3 min read

Legal marijuana sales are booming in California. Just today, another city in Orange County began reviewing cannabis store permits. There are hundreds of dispensaries selling legal weed across the state.

This means a new population of employees working as growers, distributors, and in retail. However, for those that bring home the bacon from cannabis sales, getting a mortgage can be a challenge. Why? The federal government doesn’t like that kind of green. While legal in many states, marijuana is a Schedule I substance at the federal level. This means that government backed loans - like FHA loans - will not take into account any income related to marijuana sales. This is a problem for borrowers because they likely will not show enough income to qualify for the loan from other means. But don’t stress - there’s now a way to use money made in the legal weed business and qualify for a mortgage.

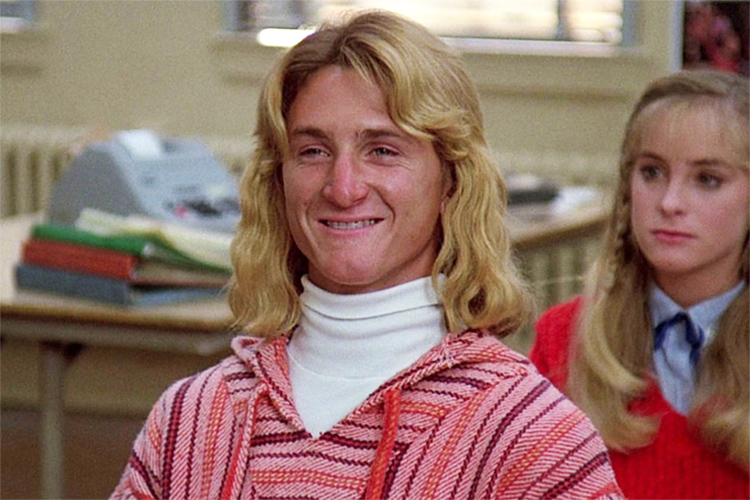

A lender in Encinitas is working with Truss Financial Group for those in the cannabis industry - and counting their cannabis related income - for home loans. It’s like, totally radical man. Let’s learn a bit more about this loan.

This is not your grandfather’s mortgage. Since this lender does things a little differently, the application process has some nontraditional steps. The product they offer uses the borrower’s bank statements to verify income. This type of loan has been a go-to for small business owners and entrepreneurs who maximize their legal deductions, and thus have a W2 that doesn’t tell a complete financial story. They’ll use 12-24 months of bank statements to come up with an average monthly income, which will help determine how much someone can borrow. Credit scores are part of the equation, but they don’t have to be excellent. 620 is what’s needed for approval. I tried to ask if they’d do a special if someone’s credit score is exactly 420, but it’s a no go. Never hurts to ask.

I think you may also be surprised at the interest rates you can get. They’ll be a bit higher than the big banks offer, but nothing like a hard money loan. Additionally, these loans can be used to buy: apartments, townhomes, single family homes, and vacation homes. The full spectrum of homes if you will.

You may be ready to go and have the perfect house picked out. What you’ll want to know is that before you apply, it’s a good idea to give the team at Truss Financial Group a call so that they can help you apply. The lender in Encinitas doesn’t work directly with borrowers, so you’ll need to work with an expert broker like Truss to get this done.

Still looking for that new place and not quite ready to apply? That’s cool. Truss can also help you get any questions answered so that you’re ready to go when the time is right.

Not interested at all? That’s weird that you read this entire blog post, but no worries. Cheers to you for learning about something new today. Thanks for reading!

Table of Content

Take your pick of loans

Experience a clear, stress-free loan process with personalized service and expert guidance.

Get a quote

.png?width=352&name=xxxxxx%20header%20(54).png)