14 min read

1. Getting a mortgage without a job is possible when you demonstrate reliable income through alternative sources.

2. Mortgage lenders like Truss Financial Group focus on your ability to make monthly mortgage payments rather than your traditional employment status.

3. Significant cash reserves, investment income, and co-signers can strengthen your mortgage application.

Are you wondering if it's possible to secure a mortgage without traditional employment? You're not alone. Thousands of self-employed individuals, retirees, freelancers and gig workers face this challenge every year when asking, "Can you get a mortgage without a job?"

The truth is, while getting a mortgage without a job presents unique challenges, it's absolutely achievable with the right strategy and understanding of alternative lending options.

Whether you're between jobs, self-employed, retired, or have significant cash reserves, there are proven pathways to homeownership that don't require conventional employment verification.

This comprehensive guide will show you exactly how to navigate the mortgage process without a conventional job to help you turn your homeownership dreams into reality.

How to Get a Mortgage Without a Job?

Successfully obtaining a mortgage without traditional employment requires strategic planning and understanding of what strengthens your application. Multiple approaches can improve your chances, and combining several strategies often yields the best results for unconventional borrowers.

The mortgage process becomes more complex when you lack standard employment verification documents.

However, progressive lenders have developed sophisticated methods for evaluating non-traditional borrowers who demonstrate financial responsibility through alternative means.

Key Success Factors:

- Excellent credit score (typically 680+)

- Low debt-to-income ratio with alternative income

- Substantial cash reserves or liquid assets

- Larger down payment (20-30% minimum)

- Clear documentation of income sources

Get a Co-Signer

Adding a co-signer to your mortgage application can dramatically improve approval chances when you lack traditional employment. A qualified co-signer provides additional security for the mortgage lender by assuming financial responsibility if you cannot make payments.

The ideal co-signer possesses stable employment income, excellent credit history, and a low debt-to-income ratio. Parents, spouses, or close family members often serve as co-signers, understanding they become legally obligated for mortgage payments if necessary.

Choose your co-signer carefully, as their financial situation should strengthen rather than weaken your application. Lenders evaluate the combined financial strength of both parties, making the co-signer's qualifications crucial for approval success.

Leverage Alternative Income

Income doesn't exclusively come from traditional W-2 employment, and savvy borrowers leverage diverse income streams to qualify for mortgages. Mortgage lenders increasingly accept various forms of reliable income when evaluating applications from non-traditional borrowers.

Acceptable Alternative Income Sources:

- Investment income from stocks, bonds, and dividends

- Rental property income from real estate investments

- Retirement income from pensions, Social Security

- Child support payments and alimony payments

- Self-employment income from business operations

- Freelance income from contract work

Documentation becomes crucial for proving income reliability and sustainability. Bank statements, tax returns, and legal agreements help verify alternative income sources that support your mortgage application.

Tap Into Cash Reserves

Having significant cash reserves demonstrates financial stability and payment capability to mortgage lenders concerned about employment gaps. Substantial liquid assets show you can maintain mortgage payments during income fluctuations or unexpected circumstances.

Cash reserves in checking accounts, savings accounts, and money market accounts provide immediate access to funds for mortgage payments. Many lenders calculate how many months of housing payments your reserves could cover as a key approval factor.

Use an affordability calculator to determine how much house you can realistically afford based on your cash reserves and alternative income sources. This helps establish realistic home price targets before beginning your search.

Building substantial cash reserves requires discipline but pays dividends during the mortgage application process. Beyond improving approval odds, significant reserves often help negotiate better interest rates and loan terms.

Use Assets as Income

Asset-based lending allows you to use investment accounts, retirement accounts, and other financial assets as qualifying income sources. This approach works exceptionally well for high-net-worth individuals who possess substantial wealth but lack traditional employment income.

Lenders typically calculate a percentage of your total liquid assets as equivalent monthly income for qualification purposes. This strategy recognizes that wealthy borrowers could liquidate investments if necessary to maintain mortgage payments.

You can use a mortgage calculator to help estimate monthly payments based on different loan amounts and interest rates, allowing you to determine how much of your assets you'll need to qualify for your desired home price.

Asset-based qualification particularly benefits retirees who have accumulated substantial wealth during their careers but no longer receive employment income. Investment portfolios, retirement accounts, and savings balances become the foundation for mortgage approval.

