15 min read

The real estate market continues to be one of the most lucrative investment opportunities in 2026, with rental properties offering steady cash flow and long-term appreciation. However, the key to maximizing your returns as a real estate investor lies in choosing the right financing.

Whether you’re a first-time or an experienced investor, understanding the different types of rental property loans can make or break your investment strategy.

In this article, we’ll explore the best loans for investment properties, compare the pros and cons of each financing option, and provide actionable tips to help you secure the ideal loan for your rental property.

Key Takeaways

![]() Match Loan to Goal: Choose between long-term rentals, fix-and-flip, or cash flow-focused strategies.

Match Loan to Goal: Choose between long-term rentals, fix-and-flip, or cash flow-focused strategies.

![]() Avoid Over-Leveraging: Don’t take on more debt than you can handle.

Avoid Over-Leveraging: Don’t take on more debt than you can handle.

![]() Compare Loan Terms: Shop around for the best rates and lowest fees.

Compare Loan Terms: Shop around for the best rates and lowest fees.

![]() Plan for Costs: Budget for vacancies, maintenance, and hidden fees.

Plan for Costs: Budget for vacancies, maintenance, and hidden fees.

![]() Expert Help: Consult a lender or advisor to find the best loan for your needs.

Expert Help: Consult a lender or advisor to find the best loan for your needs.

Why Financing is Important for Real Estate Investors?

When it comes to building a successful real estate portfolio, financing is one of the most critical factors. The right loan can help you maximize your return on investment (ROI), minimize risk, and scale your investments faster. On the other hand, choosing the wrong financing option can lead to high interest rates, unfavorable terms, and even missed opportunities.

How the Right Financing Maximizes ROI?

For real estate investors, rental property financing is about strategically leveraging debt to grow your portfolio.

Here’s how the right loan can boost your ROI:

- Lower Interest Rates: A loan with a competitive interest rate can significantly reduce your monthly payments, increasing your cash flow and overall profitability.

- Flexible Terms: Loans with longer repayment terms or interest-only periods can give you more breathing room to manage your finances and reinvest in other properties.

- Leverage: By using financing, you can spread your capital across multiple properties, allowing you to generate more income without tying up all your cash in one investment.

The right loan can help you acquire more properties, increase your cash flow, and achieve your financial goals faster.

However, it’s also important to understand the different financing options available and choose the one that aligns with your investment strategy.

In the next section, we’ll dive into the types of loans for investment properties, so you can find the best financing solution for your needs.

Types of Loans for Investment Properties

When it comes to financing a rental property, investors have several options to choose from. Each loan type has its own set of pros, cons, and qualification requirements.

Let’s explore the most popular rental property financing options for real estate investors.

Conventional Loans

Conventional loans are one of the most common financing options for investment properties. These loans are not backed by the government and are typically offered by banks, credit unions, and mortgage lenders.

How Conventional Loans Work:

Conventional loans are available for purchasing, refinancing, or renovating rental properties. They’re ideal for investors with strong credit and sufficient funds for a larger down payment.

Qualification Requirements:

- Good to excellent credit score (620+).

- Stable income and employment history.

- Debt-to-income ratio (DTI) below 45%.

Who should apply for Conventional Loans?

- Investors with strong credit and a larger down payment.

- Long-term rental property investments.

|

Ready to explore conventional loans for your rental property? Contact us today to compare rates and find the best financing option for your investment! |

Government-Backed Loans

Government-backed loans, such as FHA, VA, and USDA loans, are designed to make homeownership more accessible.

These loans are primarily intended for primary residences, but some programs can be used for investment properties under specific conditions.

-

FHA Loans:

- Can be used for multi-unit properties (up to 4 units) if the investor lives in one unit.

- Lower down payment requirements (as low as 3.5%).

-

VA Loans:

- Available to veterans and active-duty military personnel.

- No down payment required for eligible borrowers.

-

USDA Loans:

- Designed for rural properties.

- Low-interest rates and no down payment required.

Eligibility and Limitations

- FHA loans require the investor to occupy one unit of a multi-family property.

- VA loans are limited to veterans and military personnel.

- USDA loans are only available for properties in eligible rural areas.

Best For: Investors who plan to live in one unit of a multi-family property or are purchasing in a rural area.

