3 min read

Hate reading? Me too, watch the video here:

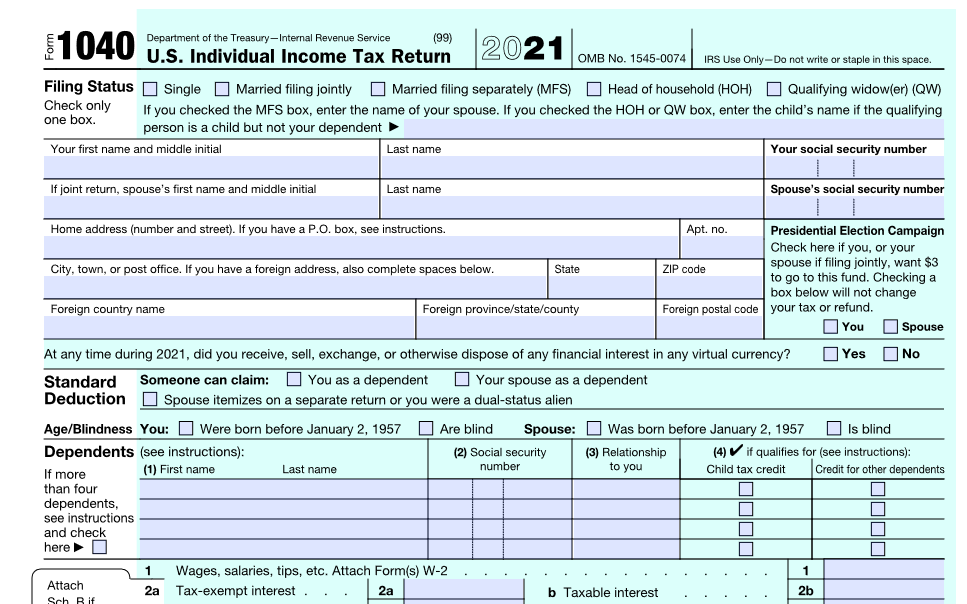

Aspiring homeowners know that securing a mortgage is often an essential part of the home buying process. One common hurdle, however, is the requirement for detailed financial documentation—namely, tax returns. While tax returns are the traditional method of proving income for a mortgage, there are alternatives for those who cannot or prefer not to use them. Among these options is the use of bank statement deposit history.

In this blog, we'll explore how one can utilize bank statement deposit history to secure a mortgage. Let's dive in.

The Basics: Why Do Lenders Need Proof of Income?

Lenders use financial documentation to assess your ability to repay the loan over time. Typically, they ask for tax returns as a way to verify your income. But tax returns can be problematic for some borrowers—for example, entrepreneurs, freelancers, or people with non-traditional income sources—whose income might not be accurately reflected in their returns.

What is a Bank Statement Loan?

A bank statement loan is an alternative type of mortgage designed for those who can't provide traditional income documentation. Instead of tax returns, lenders will look at your bank statements to verify your income.

How to Secure a Mortgage with Bank Statements

Securing a mortgage with bank statements involves a different process than the traditional route. Here's a step-by-step guide:

1. Gather Your Documentation

You'll need to gather at least 12 to 24 months' worth of bank statements, depending on the lender's requirements. These should be official statements that include your name, account number, bank name, and the balance for each period.

2. Evaluate Your Deposit Income

Lenders typically consider the income shown in your bank statement deposits. This can include salary from a job, freelance income, income from rental properties, and other regular sources. It's important to have a consistent deposit history that shows you can afford the monthly mortgage payments.

3. Consult with a Mortgage Broker

Working with an experienced mortgage broker can be invaluable when applying for a bank statement loan. They can guide you through the process, help you find lenders that specialize in these types of loans, and assist you in preparing your application.

4. Apply for the Loan

Once you have all your documentation in order and have found a suitable lender, it's time to apply for the loan. The lender will review your bank statements, credit score, and other financial details to decide if they will approve the loan.

Potential Challenges

Bank statement loans are not without their challenges. They often come with higher interest rates due to the perceived increased risk on the lender's part. Additionally, lenders might require a larger down payment compared to a traditional mortgage.

Final Thoughts

Obtaining a mortgage using bank statement deposit history instead of tax returns offers an alternative route for individuals with non-traditional income sources or those who prefer not to disclose their full tax returns. Though it comes with its own set of challenges, it can open the door to homeownership for many who would otherwise struggle with the traditional mortgage process.

Remember, it's essential to seek professional financial advice tailored to your personal circumstances before embarking on this journey. Happy house hunting

Table of Content

Take your pick of loans

Experience a clear, stress-free loan process with personalized service and expert guidance.

Get a quote