7 min read

Buying a home on a $100,000 salary is realistic with smart budgeting and the right loan strategy.

Your affordability depends on several factors, income, debt-to-income (DTI) ratio, credit score, loan type, and down payment.

Key Factors:

-

Most lenders prefer your total debt (including your new mortgage) under 36% of your gross income.

-

Home affordability typically ranges from 2.5x–3.5x your annual salary ($250K–$350K).

-

A mortgage calculator helps estimate monthly payments, loan limits, and savings impact.

Loan Options:

-

Conventional: Best for strong credit and 20% down.

-

FHA: Lower credit scores, 3.5% down.

-

VA/USDA: No down payment options.

Budget for closing costs, insurance, taxes, and maintenance to stay financially balanced.

With good planning and lender guidance, homeownership on a $100K salary is within reach.

Buying a home is one of the biggest financial decisions you'll make and knowing how much house you can afford with a $100,000 salary is essential. With the right planning, smart budgeting, and tools like a mortgage calculator or affordability calculator, you can confidently explore your options. Key factors such as your debt to income ratio, credit score, down payment amount, and ongoing monthly expenses will all influence the final number.

In this guide, we'll break down everything you need to know, from loan types and mortgage terms to payment assistance programs and budgeting tips so you can approach your home purchase with clarity and confidence.

Understand Home Affordability

Figuring out how much house you can afford goes beyond just your annual income. Mortgage lenders will evaluate:

-

Your gross monthly income

-

Monthly debt payments (like student loan payments, car loans, or credit cards)

-

Your credit score

-

The size of your down payment

In general, lenders prefer your total monthly debts (including the new house payment) to be less than 36% of your gross income, this is called your debt to income ratio. Keeping this number in check is crucial for mortgage approval.

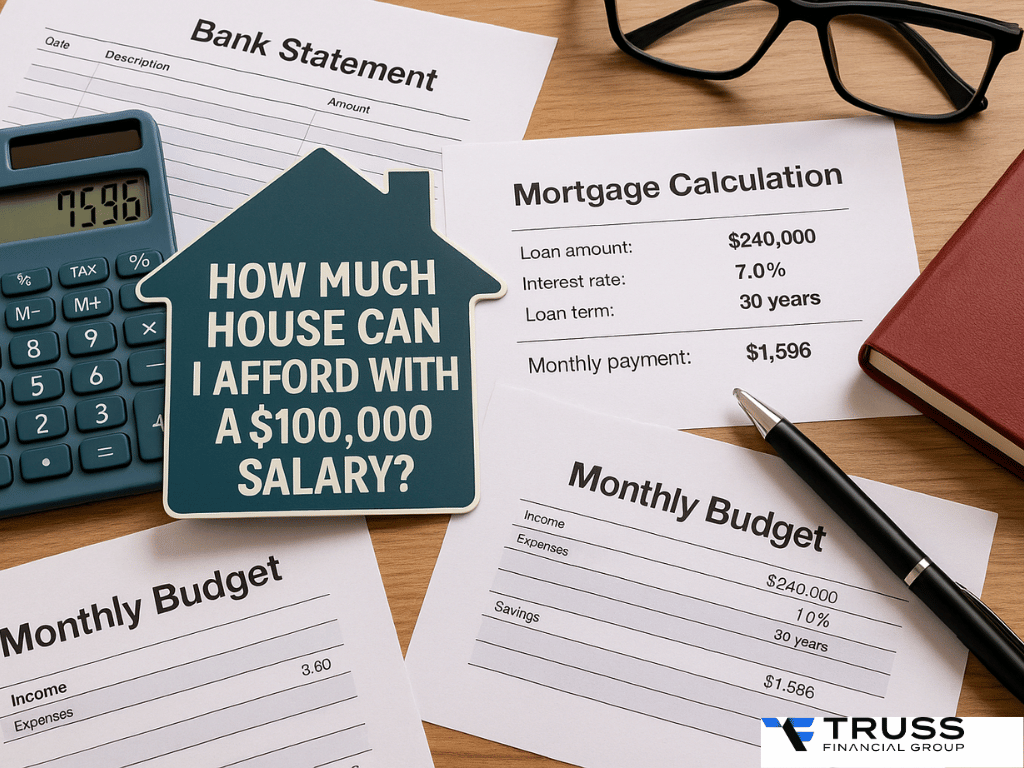

Calculating Affordability Using a Mortgage Calculator

A mortgage calculator is one of the most useful tools for estimating your monthly mortgage payment and overall affordability. Here’s what to include:

-

Loan amount

-

Interest rate

-

Loan term (e.g., 15 or 30 years)

-

Down payment amount

-

Property taxes and homeowners insurance

For someone earning $100,000 a year (roughly $8,300/month), a common affordability estimate is around 2.5x to 3.5x your income. That means your purchase price range could fall between $250,000 and $350,000 under conservative estimates or higher depending on other factors.

Use the calculator to test how different inputs like a larger down payment or a lower interest rate impact your monthly payment.