Interested in government-backed loans for your investment property? Reach out to us to see if you qualify for FHA, VA, or USDA financing! |

Portfolio Loans

Portfolio loans are offered by banks or private lenders and are not sold to secondary markets like Fannie Mae or Freddie Mac. These loans are ideal for investors who don’t meet the strict requirements of conventional loans.

How They Work

Portfolio loans are held by the lender rather than being sold to investors. This allows for more flexibility in terms of underwriting and approval.

Who should apply for Portfolio Loans?

- Investors with unique properties or those who don’t qualify for conventional financing.

- Investors looking for more flexible terms.

Need flexible financing for your rental property? Contact us to learn more about portfolio loans and how they can help you grow your real estate portfolio! |

Hard Money Loans

Hard money loans are short-term, asset-based loans typically used for fix-and-flip projects or properties in need of renovation. These loans are provided by private lenders or investors and are secured by the property itself.

How They Work

Hard money loans are based on the value of the property rather than the borrower’s creditworthiness. They’re ideal for investors who need quick funding for short-term projects.

Pros |

Cons |

|

|

Who should apply for Portfolio Loans?

- Investors looking to quickly purchase, renovate, and sell a property.

- Fix-and-flip projects or properties in need of extensive renovations.

|

Looking for fast financing for your fix-and-flip project? Get in touch with us to explore hard money loan options tailored to your needs! |

DSCR Loans (Debt Service Coverage Ratio)

DSCR loans are specifically designed for rental property investors. Instead of focusing on the borrower’s income, these loans are based on the property’s cash flow.

How They Work

Lenders evaluate the property’s rental income to determine if it’s sufficient to cover the loan payments. The Debt Service Coverage Ratio (DSCR) is calculated by dividing the property’s net operating income by the annual debt service.

Who should apply for Portfolio Loans?

- Experienced investors with strong rental income properties.

- Investors looking to finance multiple properties without personal income verification.

|

Want to finance your rental property based on cash flow? Contact us to learn more about DSCR loans and how they can help you grow your investment portfolio! |

How to Choose the Best Loan for Your Investment Property

Choosing the right loan for your rental property is one of the most important decisions you’ll make as a real estate investor.

The type of financing you select will directly impact your cash flow, ROI, and overall investment strategy. So, to make the best decision, you need to assess your investment goals, compare loan options, and understand how each financing product aligns with your needs.

Assess Your Investment Goals

Before getting into loan options, it’s important to define your investment goals. Are you looking for long-term rental income or short-term profits from flipping properties? Are you focused on cash flow or property appreciation? Your answers to these questions will help you determine the best loan for your investment property.

Long-Term vs. Short-Term Investments

- Long-Term Investments: If you’re planning to hold onto a property for several years or decades, you’ll want a loan with stable, predictable payments. Long-term rental properties typically benefit from conventional loans or DSCR loans, which offer lower interest rates and longer repayment terms. These loans are ideal for investors who want to build equity and generate consistent rental income over time

- Short-Term Investments: If you’re focused on flipping properties or holding them for a short period, hard money loans or bridge loans may be a better fit. These loans offer quick funding and flexible terms, but they come with higher interest rates and shorter repayment periods. They’re perfect for investors who need fast financing for fix-and-flip projects or properties in need of renovation.

Cash Flow vs. Appreciation Strategies

- Cash Flow-Focused Investments: If your primary goal is to generate monthly rental income, you’ll want a loan that minimizes your monthly payments and maximizes your cash flow. DSCR loans are particularly well-suited for cash flow-focused investors because they’re based on the property’s rental income rather than the borrower’s personal income. These loans allow you to qualify based on the property’s ability to generate income, making them ideal for investors with multiple rental properties or those researching alternative income strategies, such as this detailed breakdown from WallStreetZen on Paradigm Press and financial publishing services.

- Appreciation-Focused Investments: If you’re more interested in long-term property appreciation, you may be willing to accept lower cash flow in exchange for potential price increases. In this case, conventional loans or government-backed loans (like FHA or VA loans) can be a good option, especially if you’re purchasing in an area with strong growth potential. These loans offer competitive interest rates and longer terms, allowing you to hold onto the property while it appreciates in value.