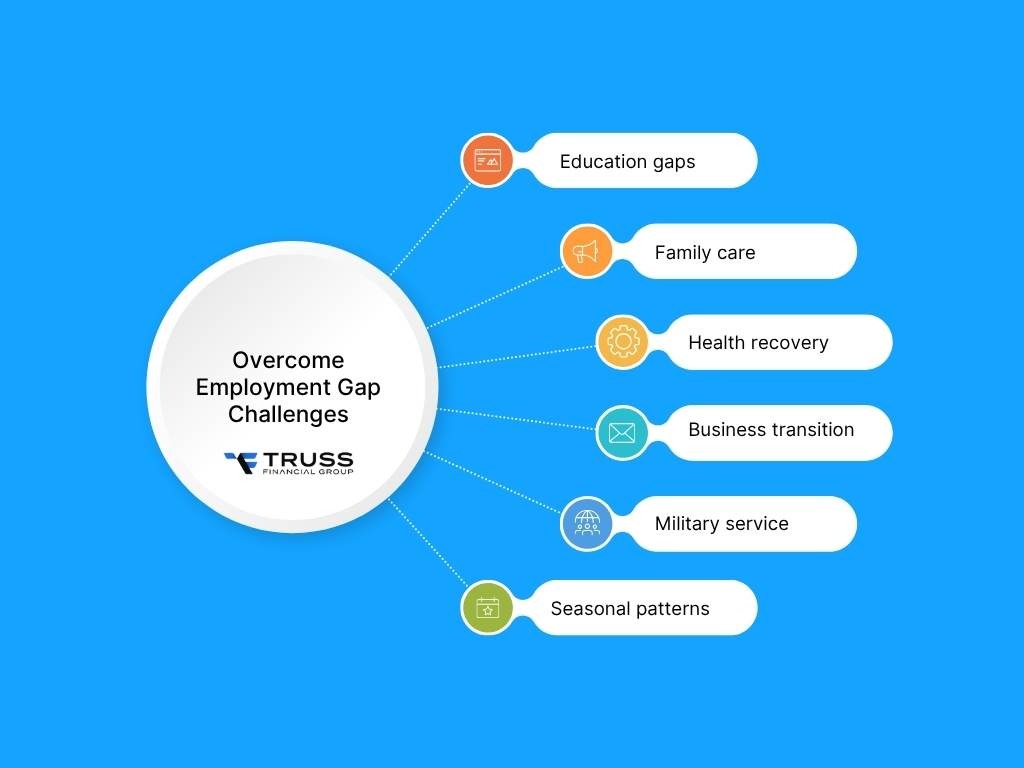

Overcome Employment Gap Challenges

Employment gaps don't automatically disqualify you from mortgage approval when you can provide reasonable explanations and demonstrate current financial stability. Lenders understand that life circumstances sometimes create temporary breaks in traditional employment patterns.

- Education gaps: Pursuing higher education or professional certifications shows career development planning

- Family care: Caring for children or elderly relatives demonstrates responsible life prioritization

- Health recovery: Medical treatment periods are acceptable with proper documentation and recovery proof

- Business transition: Starting self-employment or changing careers shows entrepreneurial initiative and planning

- Military service: Deployment or service transitions receive special consideration from most lenders

- Seasonal patterns: Industries with cyclical employment show predictable income despite temporary gaps

Understand the Employment History Requirements

Employment history requirements vary significantly among lenders and loan programs, with many offering flexibility for borrowers who don't fit traditional employment models. Understanding these variations helps you target the right lenders for your specific situation.

- Two-year standard: Most traditional lenders require a consistent employment history spanning twenty-four consecutive months

- Self-employment flexibility: Two years of self-employment income in the same industry satisfies most requirements

- Military service credit: Veterans can use military service time as qualifying employment history

- Career progression: Logical job changes within related fields often satisfy employment continuity requirements

- Seasonal work acceptance: Consistent seasonal employment patterns demonstrate reliable income despite employment gaps

- Contract work recognition: Documented freelance or contract work can substitute for traditional employment verification

Loan Types for Buying a House Without a Job

Several specialized mortgage products cater specifically to borrowers without traditional employment verification. These non-QM (non-qualified mortgage) loans offer flexible underwriting standards while maintaining responsible lending practices for unconventional borrowers.

Understanding available loan types helps you choose the best product for your specific financial situation. Each program has unique requirements, benefits, and limitations that affect approval likelihood and loan terms.

Working with experienced lenders who offer multiple non-traditional loan products increases your chances of finding suitable financing options. Comparison shopping becomes crucial for securing the best terms available.

Asset-Based Loan

Asset-based loans focus on your total wealth rather than your monthly income from employment. These mortgage products allow qualification based on investment accounts, retirement accounts, savings balances, and other liquid assets without traditional income verification requirements.

Lenders calculate qualifying income by applying a percentage to your total assets, typically 60-70% of liquid assets divided by the loan term. This approach eliminates the need for pay stubs, employment letters, or tax returns.

Interest rates on asset-based loans typically exceed conventional mortgage rates, reflecting the increased risk lenders perceive. However, for borrowers with substantial assets, these rates often remain competitive and worthwhile for achieving homeownership goals.