Understanding Your Financial Obligations

Your lender will assess all your financial obligations, including:

-

Housing costs

-

Existing debts

-

Monthly obligations like subscriptions, insurance, and childcare

The lower your total debt payments, the more home you can afford. Maintaining a low debt to income ratio and a good credit score gives you access to better mortgage rates and more flexible loan terms.

If you're carrying high balances on credit cards or have recent late payments, consider paying down those debts before applying for a home loan.

Mortgage Options: Which Loan Is Right for You?

There are several loan types to consider:

1. Conventional Loans

-

Require a higher credit score (typically 620+)

-

Best for those with strong credit and a solid down payment

-

May avoid private mortgage insurance (PMI) with 20% down

2. FHA Loans

-

Designed for lower credit scores

-

Offer lower down payment options (as low as 3.5%)

-

Include upfront mortgage insurance premium and monthly mortgage insurance

3. VA Loans

-

Available to eligible veterans

-

No down payment or mortgage insurance required

-

Competitive interest rates

4. USDA Loans

-

For rural and some suburban areas

-

No down payment needed

-

Income limits may apply

Each loan has unique benefits and requirements, so speak with a loan officer to determine the best fit.

The Role of Down Payments and Assistance

Your down payment has a huge impact on what you can afford:

-

A larger down payment lowers your loan amount, reducing your monthly payment

-

A 20% down payment can eliminate PMI on a conventional loan

If you don’t have a big savings cushion, look into payment assistance programs. These may include:

-

Government-backed grants

-

Local housing authority programs

-

Loans or matched savings plans for closing costs or down payment amount

Be sure to understand the eligibility requirements like minimum credit score and income thresholds.

Exploring Affordability with a Calculator

Use an affordability calculator to plug in:

-

Monthly income

-

Monthly debts

-

Down payment

-

Interest rate

-

Expected monthly expenses

This gives you a realistic home price range. Many calculators allow you to toggle scenarios (e.g., adjusting your interest rate, loan term, or monthly fees like HOA fees). This helps visualize how much home is realistic for your budget.

Building a Budget for Homeownership

Before house hunting, build a monthly budget that includes:

-

Mortgage payment

-

Property taxes

-

Homeowners insurance

-

HOA fees (if applicable)

-

Utilities and maintenance costs

Leave room for unexpected housing expenses like repairs or upgrades. Also include any payment assistance you qualify for in your calculations.

A budget will help keep your finances healthy long after the home purchase.

Managing Your Debt to Income Ratio

Here are tips to improve your debt to income ratio:

-

Pay off high-interest credit cards

-

Refinance or consolidate student loans or car loans

-

Increase your monthly income with a side job or promotion

-

Reduce unnecessary monthly obligations

A better ratio means a bigger loan amount and more favorable mortgage terms.

Total Homeownership Costs to Consider

Buying a home means more than just a mortgage payment. Include:

-

Property taxes (varies by location)

-

Homeowners insurance premiums

-

HOA fees

-

Maintenance and repairs

-

Utilities and internet

Knowing your full monthly housing costs ensures you won’t be overextended financially.

Expert Tips for Homebuyers

-

Get Pre-Approved: It helps you set a clear budget and shows sellers you're serious.

-

Compare Loan Types: Understand the pros and cons of FHA, VA, and conventional mortgages.

-

Don’t Forget Closing Costs: Budget for 2–5% of your purchase price.

-

Evaluate Different Scenarios:

-

Conservative: 25% of your gross income toward housing

-

Moderate: 28-30%

-

Aggressive: Up to 36%, if you have no other debt payments

-

Pick a scenario that fits your long-term financial situation.

How Location Affects Affordability

Location can drastically change what your $100,000 salary can buy. Consider:

-

Local property taxes and insurance premiums

-

Average home prices and market trends

-

Access to public transport or major job centers

-

Commute times and school districts

Buying in a less expensive area may stretch your budget further, giving you more house for your money.

FAQs: How Much House Can You Afford?

How much house can I afford if I make $100,000 a year?

Roughly $250,000 to $400,000, depending on your debts, credit score, and down payment.

Can I afford a $300k house on a $100k salary?

Yes, with a low debt load and good credit, this is generally achievable.

Can I afford a $400k house on a $100k salary?

Possibly, with a high down payment, minimal debts, and favorable mortgage terms.

Is 100k enough to buy a house?

Absolutely. Many homes across the country are affordable at this income level with the right planning.

Can I buy a million-dollar home with a 100k salary?Unlikely without significant assets or a large down payment. The monthly costs would likely exceed recommended debt to income thresholds.

Final Thoughts

Understanding how much house you can afford on a $100,000 salary requires a thorough review of your financial situation, debt obligations, and homeownership goals. Using tools like a mortgage calculator and working with knowledgeable mortgage lenders will help you make informed decisions.

By planning ahead, managing your monthly budget, and researching loan options and payment assistance programs, you can confidently move forward in your home purchase journey.

Ready to explore your options? Contact Truss Financial Group for personalized guidance and lending solutions.

Table of Content

Take your pick of loans

Experience a clear, stress-free loan process with personalized service and expert guidance.

Get a quote