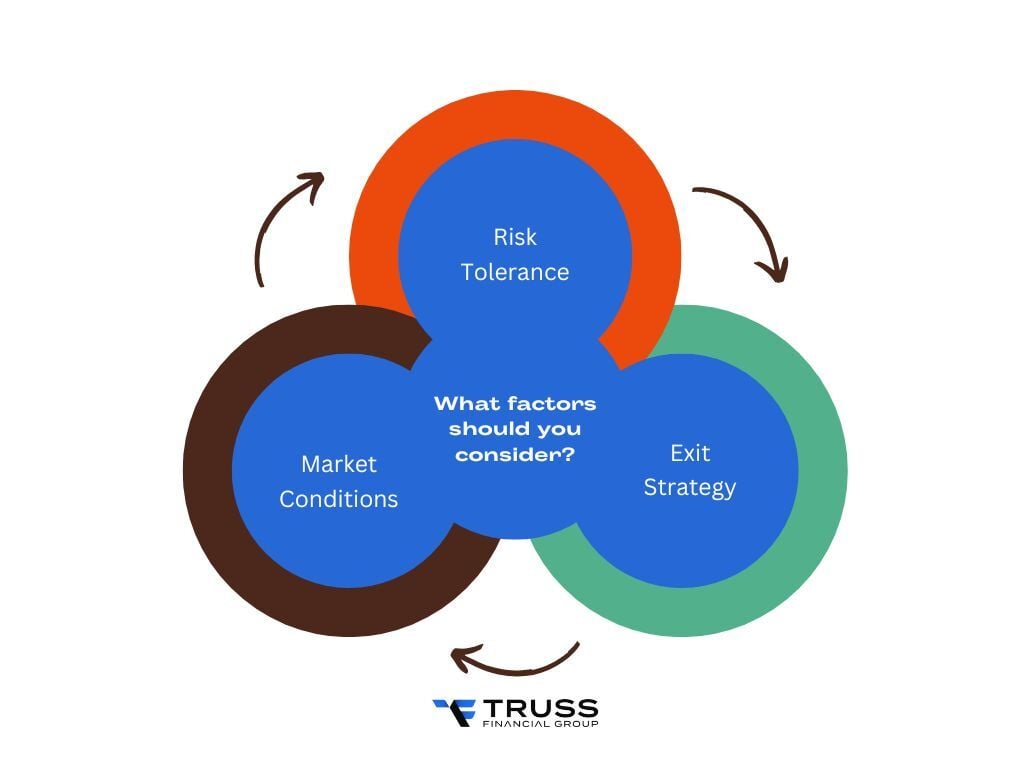

What factors should you consider?

- Risk Tolerance: Are you comfortable with higher-risk, higher-reward strategies like flipping properties, or do you prefer the stability of long-term rentals?

- Market Conditions: Is the local real estate market more conducive to cash flow (e.g., high rental demand) or appreciation (e.g., rapidly growing areas)?

- Exit Strategy: Do you plan to sell the property after a few years, or do you want to hold onto it indefinitely?

By clearly defining your investment goals, you can narrow down the best loan for your rental property and ensure that your financing aligns with your long-term strategy.

Common Mistakes to Avoid When Financing Rental Properties

Financing a rental property can be a complex process, and even experienced investors can make costly mistakes. To ensure your investment is successful, it’s important to avoid common pitfalls that can derail your financial goals. Here are some of the most common mistakes when financing rental properties and how to avoid them.

Over-Leveraging and Taking on Too Much Debt

One of the biggest mistakes real estate investors make is over-leveraging, or taking on more debt than they can comfortably manage. It’s tempting to finance multiple properties to grow your portfolio quickly, but if rental income decreases or unexpected expenses arise over-leveraging can lead to financial strain.

- Why It’s a Problem: If your rental income drops below the threshold needed to cover your mortgage payments, you may be forced to dip into your personal funds or risk defaulting on the loan. Defaulting can lead to foreclosure, which can severely damage your credit and financial stability.

- How to Avoid It:

- Stick to a conservative debt-to-income (DTI) ratio. Most lenders recommend keeping your DTI below 45%.

