter documentation requirements |

Slightly more lenient with alternative docs |

|

Preferred Lender Network |

Larger banks, national mortgage companies |

Smaller lenders, credit unions, and community banks |

|

Debt-to-Income (DTI) Limit |

Up to 50% |

Up to 50% (some flexibility above) |

Target Borrowers

Fannie Mae traditionally serves borrowers with straightforward income documentation. Think W-2 employees with consistent paychecks from larger commercial banks. Its Desktop Underwriter system is designed to process these clean financial profiles efficiently.

Freddie Mac, by contrast, was built to serve community banks and credit unions that often work with self-employed borrowers, freelancers, and those with less conventional income streams. Its Loan Product Advisor system has historically shown more tolerance for variable income and non-traditional documentation.

Automated Underwriting Systems

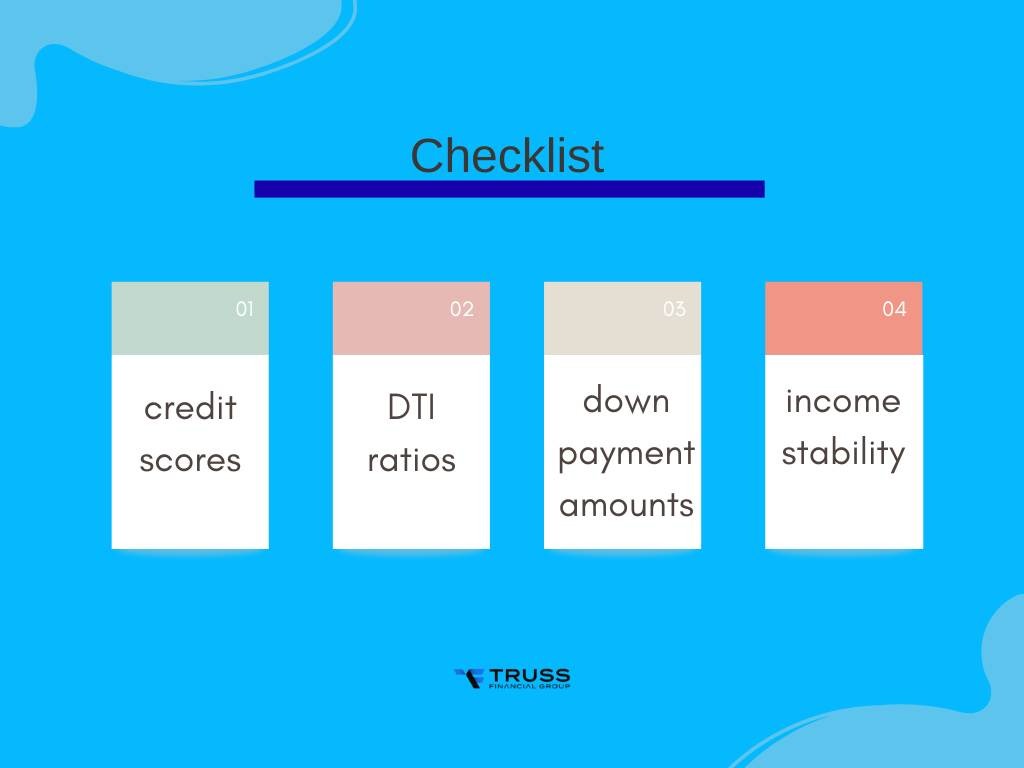

Your loan application will run through either Desktop Underwriter (Fannie Mae) or Loan Product Advisor (Freddie Mac). These are automated systems that analyze your financial profile and determine eligibility. These systems evaluate credit scores, DTI ratios, down payment amounts, and income stability differently.

A mortgage professional will typically know which system best suits your profile. If your first submission gets denied, switching to the other automated system sometimes yields approval, even with identical financial data.

