8 min read

DSCR Loans Georgia | 2024 Guide For Real Estate Investors

Real estate investors in Georgia are using debt service coverage ratio (DSCR) loans to expand their portfolios....

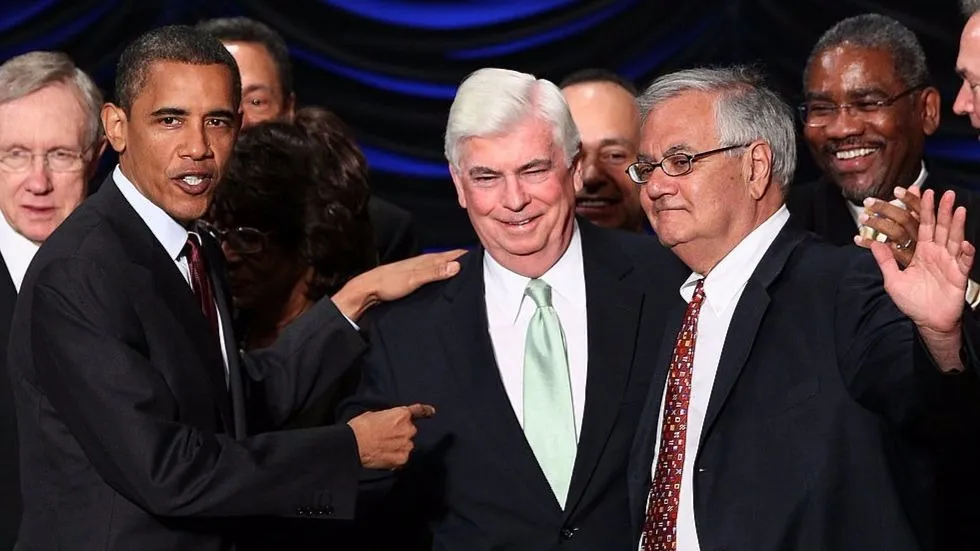

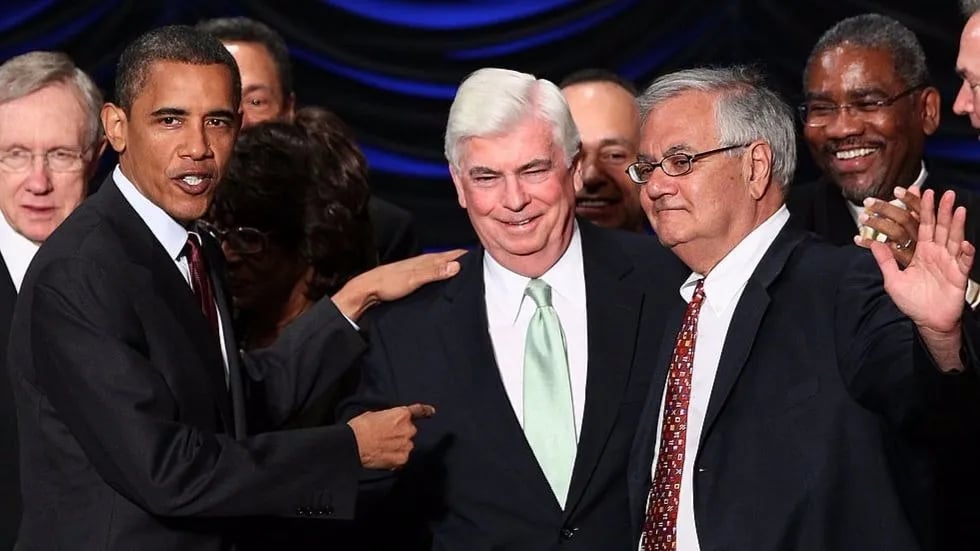

The landscape of mortgage lending has undergone significant changes over the past few decades, particularly with the introduction of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010. This legislation reshaped many aspects of the financial industry, including the mortgage market. Two types of non-traditional mortgages that have been impacted are the bank statement mortgage and the stated income mortgage. Understanding the differences between these two and how the Dodd-Frank Act influenced them is crucial for both lenders and borrowers.

A bank statement mortgage is a loan program where lenders use bank statements, typically spanning 12 to 24 months, to verify a borrower's income instead of traditional income documentation like W-2s or tax returns. This type of mortgage is particularly beneficial for self-employed individuals, freelancers, and small business owners whose income may be substantial but not consistently reflected in traditional documents.

In a bank statement mortgage, lenders review the deposits in your bank account to determine income. They look for consistent deposits and calculate income based on the average monthly deposits. This method offers a more realistic picture of a borrower's financial situation, especially for those with fluctuating incomes.

Stated income mortgages, on the other hand, are loans where borrowers can simply state their income on the loan application without the need for extensive documentation. Before the financial crisis of 2008, these were popular among self-employed individuals and those with complex income sources. However, they earned the nickname "liar loans" due to the high potential for income exaggeration.

The Dodd-Frank Act introduced stringent lending standards, which included the requirement for lenders to make a reasonable, good faith determination of a borrower's ability to repay. This effectively marked the end of the true stated income mortgage, as lenders could no longer issue loans based solely on unverified income statements.

The Dodd-Frank Act was a response to the financial crisis of 2008, which was partly attributed to irresponsible lending practices, including the widespread use of stated income mortgages. The Act imposed new regulations and oversight on financial institutions, with a significant focus on consumer protection.

One of the key components of the Dodd-Frank Act was the introduction of tighter lending standards. Lenders were now required to conduct thorough due diligence on a borrower's ability to repay the loan. This meant more rigorous income verification, which spelled the end for traditional stated income loans.

As a result of these tighter regulations, alternative documentation loans, like bank statement mortgages, gained popularity. These loans provided a pathway for borrowers with non-traditional income sources to qualify for mortgages, albeit under more stringent and regulated conditions than the old stated income loans.

While both bank statement and stated income mortgages were designed to cater to borrowers with non-traditional income sources, they differ significantly in terms of risk and documentation.

Bank statement mortgages require substantial documentation, albeit different from traditional loans. Lenders scrutinize bank statements to assess income stability and consistency. Stated income mortgages, in their original form, required minimal to no income verification, leading to higher risks for lenders.

The risk associated with bank statement mortgages is mitigated through the thorough review of financial statements. In contrast, stated income mortgages carried higher risks due to the lack of verification, contributing to their downfall post-Dodd-Frank.

Post-Dodd-Frank, the traditional stated income mortgage has all but disappeared. However, some lenders offer variations that comply with the new regulations, requiring some form of income verification, though less stringent than conventional loans. These are often referred to as "alternative documentation" or "bank statement" loans.

The Dodd-Frank Act significantly reshaped the mortgage landscape, particularly impacting non-traditional loan products like bank statement and stated income mortgages. While bank statement mortgages have adapted and thrived under the new regulations, providing a viable option for borrowers with non-traditional income, the true stated income mortgage has become a relic of the past. This shift reflects a broader move towards greater financial stability and consumer protection in the lending industry.

Understanding these changes and the current state of mortgage products is essential for borrowers and lenders alike. It ensures that loans are both accessible to those with non-traditional incomes and aligned with the industry's commitment to responsible lending practices.

Jul 10, 2024by Jason Nichols

Real estate investors in Georgia are using debt service coverage ratio (DSCR) loans to expand their portfolios....

Jul 4, 2024by Jason Nichols

Investing in real estate in Colorado is a great long-term wealth strategy. Colorado DSCR mortgages are designed...

Jun 11, 2024by Jason Nichols

For investors eyeing the commercial real estate market in Arizona, DSCR loans offer an appealing alternative. If credit...