- Ensure your rental income covers not only the mortgage but also property taxes, insurance, maintenance, and vacancies.

- Build a cash reserve to cover unexpected expenses or periods of low occupancy.

Over-Leveraging and Taking on Too Much Debt

Another common mistake is failing to shop around for the best loan terms. Many investors accept the first loan offer they receive, which can result in higher interest rates, unfavorable terms, and unnecessary fees.

- Why It’s a Problem: Different lenders offer different rates and terms, and failing to compare options can cost you thousands of dollars over the life of the loan. For example, a slightly higher interest rate can significantly increase your monthly payments and reduce your cash flow.

- How to Avoid It:

- Get quotes from multiple lenders, including banks, credit unions, and private lenders.

- Compare interest rates, loan terms, and closing costs to find the best deal.

- Negotiate with lenders to secure more favorable terms.

Ignoring Hidden Fees and Closing Costs

Many investors focus solely on the interest rate and overlook hidden fees and closing costs, which can add up quickly and eat into your profits.

- Why It’s a Problem: Closing costs for investment properties can include appraisal fees, title insurance, origination fees, and more. These costs can range from 2% to 5% of the loan amount, which can be a significant expense.

- How to Avoid It:

- Ask lenders for a detailed breakdown of all fees and closing costs before committing to a loan.

- Factor these costs into your budget when calculating the total cost of the investment.

- Look for lenders who offer lower closing costs or are willing to waive certain fees.

Failing to Plan for Vacancies and Maintenance

Another common mistake is not accounting for vacancies and maintenance costs when financing a rental property. While it’s easy to assume your property will always be occupied, the reality is that vacancies and repairs are inevitable.

- Why It’s a Problem: If you don’t plan for vacancies, you may struggle to cover your mortgage payments during periods of low occupancy. Similarly, failing to budget for maintenance can lead to unexpected expenses that strain your cash flow.

- How to Avoid It:

- Set aside a portion of your rental income for vacancies and maintenance. A good rule of thumb is to budget for at least 10% of your rental income for vacancies and 1% of the property’s value annually for maintenance.

- Conduct regular inspections and address maintenance issues promptly to avoid costly repairs down the line.

Using All Your Savings for the Down Payment

Some investors make the mistake of using all their savings for the down payment, leaving them with no financial cushion for emergencies or unexpected expenses.

- Why It’s a Problem: If you deplete your savings to finance a rental property, you may be left without funds to cover repairs, vacancies, or other unforeseen costs. This can put your investment - and your financial stability - at risk

- How to Avoid It:

- Keep a portion of your savings as a cash reserve for emergencies.

- Consider financing options that require a lower down payment, such as FHA loans or portfolio loans.

- Avoid overextending yourself by purchasing multiple properties at once.

Frequently Asked Questions (FAQs)

What is the best loan for a first-time real estate investor?

For first-time investors, conventional loans or FHA loans are often the best options. Conventional loans offer competitive rates and flexible terms, while FHA loans require a lower down payment (as low as 3.5%) if you plan to live in one unit of a multi-family property. Both are beginner-friendly and widely available.

Can I use a government-backed loan for an investment property?

Yes, but with limitations. FHA loans can be used for multi-unit properties (up to 4 units) if you live in one unit. VA loans are available to veterans and active-duty military personnel, but they’re primarily for primary residences. USDA loans are for rural properties but are not typically used for pure investment properties.

What is the minimum down payment for a rental property loan?

The minimum down payment for a rental property loan is typically 15% to 25% for conventional loans. However, FHA loans require as little as 3.5% if you live in one unit, and VA loans offer no down payment for eligible borrowers. Hard money loans may require 20% to 30%.

How does my credit score affect my loan options?

Your credit score plays a significant role in determining your loan options. For conventional loans, you’ll need a score of at least 620, while FHA loans may accept scores as low as 580. Higher scores (700+) can qualify you for better interest rates and terms, while lower scores may limit your options to higher-cost loans like hard money or portfolio loans.

Wrapping up

Ready to find the best loan for your rental property?

Contact us today to explore your options and get expert advice tailored to your investment goals. Let’s make your next rental property a success!

Table of Content

Take your pick of loans

Experience a clear, stress-free loan process with personalized service and expert guidance.

Get a quote