Income Documentation Flexibility

This is where the rubber meets the road for many borrowers. Fannie Mae generally requires comprehensive income verification: recent tax returns, W-2 forms, and pay stubs. Any gaps or inconsistencies can trigger additional scrutiny.

Freddie Mac's guidelines allow slightly more breathing room. For self-employed borrowers, Freddie Mac may accept 12-24 months of bank statements as income verification. This is a lifeline for business owners who show significant write-offs on their tax returns.

How to Know Which Option Fits You Best?

Understanding which GSE aligns with your financial profile can save you time and frustration. Here's a practical breakdown:

If you're a W-2 employee with a steady income → Fannie Mae may suit you. The Federal National Mortgage Association's underwriting system is optimized for traditional employment structures. You'll likely work with larger banks that route most loans through Fannie Mae's Desktop Underwriter.

If you're self-employed or rely on variable income → Freddie Mac may allow more flexibility. Entrepreneurs, commission-based salespeople, and freelancers often find that Freddie Mac's Loan Product Advisor evaluates their applications more favorably. Smaller lenders and credit unions that partner with Freddie Mac may better understand your income structure.

If your lender uses Loan Product Advisor → your file likely routes through Freddie Mac. Ask your loan officer which automated system they primarily use. Some mortgage companies work exclusively with one GSE, while others can run applications through both.

If you want low down payment programs (3%) → both work, but underwriting differences can change the outcome. Fannie Mae's HomeReady and Freddie Mac's Home Possible both offer 3% down options for moderate-income borrowers. However, the way each system calculates qualifying income and evaluates risk differs enough that one might approve what the other denies.

Let’s Take an Example

Consider two borrowers with identical minimum credit scores of 680 and similar DTI ratios. Both are self-employed consultants earning $120,000 annually.

Borrower A applies through a large national bank using Fannie Mae's Desktop Underwriter. The system flags irregular income patterns from the past 18 months and requests additional documentation. After weeks of back-and-forth, the application is denied due to "insufficient income stability."

Borrower B applies through a community credit union using Freddie Mac's Loan Product Advisor. The underwriter accepts 24 months of bank statements showing consistent deposits. Despite identical financials, Borrower B receives approval within two weeks.

This scenario plays out daily across the mortgage market. The difference isn't creditworthiness. It's which GSE's underwriting philosophy better matches your financial reality.

When Fannie Mae or Freddie Mac Say "No"

Even perfectly creditworthy borrowers hit roadblocks with conventional conforming loans. Common rejection reasons include:

- Limited flexibility on income verification – If your income doesn't fit neatly into W-2 boxes, automated underwriting systems may struggle to accurately assess your ability to repay

- High DTI despite strong assets – You might have substantial savings or investment portfolios, but if your debt-to-income ratio exceeds 50%, traditional systems often automatically decline

- Recent self-employment with short history – Fannie Mae and Freddie Mac typically require two years of self-employment history; newer entrepreneurs face uphill battles

- DSCR below 1 for investment properties – Both GSEs require rental income to exceed mortgage payments; properties with debt service coverage ratios below 1.0 rarely qualify

- Retirees or asset-rich borrowers without active income – Traditional employment income formulas don't accommodate borrowers with significant assets but no W-2 or 1099 income

These rejections don't reflect your financial responsibility or ability to repay. They simply mean your situation doesn't align with the standardized criteria government-sponsored enterprises must follow.

The good news? These are precisely the scenarios where Non-QM mortgage options shine. When Fannie Mae doesn't fit your profile, alternative lending programs provide viable paths to homeownership or help you tap home equity when you need it most.

The Non-QM Path: When Traditional Loans Don't Fit

Non-QM (Non-Qualified Mortgage) loans exist for borrowers who don't meet the strict documentation and income verification requirements of qualified mortgages backed by Fannie Mae and Freddie Mac. These aren't subprime loans. They're simply mortgages with different underwriting standards that evaluate your full financial picture rather than checking automated boxes.