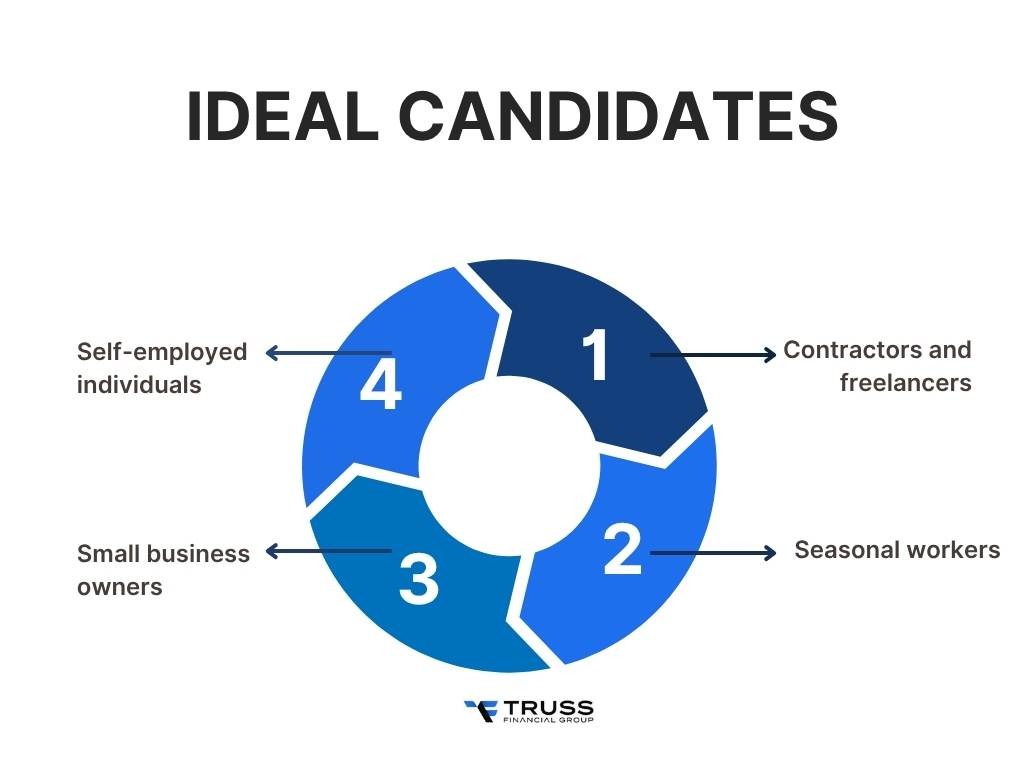

Bank Statement Loan

Bank statement loans allow self-employed borrowers and business owners to qualify using bank statements instead of traditional income documentation. Bank statement mortgages recognize that successful entrepreneurs may not show true earning capacity on tax returns due to business deductions.

Lenders typically require 12-24 months of bank statements showing consistent deposits and positive cash flow patterns. They analyze deposit regularity to determine average monthly income, focusing on actual business cash flow rather than taxable income.

Ideal Candidates:

- Self-employed individuals with strong cash flow

- Small business owners with complex tax situations

- Contractors and freelancers with variable income

- Seasonal workers with cyclical earnings patterns

Debt Service Coverage Ratio (DSCR) Loan

DSCR loans are designed specifically for real estate investors purchasing rental properties without personal income verification. These loans focus on the property's income potential rather than the borrower's employment history or personal financial situation.

The debt service coverage ratio compares projected rental income to total debt obligations, including the new mortgage payment. A DSCR of 1.0 means rental income exactly covers debt payments, while ratios above 1.25 indicate positive cash flow.

Is your property's DSCR calculation below 1?

We specialize in helping borrowers with low DSCR.

DSCR loans from Truss Financial Group allow investors to expand portfolios without personal income limitations, making them ideal for unemployed individuals entering real estate investing. Property performance becomes the primary qualification factor rather than employment verification.

Refinancing Without a Job

Existing homeowners without traditional employment can often refinance using similar strategies to those seeking new mortgages. Your payment history, home equity, and alternative income sources become crucial factors in the refinancing evaluation process.

Consistent mortgage payment history demonstrates financial responsibility even without current employment. Lenders view borrowers who maintained payments during unemployment as lower risk than those seeking initial financing without jobs.

Government-backed refinancing programs sometimes offer streamlined options requiring minimal income verification. FHA streamline refinances and VA Interest Rate Reduction Refinance Loans may work for qualified unemployed borrowers with existing government loans.

Maximizing Your Larger Down Payment Strategy

A larger down payment serves as one of the most powerful tools for overcoming employment concerns in mortgage applications. When you can demonstrate substantial upfront investment in the property, lenders view you as a lower-risk borrower despite lacking traditional employment income.

