Bank Statement Mortgages

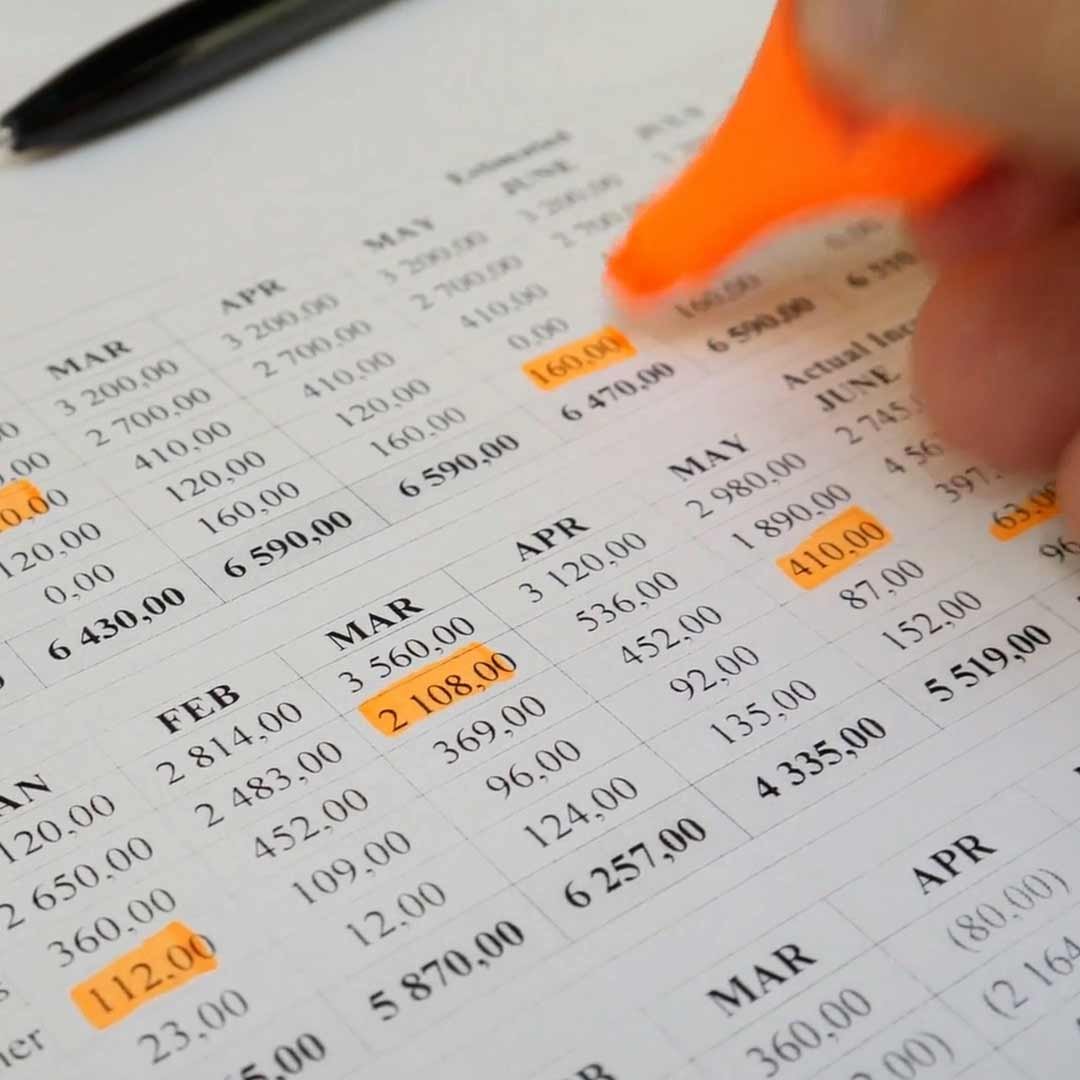

If your business shows consistent income, a Bank Statement Mortgage can help you qualify for a mortgage despite taking many write-offs. We use anywhere from 3-24 months of your business or personal bank statement deposit history, then divide it in half to compensate for your expenses. We use the resulting number to document your monthly income and help you qualify for a low-rate mortgage loan.