Truss Financial Group specializes in helping borrowers who don't check every Fannie or Freddie box, yet still deserve smart, flexible mortgage options. The Non-QM programs focus on your actual ability to repay based on bank statements, asset reserves, or rental property cash flow (not just tax returns and pay stubs).

Here's how Non-QM solutions address common GSE rejection scenarios:

|

Borrower Type |

Problem |

TFG Non-QM Solution |

|

Self-employed |

No W-2 or tax returns showing reduced income |

Bank Statement Mortgage |

|

Retired / Asset-rich |

No steady employment income |

Asset Depletion Loan |

|

Real estate investor |

DSCR < 1 or mixed income sources |

DSCR Loan (Below 1 Accepted) |

|

High DTI |

Strong assets but income-to-debt mismatch |

Stated-Income or Alternative Doc Loans |

|

Senior homeowners |

Want to access home equity without monthly payments |

Truss Equity Select (55+ HELOC) |

Bank Statement Mortgages

Self-employed borrowers often write off business expenses, reducing taxable income. This makes them look less qualified on paper than they actually are. Bank statement mortgages solve this by analyzing 12-24 months of business or personal bank deposits to calculate true income. This approach reveals your actual cash flow rather than tax-minimized figures.

Asset Depletion Loans

Retirees and high-net-worth individuals with substantial investment portfolios often lack traditional income documentation. Asset depletion loans divide your liquid assets by the loan term (typically 360 months), creating a "monthly income" figure that qualifies you for financing. If you have significant retirement savings or brokerage accounts, this strategy unlocks purchasing power without needing W-2s. Learn more about how to calculate Fannie Mae asset depletion mortgage formulas and see if this approach works for you.

DSCR Loans for Real Estate Investors

Investment property financing through Fannie Mae and Freddie Mac requires rental income to cover 100% of the mortgage payment (DSCR ≥ 1.0). But promising properties in growth markets often have lower initial rents or require renovations. The DSCR below 1 program evaluates the property's future income potential and your overall portfolio strength, not just a single metric.

Truss Equity Select HELOC

For homeowners 55 and older, accessing home equity through traditional refinancing or home equity loans can be challenging without active employment income. The Truss Equity Select program provides flexible lines of credit based on home equity, not current income, helping seniors fund retirement, medical expenses, or investment opportunities.

Fannie Mae vs Freddie Mac vs Non-QM (Summary Table)

|

Feature |

Fannie Mae |

Freddie Mac |

Non-QM (Truss) |

|

Down Payment |

As low as 3% |

As low as 3% |

Varies (10–25%) |

|

DTI Limit |

≤ 50% |

≤ 50% |

Up to 60% or case-based |

|

Income Documentation |

W-2, Tax Returns |

W-2, Tax Returns |

Bank Statements, Assets |

|

Self-Employed |

Limited flexibility |

Slightly better |

Designed for it |

|

Investment Properties |

Standard DSCR ≥ 1 |

Standard DSCR ≥ 1 |

DSCR < 1 Accepted |

|

Eligible Borrowers |

Prime |

Prime / Near-Prime |

Non-Traditional |

|

Best For |

Traditional employees |

Small business owners, varied income |

Asset-rich, self-employed investors |

FAQ

What is the main difference between Fannie Mae and Freddie Mac?

The primary difference lies in their target markets and lender partnerships. Fannie Mae primarily purchases mortgages from larger commercial banks and serves W-2 employees with straightforward income documentation. Freddie Mac focuses on buying loans from smaller community banks and credit unions, often showing more flexibility toward self-employed borrowers and those with variable income.

Both use different automated underwriting systems (Desktop Underwriter for Fannie Mae and Loan Product Advisor for Freddie Mac), which evaluate borrower risk differently.

What do Fannie Mae and Freddie Mac do?