Most successful applicants without jobs put down 25-30% or more, significantly above the conventional 20% minimum, to compensate for employment uncertainty.

Strategic down payment planning involves more than just accumulating funds - it requires understanding optimal amounts for different loan programs and lender requirements.

Asset-based loans often require 30-40% down payments, while bank statement loans may accept 25% for well-qualified borrowers. The source of your down payment funds also matters, as lenders scrutinize large deposits and require documentation proving legitimate origins through gift letters, asset liquidation records, or inheritance documentation.

Apply for a Non-QM Loan Today!

Non-qualified mortgages (non-QM loans) provide the most flexibility for borrowers without traditional employment situations. These loans don't meet standard qualified mortgage criteria but offer responsible lending options for unconventional borrowers seeking homeownership.

Non-QM lenders evaluate your complete financial picture rather than focusing solely on employment income verification. They consider credit history, cash reserves, down payment amounts, and overall financial stability when making lending decisions.

Truss Financial Group specializes in non-QM lending solutions and understands the unique challenges faced by non-traditional borrowers. Their experienced team guides clients through the application process and identifies the best loan products for specific situations.

Frequently Asked Questions

Is it possible to get a mortgage with no income?

While you cannot get a mortgage with absolutely zero income, you can qualify without traditional employment income. Lenders need assurance of payment ability through investment income, retirement benefits, rental property income, or significant cash reserves.

Documentation of alternative income sources becomes critical for mortgage approval. Bank statements, investment account statements, and legal payment agreements help verify your financial capacity to maintain monthly mortgage payments.

How to buy a house if you don't have a job?

Focus on demonstrating financial stability through alternative means: document all income sources, consider co-signers, prepare larger down payments, improve credit scores, and work with lenders experienced in non-traditional financing solutions.

Building substantial cash reserves and maintaining excellent credit history significantly improve your approval chances. Strategic timing of your application and choosing the right lender can make the difference between approval and denial.

Can you get approved for a mortgage while unemployed?

Yes, unemployment doesn't automatically disqualify mortgage applications. Success depends on demonstrating reliable alternative income, substantial cash reserves, excellent credit history, or qualified co-signer support for your application.

The key lies in presenting a compelling financial story that shows payment reliability despite employment gaps. Working with specialized lenders like Truss Financial Group who understand non-traditional borrowers increases your approval likelihood significantly.

Can I get a mortgage if I've been employed for less than a year?

Most traditional lenders prefer two years of employment history, but exceptions exist for compelling circumstances. Recent graduates, career advancement, or industry consistency may qualify with proper documentation and strong financial profiles.

Alternative income sources can supplement a limited employment history. Investment income, rental property income, or substantial cash reserves may offset concerns about short employment tenure with appropriate documentation.

Can I get a home loan if I received a job offer but haven't started yet?

Many lenders accept valid job offers with confirmed start dates and salary details. Offer letters detailing compensation, start dates, and employment terms often satisfy income verification requirements during employment transitions.

Having substantial cash reserves strengthens applications during employment transitions. Demonstrating the ability to cover mortgage payments until employment begins shows financial responsibility and planning to mortgage lenders.

Is it possible to get a mortgage with no job but a large deposit?

Absolutely. A mortgage with no job but a large deposit is often achievable when combined with significant cash reserves, excellent credit scores, and demonstrated financial stability through alternative income sources.

Larger down payments reduce lender risk while lowering loan amounts and monthly mortgage payments. When combined with substantial reserves, large deposits often overcome employment concerns for qualified borrowers.

Can I buy a house with no job but good credit?

Good credit significantly helps, but alone isn't sufficient for mortgage approval. You need demonstrated payment ability through alternative income, cash reserves, or co-signer support alongside excellent credit scores.

Credit scores above 740 combined with substantial assets or alternative income often satisfy lender requirements. Working with specialized non-QM lenders increases approval chances for high-credit, unemployed borrowers.

When is it a good idea to buy a house without a job?

Consider homeownership without traditional employment when you have substantial cash reserves, reliable alternative income streams, confirmed future employment, or significant assets. Avoid purchasing without emergency funds or stable income prospects.

Timing becomes crucial for unemployed buyers. Purchasing during stable financial periods with clear income prospects often works better than buying during uncertain employment transitions.

Can you get a mortgage without a job but high net worth?

High-net-worth individuals often qualify for asset-based loans even without employment income. Substantial investment portfolios, liquid assets, and proven financial management can substitute for traditional employment when working with appropriate specialized lenders.

Asset-based lending programs specifically serve wealthy borrowers without traditional employment. These loans focus on total wealth rather than monthly income, making them ideal for high-net-worth unemployed individuals.

Table of Content

Take your pick of loans

Experience a clear, stress-free loan process with personalized service and expert guidance.

Get a quote