Both government-sponsored enterprises operate in the secondary mortgage market. They purchase conforming loans from private lenders, which provides financial institutions with fresh capital to issue more mortgages. After buying loans, they bundle them into mortgage-backed securities and sell them to investors.

This process creates liquidity in the mortgage market, keeps interest rates competitive, and ensures a steady flow of mortgage funds for American homebuyers. Neither entity originates loans directly to consumers.

When did Fannie Mae and Freddie Mac collapse?

During the 2008 financial crisis, both GSEs faced near-insolvency due to significant losses on subprime mortgages and mortgage-backed securities. In September 2008, the Federal Housing Finance Agency placed both Fannie Mae and Freddie Mac into government conservatorship, where they remain today.

The U.S. Treasury provided $190 billion in bailout funds to stabilize them. Since then, both have returned to profitability and repaid their government loans, though they continue to operate under federal government oversight.

Why are they called Fannie Mae and Freddie Mac?

"Fannie Mae" is a phonetic play on FNMA (the Federal National Mortgage Association). Similarly, "Freddie Mac" derives from FHLMC (the Federal Home Loan Mortgage Corporation). These nicknames make the organizations' acronyms easier to pronounce and remember.

The personification helped humanize what would otherwise be bureaucratic-sounding federal housing finance entities.

What are the disadvantages of a Freddie Mac loan?

Freddie Mac loans carry the same limitations as all conforming mortgages: strict income documentation requirements, conforming loan limits (capped at $806,500 in most areas for 2025), and standardized underwriting criteria. Borrowers with complex income structures, high-value properties, or unique financial situations may find these requirements restrictive.

Additionally, because Freddie Mac works primarily with smaller lenders, borrowers in some markets may have fewer financing options compared to Fannie Mae's broader network of larger banks.

Who qualifies for Fannie Mae and Freddie Mac?

To qualify for conforming loans backed by either GSE, borrowers typically need: a minimum credit score of 620-680, a debt-to-income ratio at or below 50%, steady employment history (usually two years), documented income through W-2s or tax returns, and a down payment of at least 3%.

Both entities set maximum loan amounts based on geographic area. Borrowers must also meet property standards. The home must be owner-occupied or meet investment property criteria, and it must pass appraisal requirements.

Can I switch from a Fannie Mae loan to a Non-QM loan?

Yes. If you're denied for a conventional mortgage through Fannie Mae, you can absolutely pursue Non-QM financing. Many borrowers discover Non-QM options after hitting roadblocks with traditional underwriting. The main differences include higher down payment requirements (typically 10-25%) and potentially higher interest rates, but

Non-QM loans offer far greater flexibility on income documentation and credit guidelines. You can also refinance an existing Fannie Mae mortgage into a Non-QM loan if your financial situation has changed.

Do Non-QM loans have higher interest rates?

Generally, yes. Non-QM loans carry higher interest rates than conforming mortgages because lenders assume additional risk without the government-sponsored backing of Fannie Mae or Freddie Mac. However, the rate premium is often modest (typically 0.5-2% higher), and many borrowers find the flexibility worth the cost.

For self-employed borrowers, real estate investors, or asset-rich retirees who wouldn't qualify conventionally, a slightly higher rate is a reasonable trade-off for accessing financing that otherwise wouldn't exist.

Final Thoughts: Choose the Right Fit

It’s important to understand the difference between Fannie Mae and Freddie Mac, but what matters more is finding financing that works for your unique situation. Whether you fit inside the Fannie or Freddie box or fall slightly outside, your mortgage shouldn't depend on a computer's verdict.

Truss Financial Group helps borrowers qualify using their real financial story, not just the paperwork that automated underwriting systems demand.

If you've been told "no" by conventional lenders, or if you're just starting your homebuying process and know your finances don't follow traditional patterns, it is recommended to explore your best-fit options today.

Table of Content

Take your pick of loans

Experience a clear, stress-free loan process with personalized service and expert guidance.

Get a quote